Local air traders in Hong Kong are feeling cautious about their prospects for business this quarter, particularly following the Chinese New Year, according to the latest DHL Hong Kong Air Trade Leading Index (DTI) findings.

The report — commissioned by DHL Express Hong Kong and compiled by the Hong Kong Productivity Council — found that the Overall Air Trade Index retreated by 3.4 points from the traditional peak season last quarter with 10% of local air traders stating that the outcome of the latest traditional peak season, was better than their initial expectations, while 45% reported that the performance was worse than expected.

The remaining 45% of respondents indicated that their actual numbers were close to their expectations.

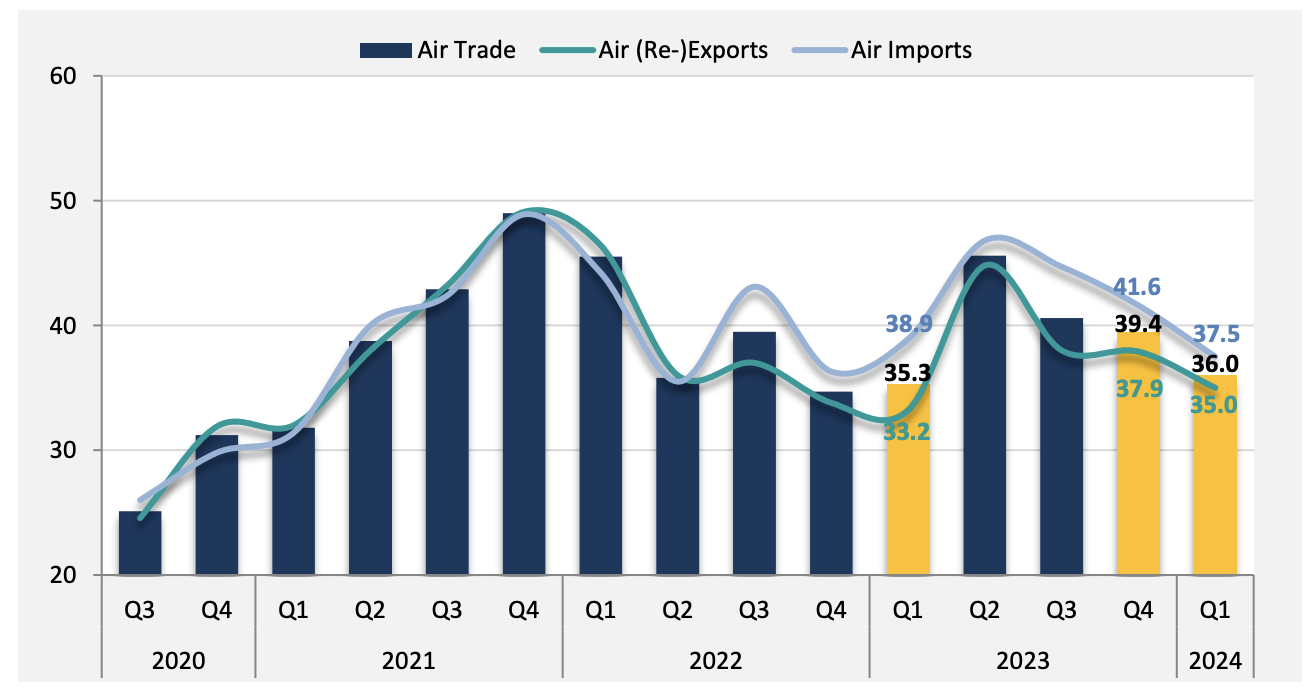

Both import and (re-)export performance softened, leading to a further weakening of the Overall Air Trade Index by 3.4 points to 36.0 points in Q1 2024. However, it remained slightly stronger than the level reported in Q1 2023 (35.3 points).

However, air traders were conservative towards their business expectations in Q1 2024 compared to Q1 2023, with only a quarter of respondents holding a positive outlook towards the upcoming Chinese New Year.

Additionally, only one-fifth expect more sales orders after the Chinese New Year compared to Q1 2023.

"24% of local air traders expressed a positive outlook towards the pre-Chinese New Year (CNY) holiday when compared to the same period in 2023, while 36% had a negative outlook," the DTI report said.

It added that in looking towards to post-CNY period until the end of Q1 2024, local air traders were more conservative, with 20% expecting more sales orders than last year and 46% expecting a similar number of sales orders.

"The overall air trade market remains soft in Q1 2024, with the Overall Trade Index further falling by 3.4 points to 36.0 points," said Edmon Lai, chief digital officer of HKPC.

He noted that all markets, except for the other Asia Pacific markets, suffered declines at different magnitudes, and the Americas is the market suffering the greatest drop of 9 points.

"With the business outcome in the Q4 traditional peak season of 2023 behind expectations, air traders have become conservative towards their trade outlook this quarter, especially business after the Chinese New Year," Lai said.

"With the risk of economic downturn expected to continue for a certain period, air traders should get themselves prepared for this long-term challenge," he added, noting that traders are also advised to explore opportunities in other markets, particularly in the other Asia Pacific region.

The report found that in other Asia Pacific markets — Singapore, Malaysia, Thailand, Vietnam, India, Taiwan, South Korea, Australia, etc.— gifts, toys and houseware, as well as B2C were the three key drivers of Q1 2024 sales.

The rest were expected to be softer than last quarter.

"Except for Asia Pacific's Index, all markets experienced drops. Notably, the Americas index significantly declined in Q1 2024, marking the largest drop among all markets," the DTI report said.

It added that gifts, toys and houseware were the only air-freighted commodities that registered an uplift this quarter and ranked top among all air-freighted commodities.

Meanwhile, indices for all other commodities declined, with the index for food and beverage experiencing a drastic drop from its recent high.

The DTI analyzes the key attributes of business demands based on a survey of more than 600 Hong Kong companies that focus on in- or outbound air trading.

An index value above 50 indicates an overall positive outlook, while a reading below 50 represents an overall negative outlook for the surveyed quarter. The further the reading is from 50, the more positive or negative the outlook is.