Global air cargo markets continued to show demand recovery and showed a moderate growth momentum in September.

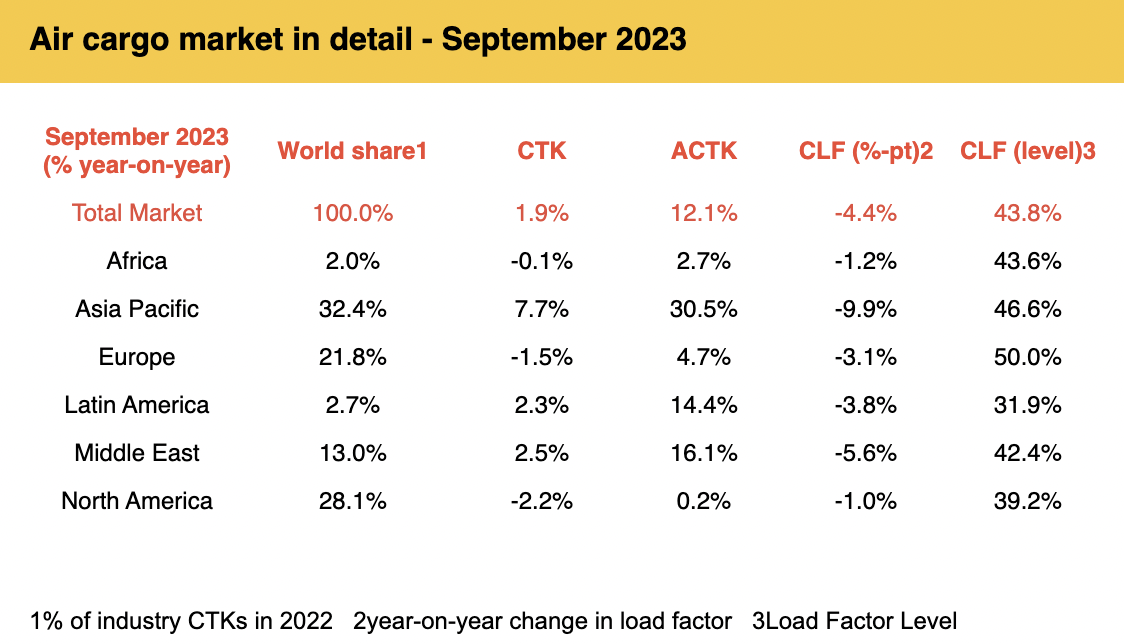

The International Air Transport Association (IATA) released data for September 2023 global air cargo markets, which showed global demand — measured in cargo tonne-kilometers (CTKs) — increased by 1.9% compared to September 2022 levels (+1.6% for international operations).

Capacity, measured in available cargo tonne-kilometers (ACTKs), was up 12.1% compared to September 2022 (+11.0% for international operations).

IATA noted that the latest figure showed continuing demand recovery for the air cargo industry.

It added that growth was largely related to international belly capacity, which rose 31.5% year-on-year as airlines scaled up operations to meet peak-northern summer travel season demand.

Possible strong year-end peak season

"Air cargo eked out modest growth (1.9%) in September despite falling trade volumes and high jet fuel prices," said Willie Walsh, director-general of IATA. "That clearly shows the strength of air cargo's value proposition."

"With the key export order and manufacturing PMIs hovering near positive territory, we can be cautiously optimistic for a strong year-end peak season," he added.

September regional performance

For September, IATA said Asia-Pacific airlines saw their air cargo volumes increase by 7.7% in September 2023 compared to the same month last year. This also marks a "significant improvement" in performance compared to August (+4.6%).

IATA said carriers in the region benefited from growth on three major trade lanes: Europe-Asia (+9.6%), Middle East-Asia (+7.0%) and Africa-Asia (+12.8%).

Available capacity for the region's airlines was also up by 30.5% compared to September 2022 as more belly capacity came online from the passenger side of the business (a year ago, the key Asian markets of Japan and China were still largely under severe COVID-19 travel restrictions).

For the period, North American carriers had the weakest performance in September, with a 2.2% decrease in cargo volumes. IATA said although contractions in the North America-Asia trade lane narrowed (from -4.3% in August to -1.8% in September), the North America-Europe market stabilized its decline at (-2.5%) for the second month in a row. Carriers in the region did not benefit significantly.

European carriers saw their air cargo volumes decline by 1.5% year-on-year — also showing a weaker performance than in August (-0.6%). IATA said carriers in the region suffered from further contractions in the Europe market (-5.7% in September vs -5.2% in August).

Middle Eastern carriers, meanwhile, had the strongest performance in September, with a 2.5% year-on-year increase in cargo volumes as carriers in the region benefited from growth in the Middle East-Asia (+7.0%) and Middle East-Europe markets (+3.3%).

For the period, Latin American carriers saw a 2.3% year-on-year increase in cargo volumes.

African airlines saw their air cargo volumes also drop by 0.1% in September, despite the strong growth of demand on the Africa-Asia trade lane (+12.8%).