Major shipping lines made US$122 billion in operating profit for the first three quarters of 2022, according to a new analysis by Sea-Intelligence, which also noted that despite the lofty performance this also "strongly suggests" that the pandemic-related carrier profitability boom is at the "end-of-the-line."

The maritime analyst said of this EBIT (Earnings Before Interest and Tax), the third quarter figure was US$ 35.6 billion so far — minus CMA CGM who have published their EBITDA but not their EBIT/operating profit.

Major shipping lines recorded a combined EBIT of US$41.6 billion in the second quarter, which Sea-Intel said then, passed their past Q2 earnings in the past 11 years.

"The major shipping lines (that report financial figures) made a staggering USD 124 billion in operating profit in 2021, following that up with nearly US$122 billion in the first three quarters of 2022 alone," Sea-Intelligence said.

Source: Sea-Intelligence

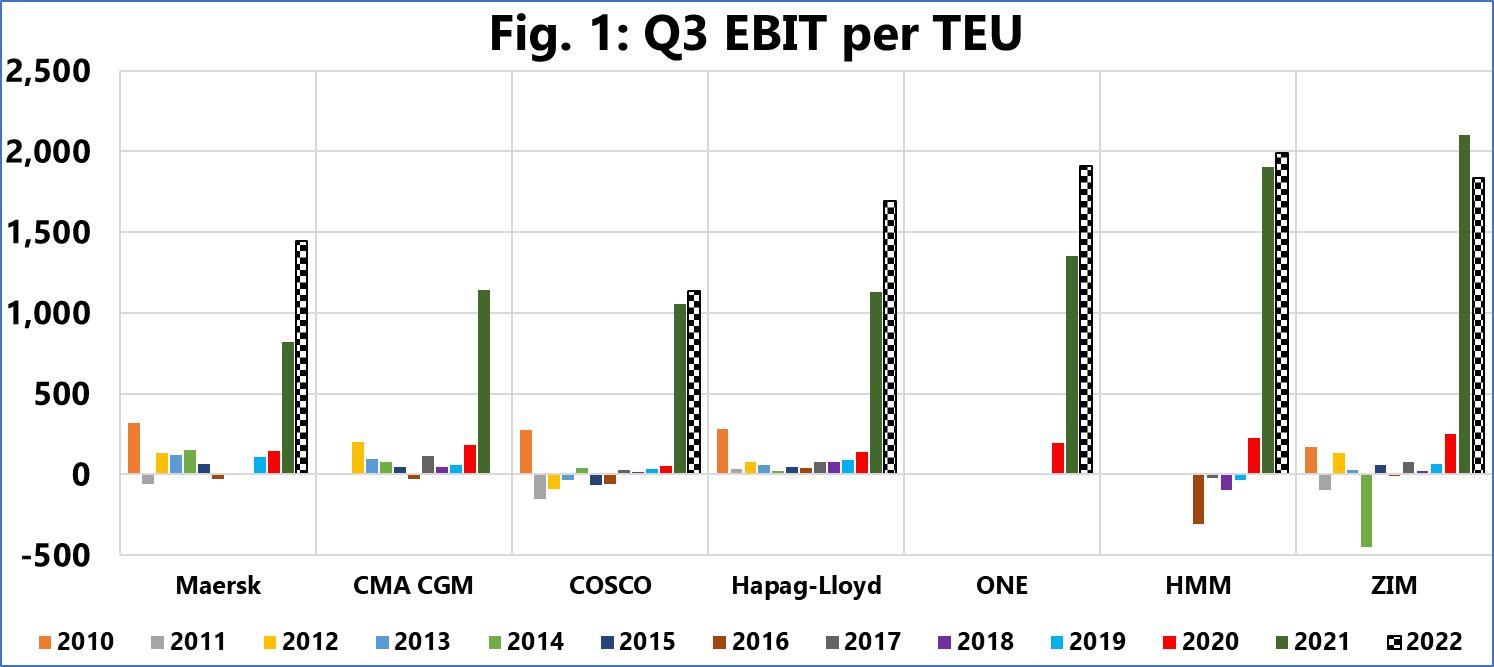

Based on its data, Sea-Intel noted that Figure 1 shows the Q3 EBIT/TEU for 2010-2022, for the major carriers that report EBIT and global volumes.

"The figures for 2021-Q3 and 2022-Q3 dwarf those of the previous years, with some of the carriers seeing a substantial increase year/year (Y/Y) in 2022-Q3. ZIM was the only carrier with a Y/Y decrease, but still with one of the strongest 2022-Q3 EBIT/TEU figures," it said.

Sea-Intelligence noted that not all of the developments are positive from the perspective of the shipping lines though.