Kuehne+Nagel (K+N) reported declines in volumes, revenues and profits for the second quarter of the year, although the airfreight forwarder said the group still achieved "solid results" in a challenging market environment.

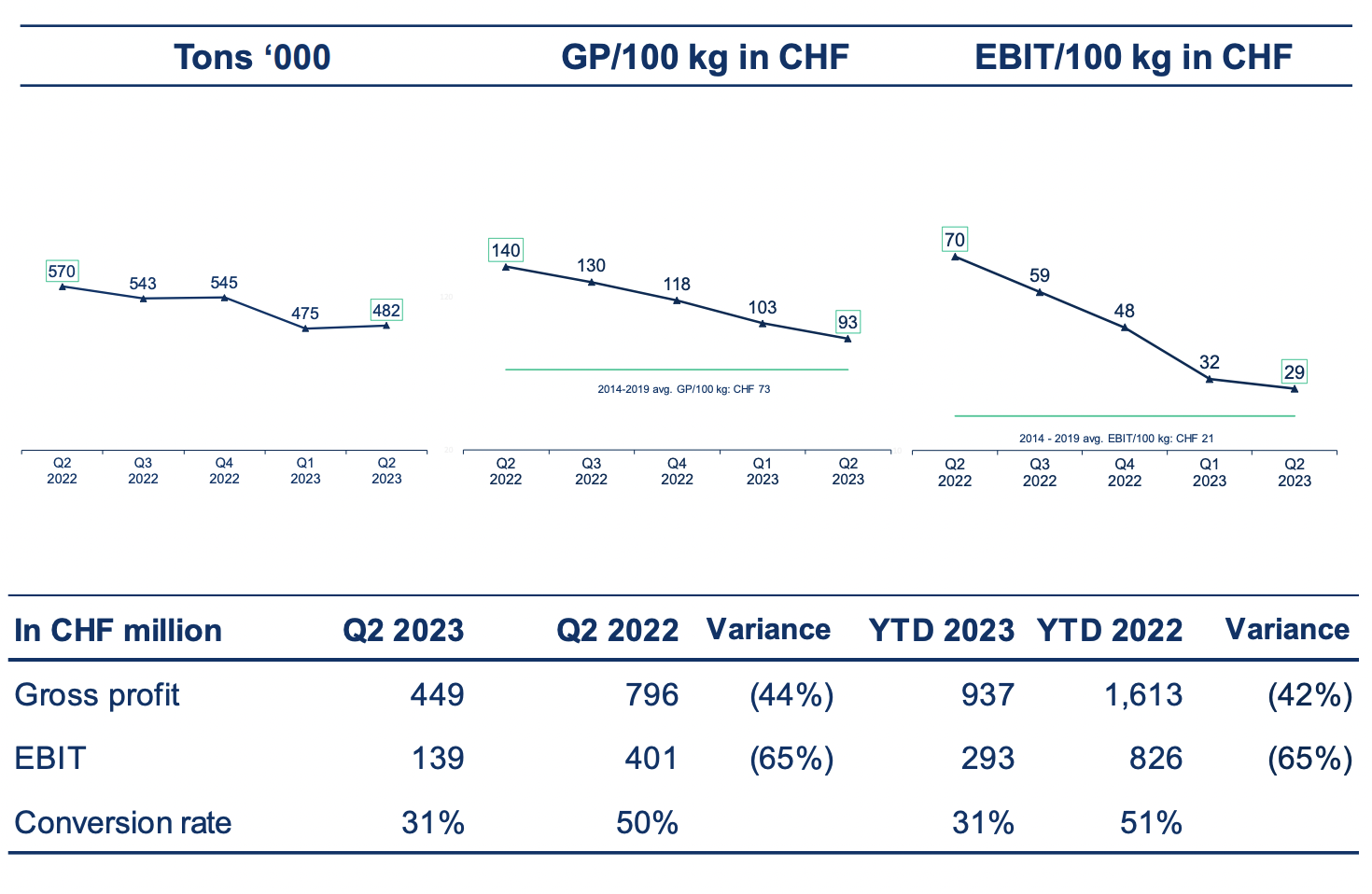

The airfreight forwarder saw air cargo volumes decline to 482,000 tonnes in the second quarter compared to 570,000 tonnes during the same period in 2022. This is, however, higher than the 475,000 tonnes recorded in Q1 2023.

Gross profit for the segment during the period dropped by 44% to CHF 449 million (US$522.7 million), while earnings before interest and tax (EBIT) also declined by 65% to SFr139 million (US$161.8 million) from SFr401 million (US$466.8 million) recorded during the same period last year.

[Source: Kuehne+Nagel]

The world's leading air forwarder said that the "volume decline [is] in line with market development[s]."

It noted that its cost reduction programmes had driven down cost per 100kg by 9% year on year in the second quarter.

K+N also announced that its acquisition of Morgan Cargo — a leading South African, UK and Kenyan freight forwarder specialising in the transport and handling of perishable goods — is expected to close in Q3 2023.

For sea logistics, K+N said the numbers point to recovery.

For the period, the forwarder said volume increased to 1.107 million tonnes — slightly lower than the 1.114 million tonnes seen during the same period in 2022 but higher than the 987,000 tonnes recorded in the first quarter of 2023.

"Volume [is] showing signs of recovery," K+N said, adding that the business also increased market share centred in the Transpacific.

The forwarder said its focus is on the continued long-term shift toward higher-yielding volumes. K+N added that intensified cost measures result in a 13% year-over-year reduction in cost per TEU in Q2.

For contract logistics, K+N noted market share expansion in the pharma and e-commerce segments.

"The pandemic-related special economic situation in 2021 and 2022 continued to distort the year-on-year comparisons across the entire range of figures," the forwarder said in a statement.

In the second quarter, the company saw a significant decrease in revenues, with a 43% decline amounting to Sfr6 billion. Additionally, earnings also experienced a decline of 50% to Sfr 398 million, while EBIT was down 51% to Sfr 523 million.

Results "significantly greater" than pre-Covid period

"Kuehne+Nagel coped well with the transition from the exceptional economic situation shaped by the pandemic. In a weakened economic environment, Sea and Contract Logistics gained market share and kept earnings stable," said Stefan Paul, CEO of Kuehne+Nagel International AG.

"In contrast, volumes in Air Logistics declined broadly in line with the market."

Paul noted that while K+N's ongoing cost control efforts became more visible in the second quarter of 2023, the company's "strategic path" is unchanged, with a focus on high-quality logistics services and an extraordinary customer orientation.

For his part, Dr Joerg Wolle, chairman of the board of directors of Kuehne+Nagel International AG, noted that in the first half of 2023, the Kuehne+Nagel Group's financial results were "significantly greater" than the comparable figures of the pre-Corona period — and that the Group has "performed well in the new environment."

"In the coming years, Roadmap 2026 will remain the key driver of Kuehne+Nagel's strategic development. The program, launched in March 2023, was very positively received both internally and externally, and we are already seeing the first successes," Wolle said.

"Our focus remains on the provision of high-margin services and the development of market potential in Asia, Africa and the Middle East," he added.