The global air cargo market is heading towards a ‘hot Q4’ of rate increases after a sixth straight month of double-digit growth in June, with a warning that shippers and forwarders ill-prepared for this year's peak season may find themselves 'at the mercy of the market,' according to the latest analysis by Xeneta.

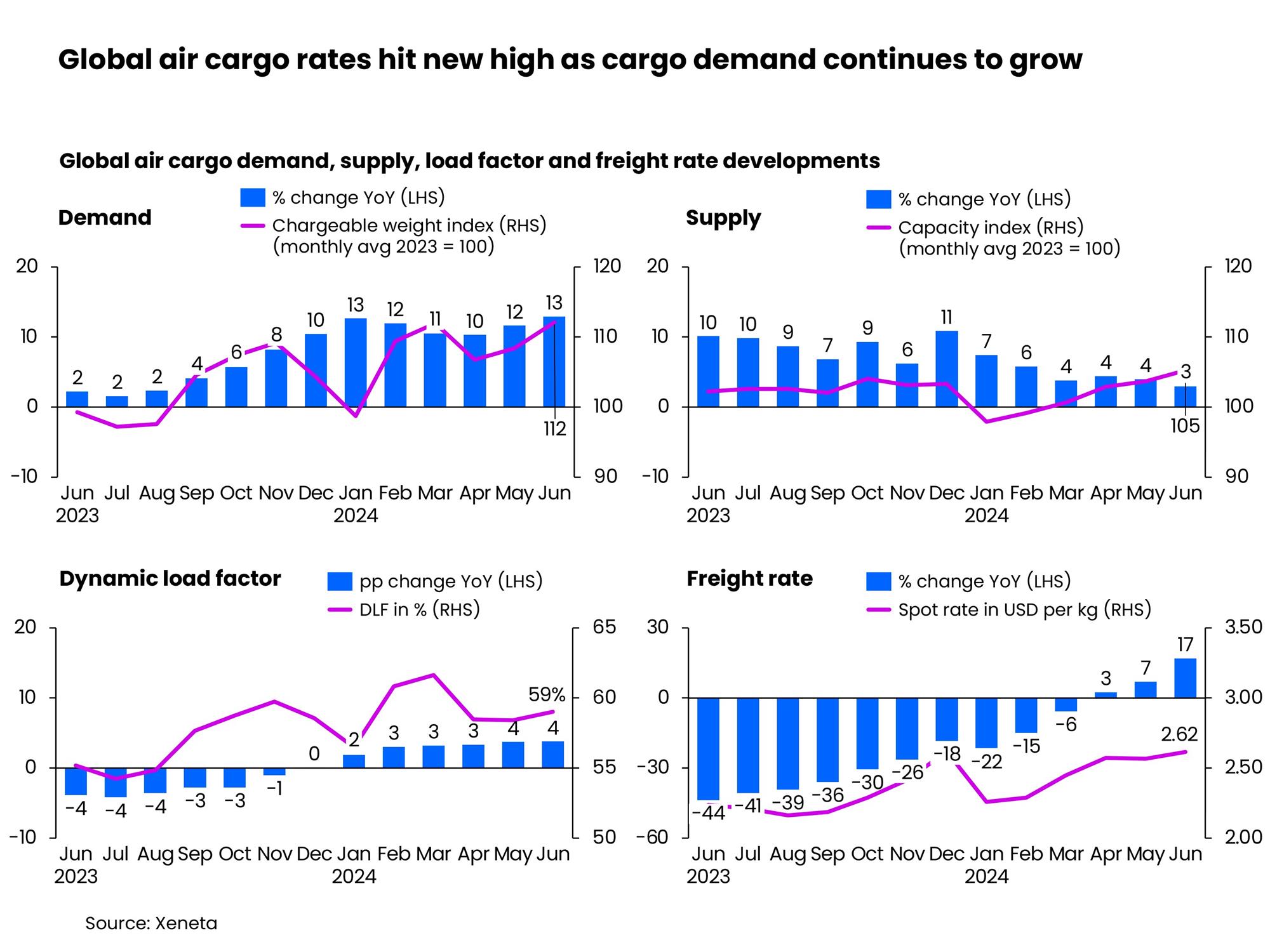

Demand in June, measured in chargeable weight, was up 13% year-on-year, continuing the upward trend seen throughout the first half of 2024.

