Golden Week is a week-long national holiday in China, so Chinese factories will be closed. As importers rush to ship goods from China to the US before the holiday's closures, there is usually increased demand for air cargo services, but capacity will be tight, and prices will be high for both ocean freight and airfreight.

Source: DHL HK

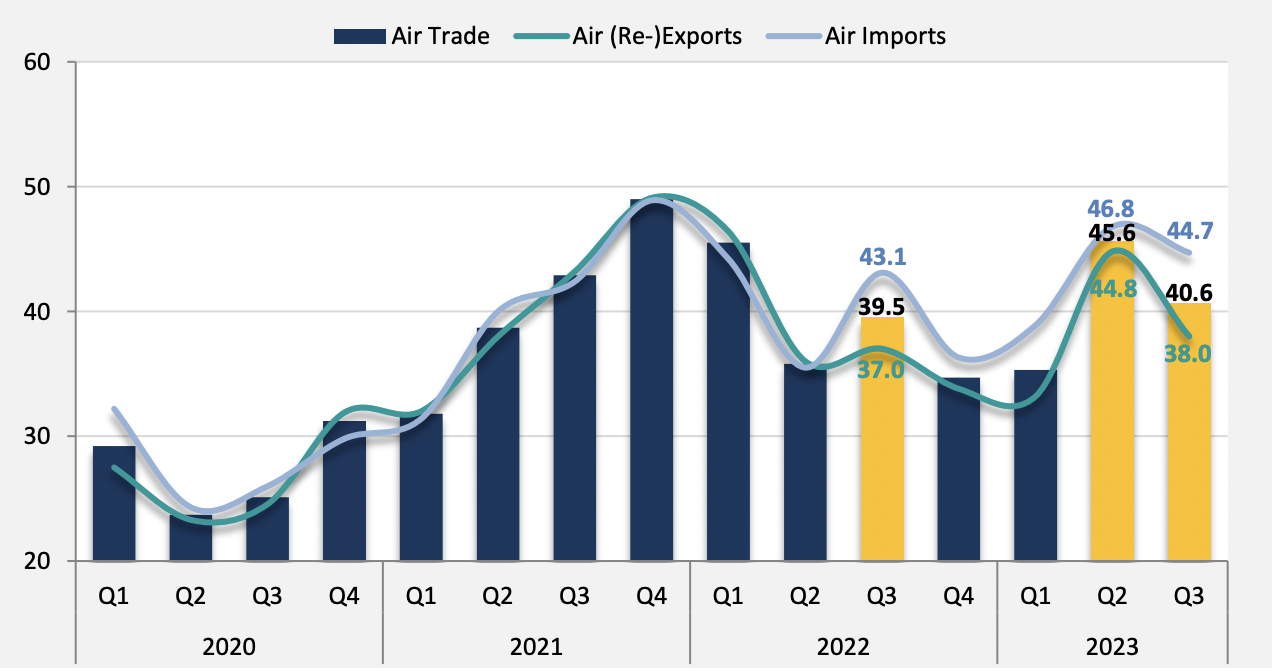

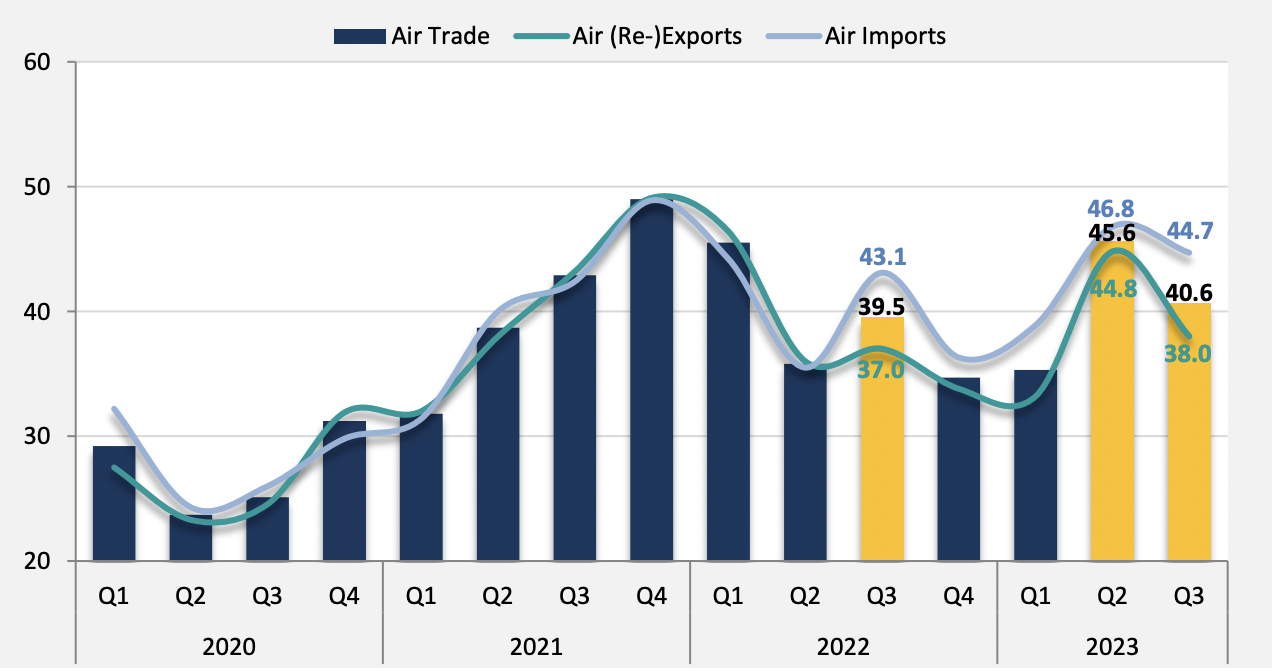

The report — commissioned by DHL Express Hong Kong and compiled by the Hong Kong Productivity Council (HKPC) — found that the Overall Air Trade Index retreated by 5.0 points to 40.6 points in Q3 2023, mainly due to the weakened (re-)export performance.

However, it noted that this was still at a higher level than in Q2 2022 when the fifth wave of the pandemic took place.

"In Q3 2023, Overall Air Trade Index retreated after a big jump last quarter under declining sales volume. However, it was still at a higher level compared with the time during the fifth wave of the pandemic, which took place early last year," the DTI said.

The report noted that all sub-indices, markets and commodities suffered drops when compared with last quarter, while online B2C registered growths in product variety and urgent shipment but slipped in sales volume.

"All air-freighted commodities recorded a dip, except for watches, clocks and jewellery, which picked up by two points," it added, noting that food and beverage continued to register the highest index despite a retreat of nine points from its peak.

The DTI said that the removal of the mask mandate in Hong Kong in March 2023 enabled society to resume normalcy in full, and along with this, 5 percentage points more air traders reported profitability improvement in Q2 2023 than the last quarter.

"Looking back, the start of the pandemic in February 2020 hit local air traders the hardest, with 68% reporting deteriorated business performance and 10% having reflected growth," it said.

