Global air cargo tonnages have bounced back in the second week of 2024 following their typical slowdown in the second half of December and the first week of January, according to the latest figures from WorldACD Market Data.

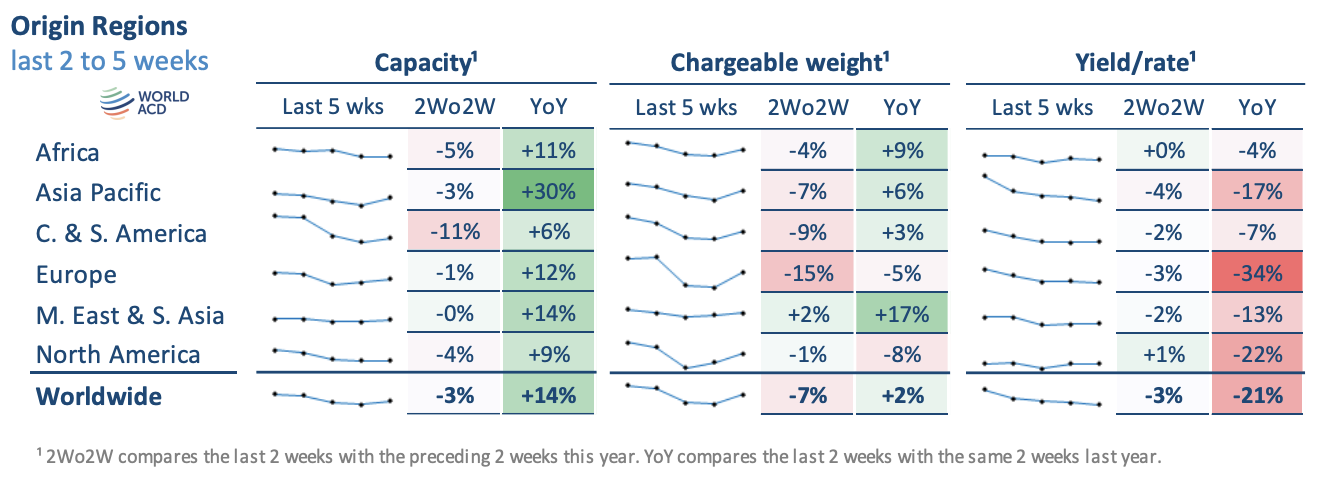

The report noted that this growth included double-digit percentage increases in demand to Europe from Asia Pacific and from the Middle East & South Asia in the last two weeks, which may reflect some modal shift to air due to disruptions to shipping in the Red Sea.

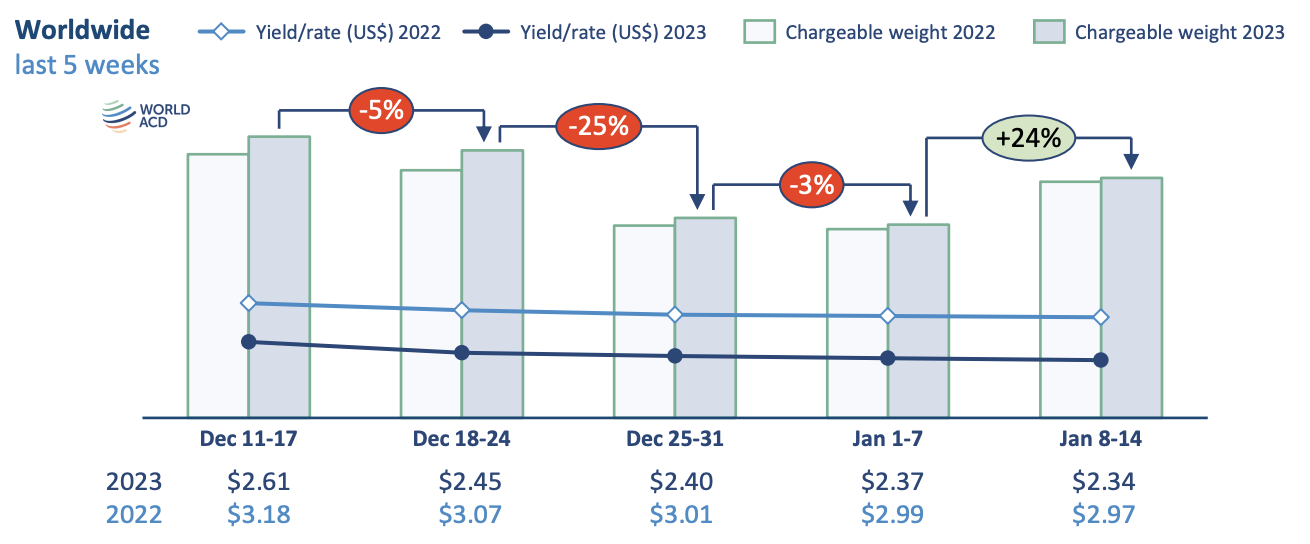

The air cargo market data provider said preliminary figures for week 2 (January 8 to 14) indicate that global air cargo tonnages rose 24% compared with the previous week.

This comes after falling by around 30% in the second half of last month and by around 3% in week 1.

WorldACD said average worldwide rates dropped again slightly in week 2 after falling by around 2% in the first week of 2024.

It added that these patterns are "broadly similar" to those of previous years, although that 24% tonnage rebound in week 2 was stronger than in the equivalent week last year.

Expanding the comparison period to two weeks, WorldACD said total combined tonnages for weeks 1 and 2 this year were down by 7% globally, compared with the preceding two weeks (2Wo2W), and average yields fell by 3%, with capacity down 3% — also familiar patterns for this time of year in 2023.

"There have been anecdotal reports in recent days of cargo owners switching some cargo from sea to air because of longer ocean voyages caused by the disruptions in the Red Sea. Although it's unclear yet to what extent this has contributed to air cargo demand, those elevated tonnage figures to Europe from the Asia Pacific and from the Middle East & South Asia likely reflect some contribution from modal shift on these lanes from sea to air and to sea-air," WorldACD said.

It added that in contrast to the higher tonnages ex-Asia Pacific to Europe, demand ex-Asia Pacific to other markets declined on a 2Wo2W basis, including an 18% drop to Middle East & South Asia and a 9% fall to North America, while intra-Asia Pacific tonnages also dropped sharply by 21%.

"But the uplift in chargeable weight to Europe from Asia Pacific and from Middle East & South Asia has not yet brought any corresponding increase in average prices, with rates to Europe from Asia Pacific and from Middle East & South Asia down by 6% and 2%, respectively, on a 2Wo2W basis," the report said.

Demand, capacity up year-on-year

WorldACD said year on year, demand remains up slightly (2%) globally.

Continuing a positive trend ex-Asia Pacific observed in the final quarter of 2023, demand ex-Asia Pacific in the first two weeks of this year is up 6% compared with this time last year, despite the Lunar New Year (LNY) in 2024 coming later (February 10) than last year (January 22) — an improvement this year that is, therefore, unlikely to be a pre-LNY surge.

Elsewhere, tonnages for the first two weeks of this year are up YoY, ex-Middle East & South Asia (17%), ex-Africa (9%) and ex-Central & South America (3%), but they remain down ex-North America (-8%) and ex-Europe (-5%).

On the pricing side, WorldACD said worldwide average rates are currently 24% below their levels this time last year, at an average of US$2.34 per kilo in week 2, although they remain significantly above pre-Covid levels (+31% compared to January 2019).