Continuing congestion, exacerbated by the impact of El Nino to the end of 2023, will increase voyage costs and may affect trade patterns should longer waiting times result in operations through the Panama Canal becoming commercially unviable, according to a new analysis by Drewry.

The maritime research consultancy firm said in a recent report that charter rates in the dry bulk market improved for the sub-capesize vessels in August amid increased congestion in the Panama Canal.

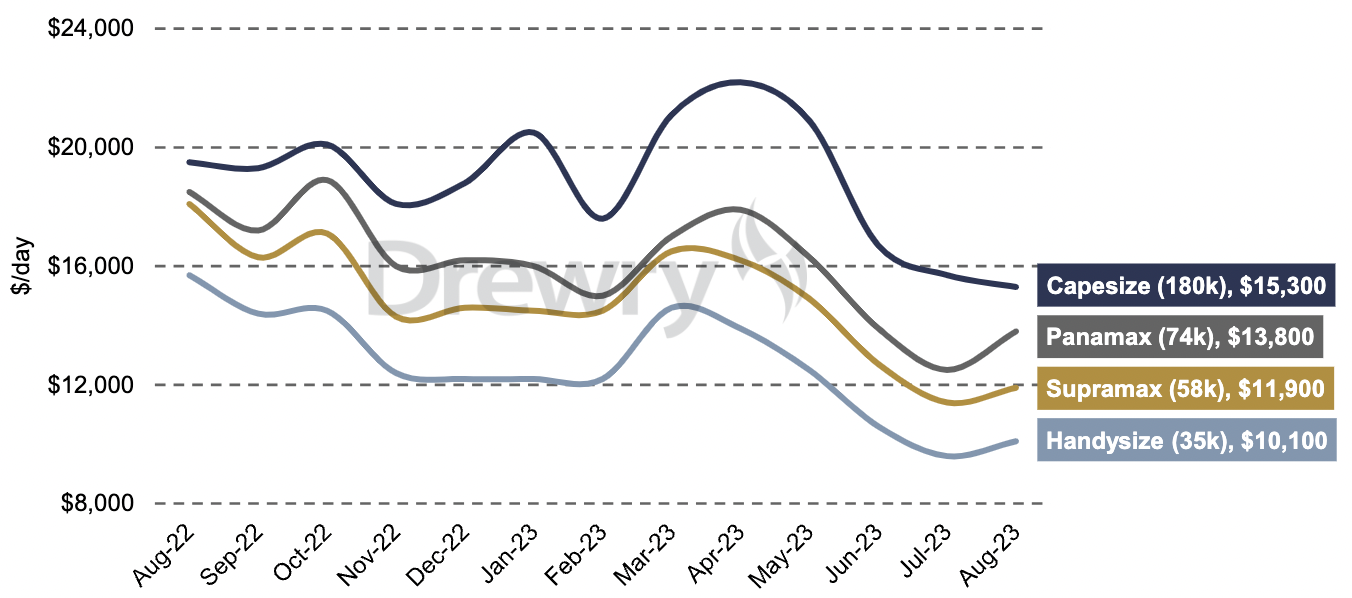

The 1-year TC rates strengthened in August after declining for three consecutive months as additional waiting time squeezed supply in the market.

1-year TC rates

[Source: Drewry Maritime Research]

