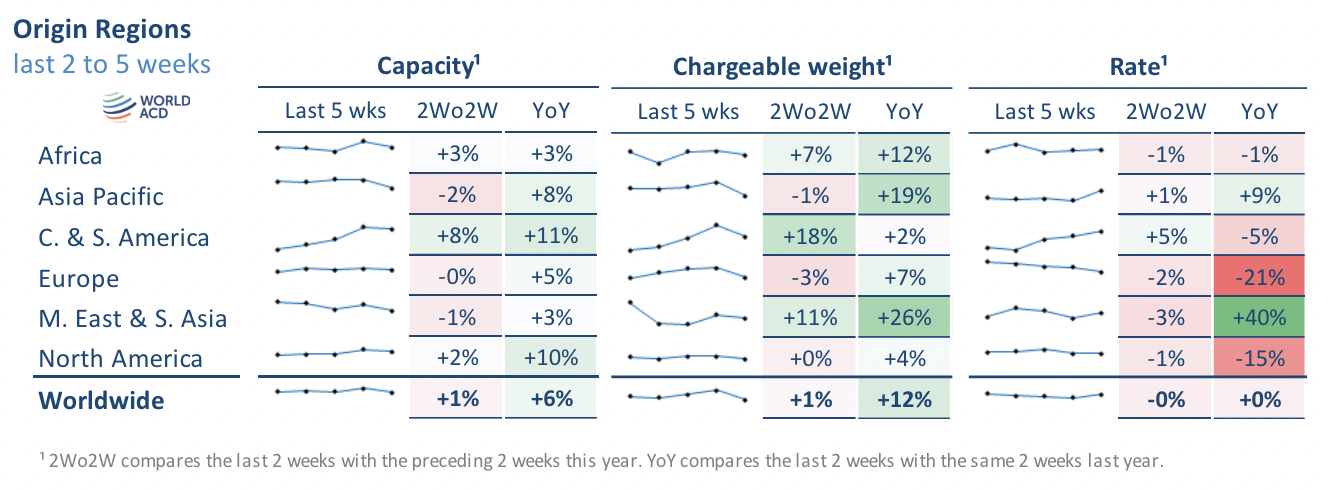

Worldwide air cargo tonnages dipped in the week commencing April 29, amid the Labour Day holidays and Japan's Golden Week, while demand and rates remain highly elevated from Middle East & South Asia (MESA) origins to Europe, and average global rates increased slightly.