The ocean and air freight rate benchmarking and market intelligence platform noted that, in contrast, cargo supply grew at its slowest pace in 2024, edging up only 3% year-on-year.

As a result, the global air cargo dynamic load factor — Xeneta's measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity — increased by 4% pts year-on-year.

Xeneta noted that while June's data, alongside previous months of annual growth, must be balanced against the weak comparison seen in the corresponding months of 2023, market players are now busy strategizing on the best ways to navigate the financial challenges and opportunities expected to present themselves in Q4.

"June's growth in demand was not surprising and we would expect to see a continuation of double-digit year-on-year growth in July and August because of low demand in the same months last year. The global machine is humming along nicely at this level — but this is likely the calm before the storm in terms of air freight rates," said Niall van de Wouw, chief airfreight officer at Xeneta.

"I've heard already that certain airlines and forwarders are thinking of implementing a peak season surcharge by the end of August. There's a consensus it will be a hot Q4 for air cargo in many Asian markets."

"We expect lower demand growth year-on-year in the second half of 2024 because of such a strong Q4 2023 comparison, but if you haven't arranged your Q4 capacity by now, you could be in for quite a ride," he added.

Looking at demand vs. supply for the last quarter of 2024, van de Wouw said, 'the rules of the game are becoming clear' and contain strict compliance conditions. That is, shippers and forwarders with capacity agreements in markets that are 'tight' already, based on fixed volumes and a peak surcharge, will have reduced risk, while those dependent on the spot market can expect to pay a hefty premium.

"In 2023, the market did not anticipate the demand we saw. This year, it does. Shippers with capacity agreements in place will be better prepared, but if they go above the agreed-upon threshold, they will face paying market rates," van de Wouw said.

He added that on the short-term spot market, this could mean "50% increases in rates above what we see now once the market really heats up."

The e-commerce boom, disruptions in ocean freight due to conflict in the Red Sea, and general improvements in global manufacturers' activities were the three main pillars driving up global air cargo spot rates in June.

The Xeneta report said these registered their largest increase of the year so far, climbing 17% year-on-year to US$2.62 per kg.

Measured month-on-month, the air cargo spot rate edged up 2% in June, as the 4% month-on-month growth of cargo demand continued to outpace capacity supply.

Zooming into the corridor level, Southeast Asia to Europe and the US markets saw the largest cargo spot rate increases in June, growing 14% versus May to US$3.65 per kg and US$5.32 per kg respectively.

Northeast Asia to Europe and the US also experienced modest spot rate increases, up 5% to US$4.26 per kg and 4% to US%4.00 per kg.