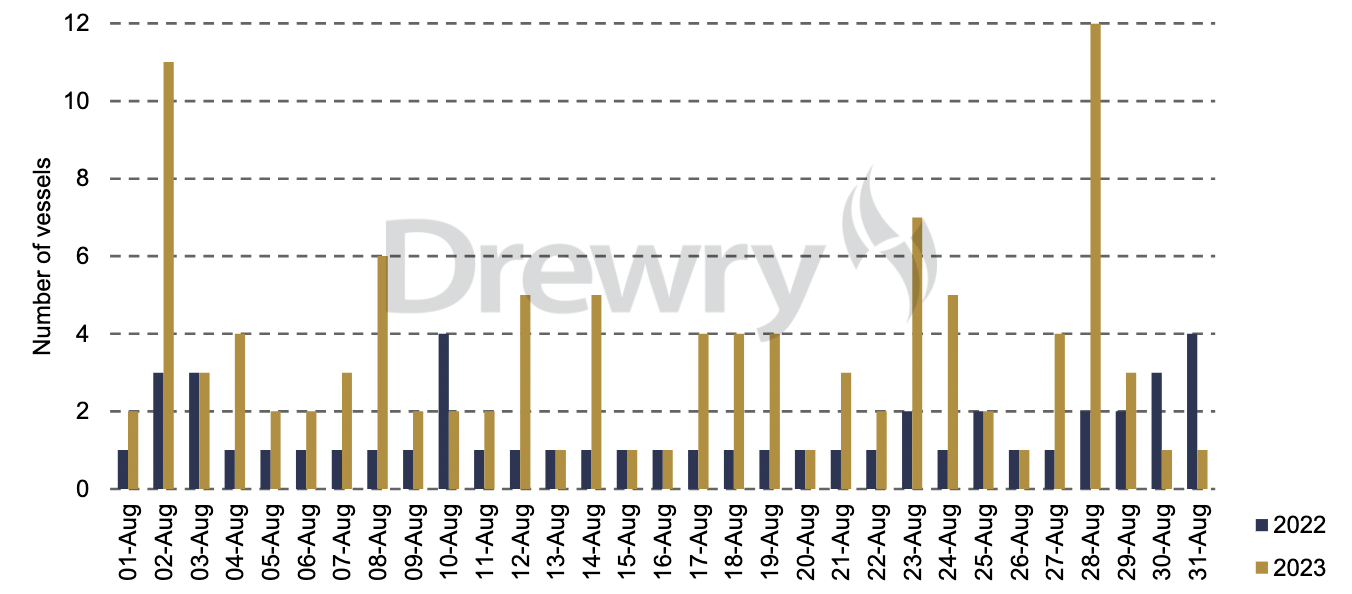

Drewry noted that waiting tonnage increased significantly as falling water levels in the canal, caused by the ongoing El Nino drought, resulted in restrictions on vessel throughput.

The number of vessels waiting in the Panama region was higher year-on-year on almost every day in August 2023.

Daily arrivals in Panama

[Source: Drewry Maritime Research]

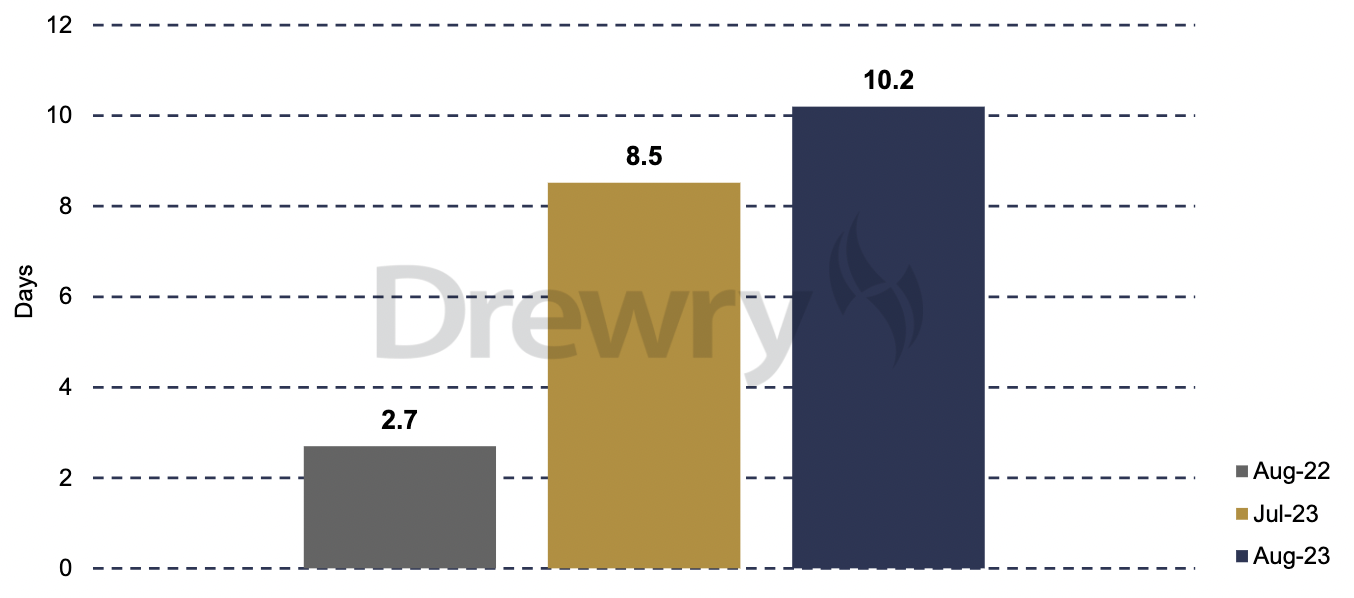

Drewry said the average vessel passage time through the canal in August 2022 was 2.7 days, which rose to 8 days in July 2023 and 10 in August 2023.

Some vessels have taken as long as 16 days to complete the transit.

Average maximum waiting time for vessels

[Source: Drewry Maritime Research]

"While all vessel segments have suffered from the congestion, in August, the disruption appears to have impacted Handysize and Supramax vessels more severely than Panamaxes," the report said.

