Supply chains are almost back to normal in terms of activity, inventories and seasonality, according to a new analysis by S&P Global Market Intelligence, yet, it noted that there are plenty of uncertainties in both the government policy and physical risk heading into the second half of 2023 as firms start to implement long-term supply chain restructuring plans.

Supply chains continue to settle

S&P said evidence of a return to normal supply chain activity is now well established and largely due to a decline in activity — and the S&P Global manufacturing PMI showing supplier delivery times have reached their fastest since April 2009 as of May.

From an inventory perspective, it added that manufacturers' stocks of purchases in May were a touch above the first-quarter 2023 average, while stocks of finished goods are close to balance.

Retailers' inventories, on the other hand, are more of a "mixed bag" based on corporate financial data, with fast-fashion firms' inventory-to-sales ratios in line with pre-pandemic levels.

S&P said inventories also remain elevated for home appliances, building suppliers and electronics, though that reflects depressed demand rather than a new "just in case" management model.

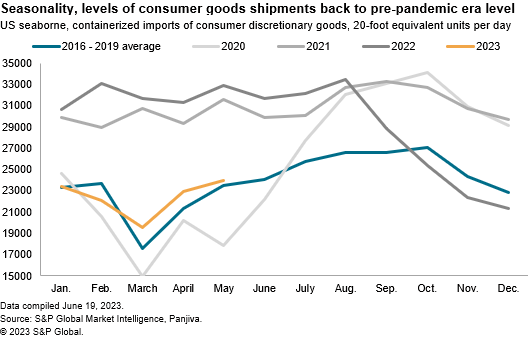

"One of the most visible signs of disruptions during the pandemic was shortages and delayed deliveries of consumer discretionary goods, ranging from home appliances and televisions to furniture and apparel. That led to disrupted shipping patterns, which now appear well on the way to being corrected," the analysis said.

"In 2023, there appears to have been a return to historic levels in both the level and pattern of shipments during in the first part of the year."

S&P noted that in May 2023, US seaborne imports of containerized freight fell by 27% year over year and were 2% above the 2016 to 2019 average for the month.

Challenges to remain in the second half

Meanwhile, the analysis pointed out that a series of EU-focused environment-linked regulations are being negotiated or coming into force during the second half of 2023 — which could "prove particularly consequential" for the steel and aluminium sectors and their downstream supply chains.

S&P said the EU and US are in the process of negotiating an agreement on tariffs to be applied on steel and aluminium based on the greenhouse gas emissions of production.

The European Commission has indicated a deal could be completed by October.

The implementation of the EU's Carbon Border Adjustment Mechanism (CBAM) also takes effect in October with a requirement to report imports under the scheme.

While international trade activity patterns appear to have returned to normal, S&P said physical logistics network disruptions from a variety of natural disasters and staff-related factors remain possible, particularly during the peak shipping season.

It said that the risk of a West Coast port strike has diminished with a new — but as yet unratified — deal, but inland labour disruptions cannot be ruled out.

Low water levels in the Panama Canal are already restricting ship movements from Asia to the Atlantic basin.

S&P also added that the logistics sector had endured several cyber attacks over the past five years, the impact of which can be elevated during the peak shipping season.

"As supply chain activities have normalized, corporations are reviewing and implementing supply chain changes in the light of the past three years. The second half of 2023 should bring more announcements of long-term supply chain strategy choices," S&P said.

It added that a central issue is that the main routes to change are all long-term in nature and expensive to implement in a lower cash-flow/higher interest rate environment which is particularly the case for inventory management and multi-sourcing, which both add cost.

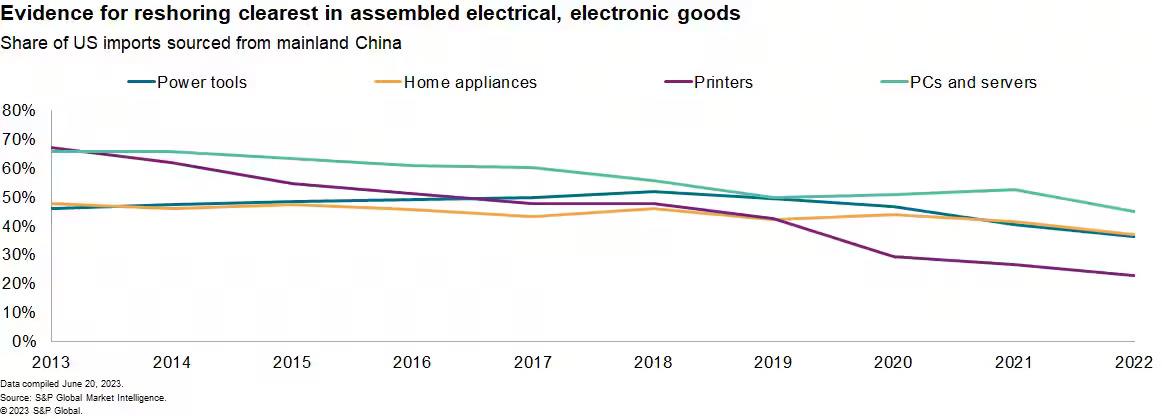

"There is plenty of evidence that reshoring is already taking place," commented Chris Rogers, head of supply chain research at S&P Global Market Intelligence.

He noted that mainland China's suppliers' share of US imports printers was 23% in 2022, down steadily from 67% in 2013.

There have been similar patterns for power tools, home appliances and personal computers as well.

"Reshoring can take years to implement. A key part of that process, alongside other resilience strategies, such as inventory management and multi-sourcing, is the investment to digitize supply chain operations," Rogers added.

"There's evidence of that taking place," he added, noting that a recent survey by S&P Global's 451 Research showed that 42% of firms already have comprehensive supply chain visibility systems in place, while another 33% are in the discovery, or proof-of-concept stage.