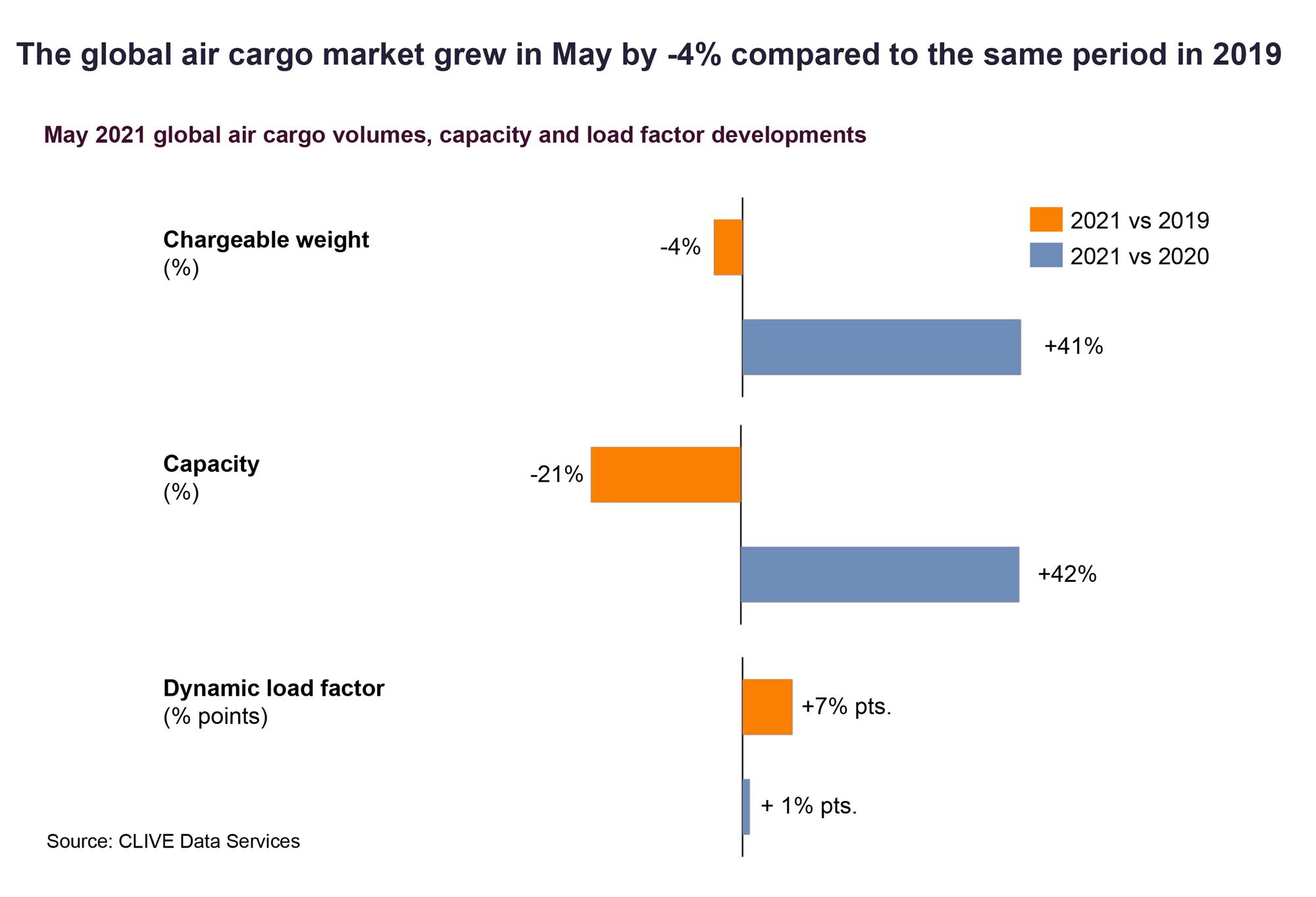

Continued market uncertainties and (extended) public holidays contributed to a -4% drop in global air cargo demand in May 2021 versus the pre-Covid level in 2019, according to the latest industry volume, load factor, and rates analysis by CLIVE Data Services and TAC Index.