"Their profitability improved in the following quarters before the fifth wave of the pandemic (Q1 2022). The three quarters prior to this made up the best performing period in three years," the report added.

Meanwhile, the DTI noted that with Hong Kong eyeing a green future, zero-emission has emerged as one of the significant trends in the city.

Local air traders willing to pay more for sustainable shipping

The report said more than 60% of local air traders revealed they were willing to participate in initiatives to reduce carbon emissions.

Almost 90% also said they are willing to pay up to 10% of their logistics cost to contribute to the goal.

"This quarter's results align with the downtrend in External Merchandise Trade Statistics in April and May 2023 announced by C&SD2 that the air trade industry in Hong Kong is facing challenges from the external environment," said Edmond Lai, chief digital officer of HKPC.

He noted that retreats in indices were discovered in most markets, covering the majority of the air-freighted commodities. In particular, a larger drop was discovered in the Americas, which was dragged down by its (re-)export performance.

"As the risk of economic recession in the US persists, enterprises are advised to prepare themselves by proactively expanding into other markets to address mid-to-long-term challenges," Lai added. "On the other hand, we are pleased to see that nearly two-thirds of the surveyed air traders are willing to take part in reducing emissions."

The HKPC chief said given the HKSAR Government's commitment to halving its carbon emissions by 2035, the air trade industry is set to become one of the key drivers of sustainable development.

The DTI analyzes the key attributes of business demands based on a survey of more than 600 Hong Kong companies that focus on in- or outbound air trading.

An index value above 50 indicates an overall positive outlook, while a reading below 50 represents an overall negative outlook for the surveyed quarter. The further the reading is from 50, the more positive or negative the outlook is.