Container freight rates could reach pandemic record highs as ocean carriers continue to sail around the Cape of Good Hope due to ongoing challenges in the Red Sea.

Ocean supply chain advisory firm Sea-Intelligence said the Asia-Europe spot rate, for example, could exceed US$20,000/FFE.

"Spot rates continued to skyrocket this week, and shippers are clearly getting anxious, in relation to how high rates may go. But the truth is, nobody really knows," said Alan Murphy CEO of Sea-Intelligence.

He noted that prices will increase until sufficiently many shippers cannot afford to ship their goods — and this will lower container demand, to the point where it matches the available vessel capacity.

"But the actual level where this happens is not known," Murphy added. "The easiest answer to 'how high can rates go?' would be to point to the maximum level seen during the pandemic."

"This, however, does not account for the increased round-Africa sailing distances that weren’t present during the pandemic," the Sea Intelligence chief added.

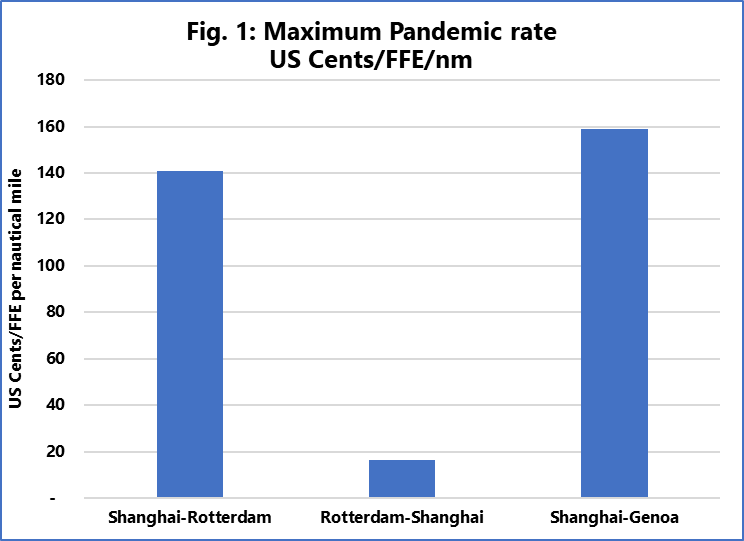

The analysis accounted for the longer sailing distances and rates in relation to the distance sailed, i.e. US Cents/FFE for each nautical mile sailed.

[Source: Sea-Intelligence]

"For the pandemic, this is shown in Figure 1. While Figure 1 is simply a display of historical fact, it also sets a precedent, which is that during times of severe distress, freight rates per nautical mile can reach these very high levels," the report said.

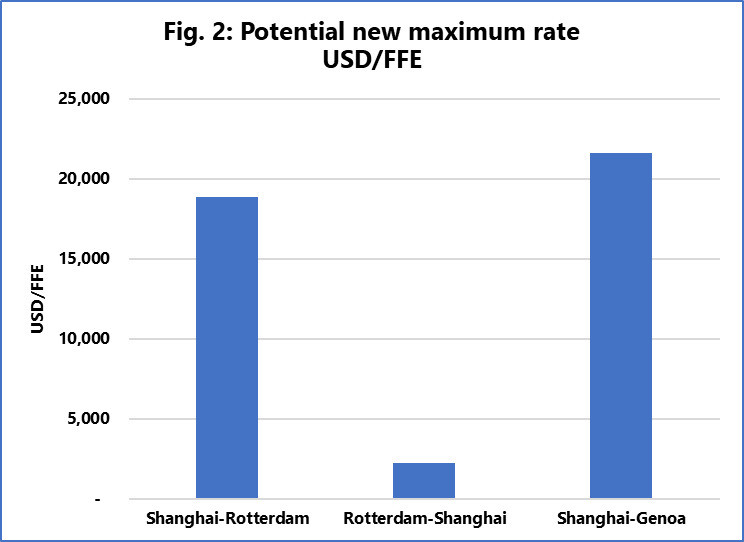

Murphy noted that if freight rates increase in line with the additional nautical miles sailed due to Cape of Good Hope diversions, "we arrive at the scary scenario for shippers".

[Source: Sea-Intelligence]

"If the rate paid per nautical mile reaches the same level as during the pandemic, we will see spot rates of US$18,900/FFE from Shanghai to Rotterdam, US$21,600/FFE from Shanghai to Genoa, and US$2,200/FFE on the back-haul from Rotterdam to Shanghai," he said.

"This is not to say that the rates couldn't go any higher; this is just to say that if rates per nm go as high as during the pandemic, then spot rates would go as high as shown in Figure 2," Murphy added.