CLIVE said after more positive indicators for the air cargo market in the first four months of the year, May 2021 data showed a "less favourable trend," with the fall in demand joined by a second consecutive month-over-month drop in ‘dynamic load factor’ and air freight rates, which peaked in early May, falling away towards the end of the month.

Path of growth slowing?

It added that the global air cargo industry will now have to wait until the publication of June 2021 market data to determine if May’s public holiday disruptions explain the shift in demand or whether the positivity of April’s +1% growth versus the same month of 2019 created a ‘false dawn’ of a sustainable growth recovery for the rest of the year.

“There were several (extended) public holidays in May which were not present in May 2019 (China, Russia and Eid al-Fitr at the end of the Ramadan) which will have impacted the monthly growth rate in a negative manner. By how much is hard to tell - so May 2021 is more complex to qualify than to quantity,” said Niall van de Wouw, Managing Director of CLIVE Data Services.

“The monthly data leaves us with a question mark that is likely to go unanswered until we see June’s level of demand. There are signals in May’s data that may be a cause for concern – particularly the -9% decline in air cargo volumes ex Europe versus May 2019 – but it’s certainly far too soon to tell if we are seeing a structural change in the recovery of the last few quarters,” he added.

Nonetheless, van de Wouw said, “there are several indicators in May that the path of growth may be slowing.”

CLIVE noted that dynamic load factor for May of 69% – based on analysis of both the volume and weight perspectives of cargo flown and capacity available – was 7% points higher than in 2019, although this also presented falls of -2% points and -4% points versus April and March 2021.

Available capacity in May 2021 was down -21% compared to the level of May 2019. This shows the gap in airline capacity is widening again compared to pre-pandemic market conditions following the -18% figure in April and -14% for March.

It also reported that May 2021 data versus the same month of 2020, when Covid restrictions caused severe disruption to the global aviation market, show +41% growth in chargeable weight, a +42% rise in available capacity, and a +1% point increase in dynamic load factor.

To offer a meaningful perspective of the air cargo industry’s performance, CLIVE Data Services noted that it is continuing to focus on comparing the current state of the market to pre-Covid 2019 volume, cargo capacity and load factor data until at least Q3 of this year — alongside the 2020 comparison.

Higher rates seen in May

Meanwhile, TAC Index noted that higher rates in May are in line with “still elevated” load factors due to capacity reduction in the market — although it noted that it has also seen a downturn in prices on key trade lanes in recent weeks.

“Airfreight capacity is still scarce on many key trade lanes, so prices remain strong as economic activity picks up whilst passenger air capacity remains constrained due to restrictions on international travel. The BAI (Baltic Air Freight Indices) increased by 3% in May over April, but this is marked slowdown on the 17% growth seen in April-over-March,” said Gareth Sinclair of TAC Index.

He noted that pricing strength continues to be seen ex-China and Hong Kong to the US and Europe and from Europe to the US with all 3 trade lanes seeing price increases in May over April, although prices peaked in early May and have fallen away in recent weeks.

“Even so, the airfreight market continues to be strong, particularly CN/HK to US, and is likely to continue for some time as demand in several markets continues to outstrip supply as eCommerce traffic increases and economic activity strengthens in many markets,” Sinclair added.

TAC Index reported that for US to Europe, prices saw a decline in May over April levels, although they did start to rise in the last 2 weeks of the month after an almost continuous decline since late March. It said “relative strength” were evident in four trade lanes with EU-US leading the way at +173% followed by CN/HK-US at 151%, and CN/HK-EU and US-EU growing at more modest levels of 84% and 64% respectively.

Mixed rates across the region

TAC Index noted that individual market indicators continue to show the differences on particular trade lanes.

It said CN/HK – US on average saw May prices up versus April by 9% with the highest rate of the year of US$8.90 recorded in the week ending May 10 — with the underlying trend continuing to show prices rising steadily.

For CN/HK – EUR, TAC Index noted that although the average rate in May was up 5% on April, there have been declines in recent weeks from the 2021 high of US$5.07 seen in the week ending May 3.

For the US – EUR lane, there has been a steady decline in the weekly rate since the 2021 high of US$2.13 in the week ending March 23, with the May average down 5% in April.

Meanwhile, TAC Index reported that for the EUR – US, the market continued to be the “most volatile” with the rates trending upwards in recent weeks so that the May average was up 2% in April.