The underlying costs for operating liner services have increased significantly over the past couple of years, according to a new analysis by Sea-Intelligence with bunker costs seen to have experienced the largest relative cost increase compared to 2019.

In its analysis, the maritime analyst noted that while it would be ideal to analyse costs across multiple carriers, few carriers provide detailed cost data and the analysis was based on cost data published by Hapag-Lloyd.

The underlying assumption is thus that Hapag-Lloyd is representative of the market, Sea-Intelligence added, noting that the liner provides this data in a more regular manner and with several years of history.

"The important question is how much these costs have actually increased. This provides one of the anchor points, in assessing what the baseline rate level might settle at once we get through the present rate renormalization," Sea-intel said.

The Danish maritime data analyst company noted that Hapag-Lloyd has three major cost categories – transport expenses, personnel expenses, and depreciation, amortisation, & impairments.

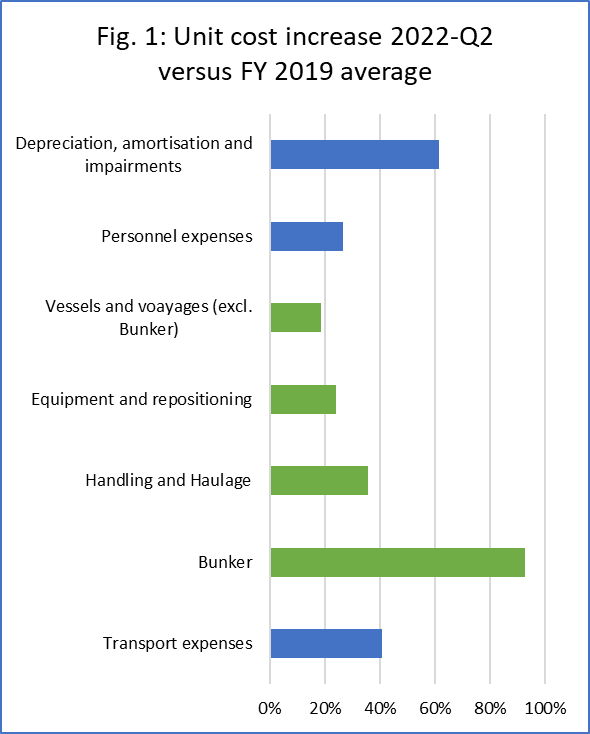

Meanwhile, transport expenses are subdivided into the bunker, handling & haulage, equipment & repositioning, vessels & voyages (excl. bunker), and expenses for pending voyages (an exceedingly small element and will not be analysed here).

Source: Sea-Intelligence

Bunker costs saw largest increase

Figure 1 shows a comparative overview of the increases in each of these cost elements. The unit cost is calculated across transported volumes in that quarter. The blue bars are the three main cost categories, and the green bars are the subcomponents of transport expenses.

"Bunker costs are here seen to have experienced the largest relative cost increase compared to 2019," the report said, adding that when accounted for the relative share, the cost increase in handling and haulage is accountable for 37% of the unit cost increase, followed by bunker fuel which is accountable for 30% of the cost increase.

Sea-Intelligence said this means that two-thirds of the inflationary pressure is related to fuel, handling and haulage.

It added that this is also a key pointer as to where the carriers are likely to focus in the months ahead, as the ongoing market downturn will force carriers to focus on cost reductions.