Drewry noted the importance of the Panama Canal to international trade and said carriers might be prompted to look at alternative routes should restrictions further impact wait times, reliability and cost.

"The Panama Canal is a crucial choke point for various trade routes," the maritime research consultancy firm said.

It added that while considerable Latin American trade flows through the canal - such as the coal trade from Colombia to Chile, ships on long-haul routes like USG-China also use this passage.

Restrictions expected to remain

"As the impact of El Nino is likely to intensify, we expect restrictions to remain in place, resulting in higher voyage costs," Drewry said.

"If shippers continue operating on their normal trade routes, the longer waiting times will increase operating costs."

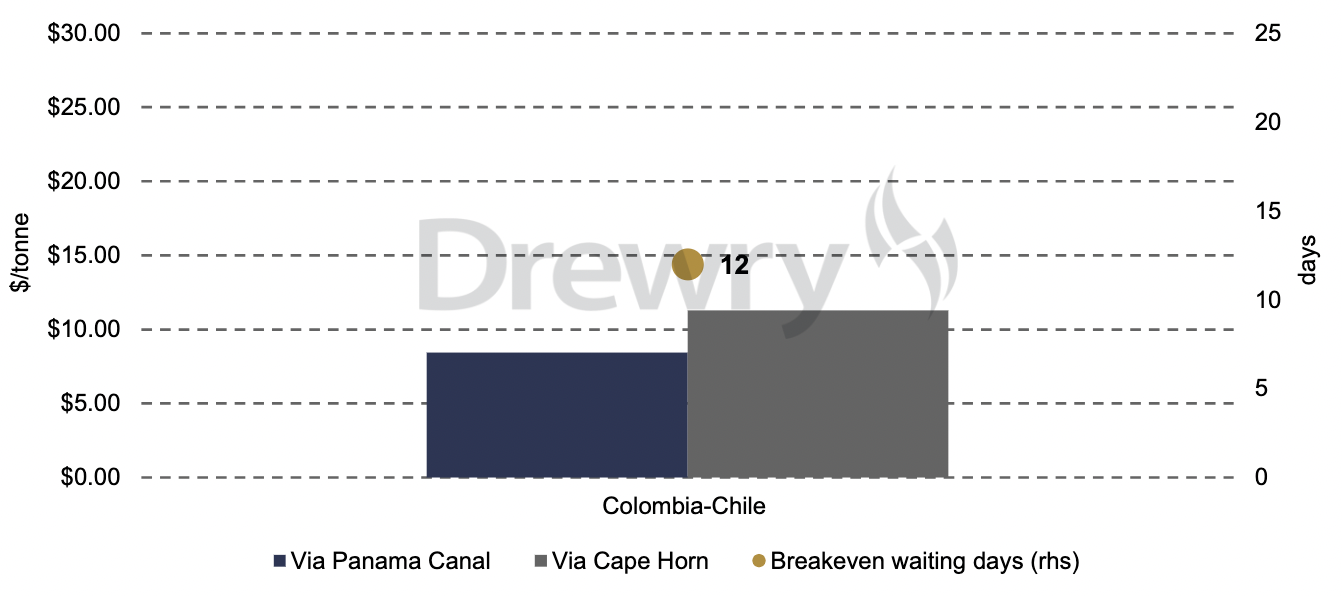

Nonetheless, Drewry warned that to explore the route/cost options open to shippers, if a five-year-old traditional Panamax vessel moving on the Colombia-Chile route via the Panama Canal were to switch to an alternative route via the Magellan Strait, voyage costs would increase by a minimum of 34%.

Similarly, a vessel currently moving from USG to China would see a 28% rise in costs if it moved through the Cape of Good Hope instead of the Panama Canal.

"Since each additional waiting day on the traditional route through the canal raises bunker and charter hire costs, we estimate that more than 22 days of waiting time due to congestion will negate the differential between the two routes," the report said.

"Similarly, it would be more economical for shippers to move through the Magellan Strait on the Colombia-Chile route if waiting days are more than 12 in Panama, as voyage costs would break even," Drewry added.

Voyage cost comparison

[Source: Drewry Maritime Research]

Drewry said, however, that re-routing of vessels is not always feasible, certainly not without an increase in cost.

It noted that trade on the WCSA-Continent route is facing critical issues right now as there is a lack of backhaul cargo to ECSA to make the alternative route commercially viable.

Many commodities like grain and soybean are seasonal, making shifts in trade sources difficult.

"As the export season of the US soybean kicks in next month, trade on the USG-China route will be affected due to the continued congestion," the report said.

However, it added that EU imports of metal concentrates like lithium and copper from Chile and Peru could become more costly as voyage rates increase.

"This might impact trade patterns, leading to an increase in the trade of metal concentrates between Argentina and the EU," Drewry further said.