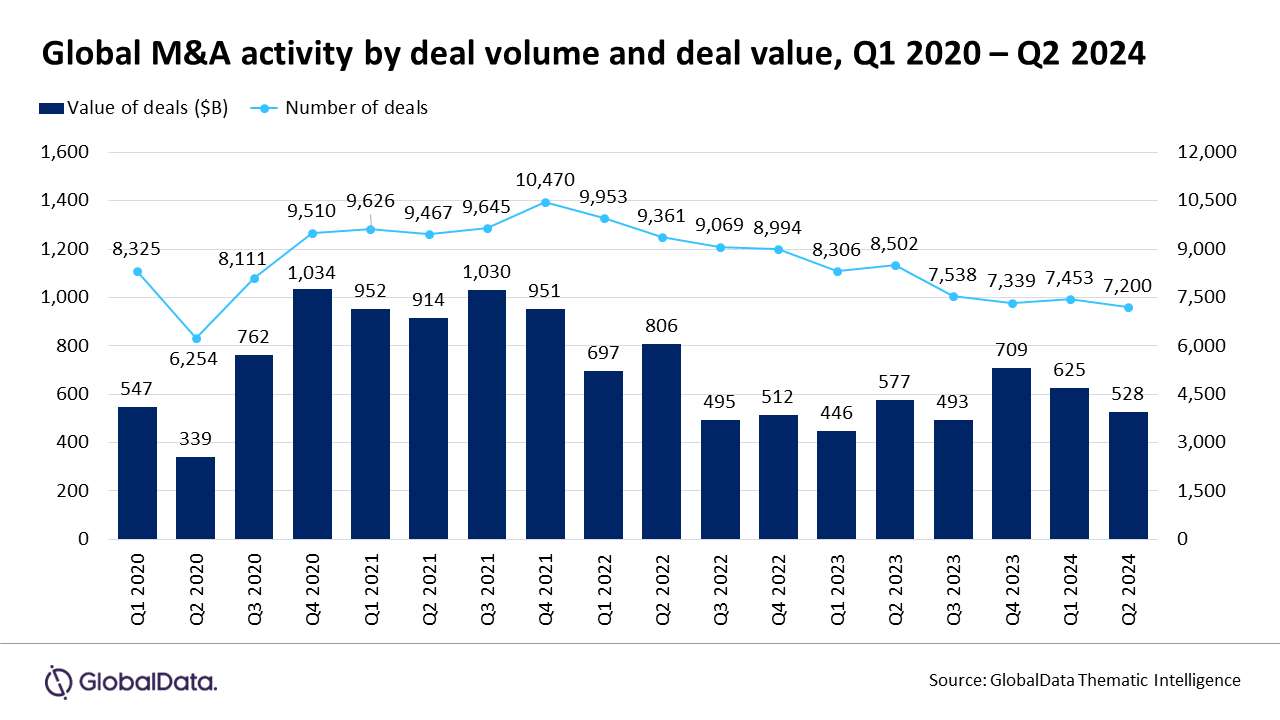

Amid the impact of persistent high interest rates and low growth across all the major economies, the second quarter of 2024 saw an overall decline in mergers and acquisitions (M&A) deal value of 9% compared to the same quarter in 2023, according to a new report from Global Data.

However, the data analytics and consulting company said the supply chain has emerged as the key theme driving deals over the period.

GlobalData's latest report, “Global M&A Deals in Q2 2024 – Top Themes by Sector – Thematic Intelligence”, noted that supply chain-related deals totalled US$39 billion across 19 deals in Q2 2024, making it the largest theme among the top 200 deals.

“Increasing geopolitical tensions, the emphasis on ESG and decarbonization efforts, labour shortages, and advancements in digital transformation have heightened the focus on supply chain deals, particularly in the consumer, basic materials, healthcare, transportation, infrastructure & logistics, and industrial sectors," said Priya Toppo, analyst, Thematic Intelligence at GlobalData.

The report noted that Johnson & Johnson's acquisition of Shockwave Medical for US$13 billion was the biggest supply chain deal.

It added that this deal was also the biggest in the healthcare sector in Q2 2024.

“An ongoing trend is the dominance of North America in M&A deal activity, accounting for 3,019 deals worth US$257 billion during Q2 2024. Nevertheless, APAC, excluding China, saw growth in deal value both on a year-on-year and quarter-on-quarter basis,” Toppo said.

Moving into the second half of 2024, the Global Data analyst said the M&A outlook “remains cautiously optimistic.”

“Prospects of rate cuts in certain markets and an overall improving global growth outlook could drive increased activity. However, mega deals will continue to face significant challenges, especially in the US, where antitrust concerns are a key focus for regulators,” Toppo said.