The International Air Transport Association (IATA) released data for global air cargo markets in August showing that demand is still down compared to the exceptional performance seen in 2021 although resilient despite economic uncertainties and geopolitical conflicts.

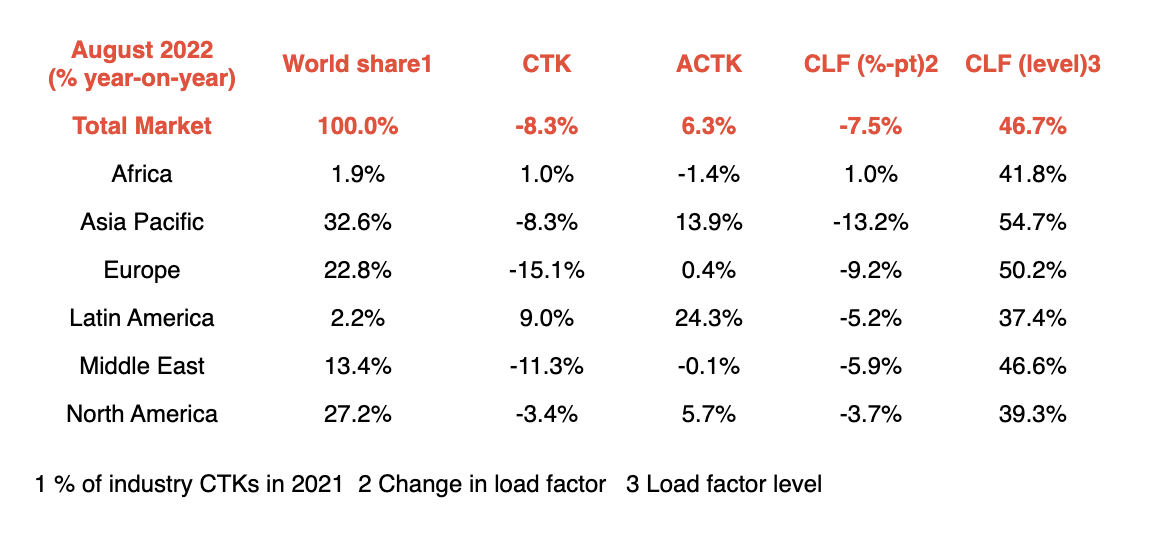

Global demand, measured in cargo tonne-kilometres (CTKs), fell 8.3% compared to August 2021 (down 9.3% for international operations). This was, however, a slight improvement on the year-on-year decline of 9.7% seen in July.

For the period, IATA noted that capacity was 6.3% above August 2021 (+6.1% for international operations) which is a significant expansion over the 3.6% year-on-year increase in July.

IATA said several factors impacted the operating environment for the month including the slight expansion in global goods trade in August, and the additional easing of Covid-19 restrictions in China which will positively impact cargo markets.

It added that while maritime will be the main beneficiary, air cargo will also receive a boost from these developments.

Air cargo shows "resilience" in August

"Air cargo continues to demonstrate resilience. Cargo volumes, while tracking below the exceptional performance of 2021, have been relatively stable in the face of economic uncertainties and geopolitical conflicts," said Willie Walsh, IATA's director general.

"Market signals remain mixed. August presented several indicators with upside potential: oil prices stabilized, inflation slowed and there was a slight expansion in goods traded globally. But the decrease in new export orders in all markets except the US tells us that developments in the months ahead will need to be watched carefully," the IATA chief added.

Source: IATA

IATA said Asia-Pacific airlines saw their air cargo volumes decrease by 8.3% in August compared to the same month in 2021 which was an improvement over the 9.0% decline in July.

"Airlines in the region benefited from slightly increased levels of trade and manufacturing activity due to the easing of Covid-19 restrictions in China," IATA said, adding that available capacity in the region increased by 13.9% compared to August 2021, also a significant increase over the 2.7% growth in July.

In its report, IATA noted that North American carriers posted a 3.4% decrease in cargo volumes year-on-year during the same month. It said this was an improvement over the 5.7% decline in July — boosted by the lifting of restrictions in China which improved demand. It added that a further boost is expected in the coming months.

European carriers worst performer for 4th month

Meanwhile, European carriers saw a 15.1% decrease in cargo volumes in August compared to the same month in 2021.

"This was the worst performance of all regions for the fourth month in a row. This is attributable to the war in Ukraine. Labour shortages and high inflation levels, most notably in Türkiye, also affected volumes," the association said, adding that capacity increased by just a mere 0.4% year-on-year in August.

Middle Eastern carriers experienced an 11.3% year-on-year decrease in cargo volumes in August.

IATA said stagnant cargo volumes to/from Europe impacted the region's performance.

Latin American carriers reported an increase of 9.0% in cargo volumes in August compared to the same month in 2021 which IATA noted was the strongest performance of all regions.

IT said airlines in this region have shown optimism by introducing new services and capacity, and in some cases investing in additional aircraft for air cargo in the coming months. Capacity was also up 24.3% compared to the same month in 2021.

African airlines saw cargo volumes increase by 1.0% year-on-year in August. IATA said this was a significant improvement on growth recorded the previous month (which saw a 3.5% drop), while capacity for August was down 1.4% compared to August 2021.