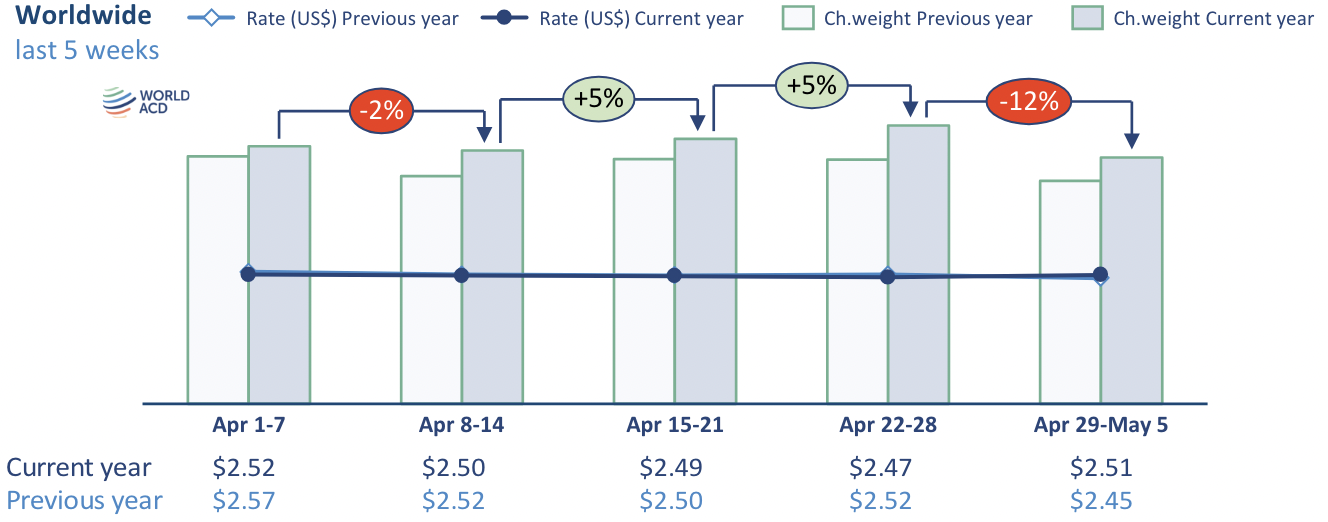

According to the latest weekly figures and analysis from WorldACD Market Data, total worldwide tonnages dropped by 12% in week 18 (April 29 to May 5) after bouncing back in the previous two weeks from the effects of Easter and Eid holidays.

Tonnages fell in week 18 from all the main global regions, but most significantly from the big Asia Pacific origin region, where volumes were down nearly 16%, week on week (WoW).

WorldACD said roughly one-third of that Asia Pacific decline could be attributed to Japan's Golden Week holiday from April 29 to May 5, which led to a WoW decline of 46% in chargeable weight from Japan origins.

Meanwhile, after booming for two consecutive weeks, buoyed by flower shipments ahead of Mother's Day, tonnages from Central & South America (CSA) declined, WoW, by 14%, of which more than half (54%) can be attributed to the post-peak drop in the flower business.

The air cargo market data provider noted that tonnages ex-Europe fell, WoW, by around 11%, with smaller declines from MESA (5%), Africa (5%) and North America (4%).

Removing the effects of Japan's Golden Week and the decline in flower shipments, ex-CSA would reduce the global tonnage decline in week 18 from 12% to 9%.

WorldACD noted that in week 18 last year, tonnages fell by a similar amount (10%).

A large part of the WoW decline in week 18 was also linked to public holidays around Labour Day on May 1, which especially impacted Europe, CSA, parts of Asia (e.g. China, Vietnam, Malaysia, Singapore, Thailand) and Africa (e.g. South Africa) with at least two-thirds of the WoW decline is from countries that celebrate Labour Day.

On the pricing side, average global rates rose slightly (1%) in week 18 to US$2.51 a kilo, which is around 2% higher than the same week last year and significantly above pre-COVID levels (42% compared to May 2019).

On a YoY basis, WorldACD said rates from origin region MESA remain highly elevated (up 40%) compared with this time last year, linked to strong demand developments combined with supply issues caused by disruptions to container shipping, and rates from Asia Pacific origin points remain significantly up (up 9%), YoY.

But average rates from Europe (down 21%) and North America (down 15%), are well below last year's levels.

MESA-Europe surge continues

WorldACD said despite the overall drop in tonnages in week 18 from all the main world regions, including from MESA origins, fresh analysis this week by WorldACD reveals that air cargo tonnages and rates from MESA origin point to Europe remain highly elevated.

Tonnages from MESA to Europe as a whole were up, year on year, by 40% in week 18 and very similar to those of the previous week.

It added that Dubai-Europe tonnages continue to boom, at almost three times their level in week 18 last year (up 183%), boosted by sea-air traffic via this key hub.

Demand from India to Europe appears to have eased slightly in the last four weeks from the extraordinarily high levels seen in weeks 8 to 14.

However, on the pricing side, average rates from India (US$3.94 per kilo, up 164%) to Europe are still exceptionally high.

Meanwhile, rates from Dubai and Colombo to Europe are up, YoY, by a more modest but still remarkable 44% and 51%, respectively, as strong demand and the disruptions to container shipping in the region caused by the attacks on ships in the Red Sea continue to stimulate very strong air cargo demand from the MESA region.