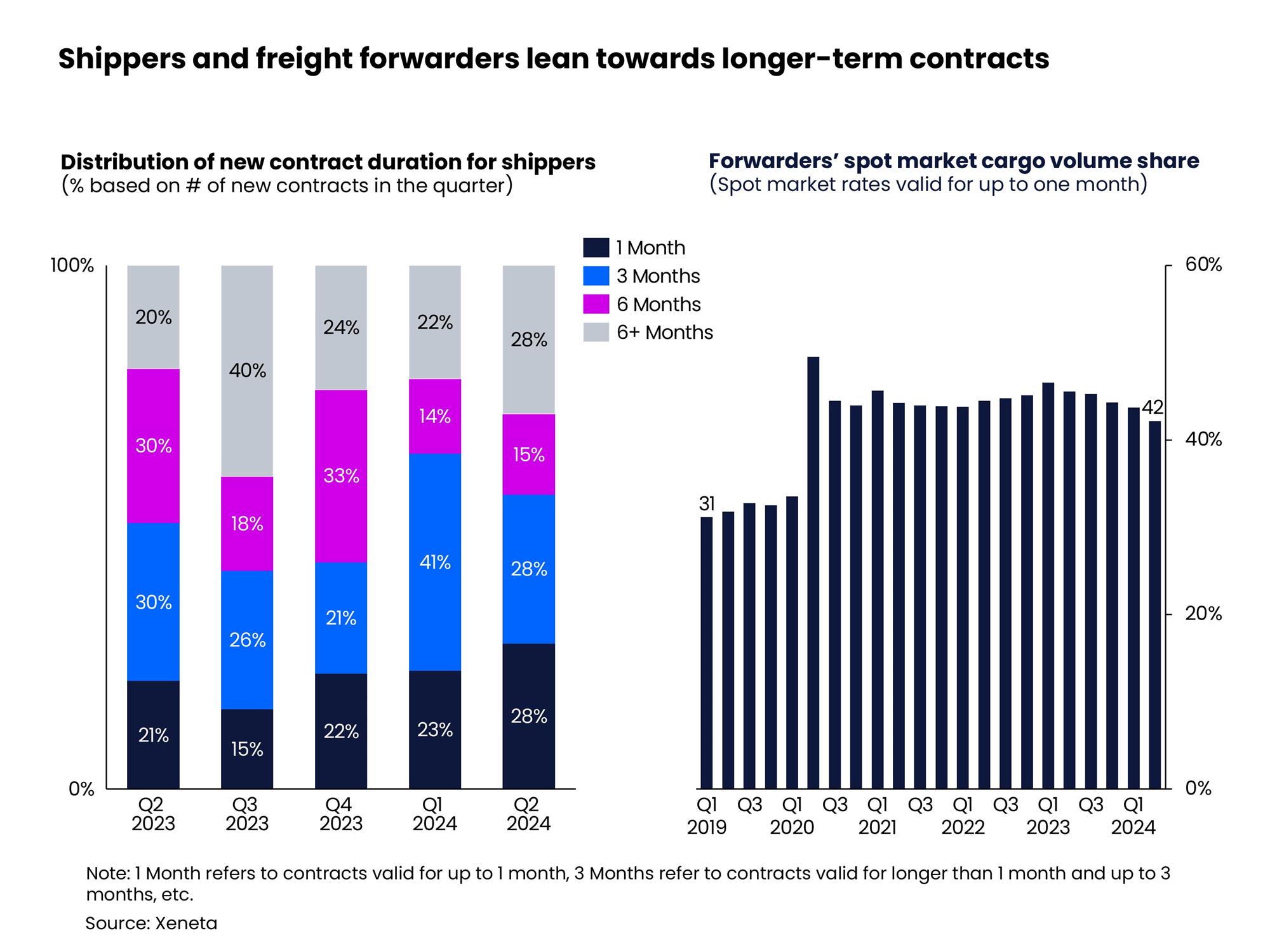

"Looking ahead, many market uncertainties remain," van de Wouw said. "Given the market turbulence and the potential for an air cargo rate boom in Q4, shippers are once again adjusting their preferred contract lengths."

He noted that in the second quarter of 2024, contracts lasting more than six months topped the list, with an increasing share of 28%.

Shippers are shifting towards contracts of six months or more to avoid the anticipated extreme freight rate fluctuations during the upcoming year-end peak season.

Xeneta noted that the decrease in three-month contracts suggests unease among shippers about renegotiating rates just before the year-end peak season.

Freight forwarders appear to share the same view, also procuring fewer cargo volumes in the spot market. In the second quarter of 2024, the proportion of cargo volumes procured in the spot market accounted for 42% of the total market, showing a 3% pts reduction versus a year ago.

"As we head into the second half of the year, it might be now or never to consider longer-term contracts. With a mix of ocean shipping chaos, an upturn in manufacturing activities, and fear-of-missing-out, a delicate balance of short and long-term contracts is on everyone's mind," van de Wouw said.

"Only time will tell, but whatever happens, you're going to be paying a lot more to ship goods from Asia Pacific once September comes," he added.