The massive IT outage caused by the CrowdStrike update on July 19 led to thousands of delayed or cancelled flights worldwide over the weekend that followed, as airport and airline systems went black.

A new analysis by Freightos noted that though many – but not all – carriers were able to restore operations relatively quickly, delays are expected for impacted shipments as the backlog is cleared.

[Source: Freightos]

Meanwhile, though some container ports and carriers also had outages, the impact on ocean freight was minimal. However, Houthis in Yemen continued their attacks on vessels in the region, including a deadly strike on a tanker.

Freightos noted that the rebel group's deadly drone attack in Tel Aviv also marks an escalation in the conflict, including Israel's retaliatory airstrike, and raises some concern about Houthi's capabilities to expand their target area.

"But with most container carriers avoiding the Red Sea since December, there should not be much impact on ocean freight," the report said.

It noted that congestion at major Asian container hubs is also "not as bad "as a few weeks ago but is still a factor tying up capacity and causing delays, including some redistribution of vessels – and congestion – to other ports in the region, now including Taiwan.

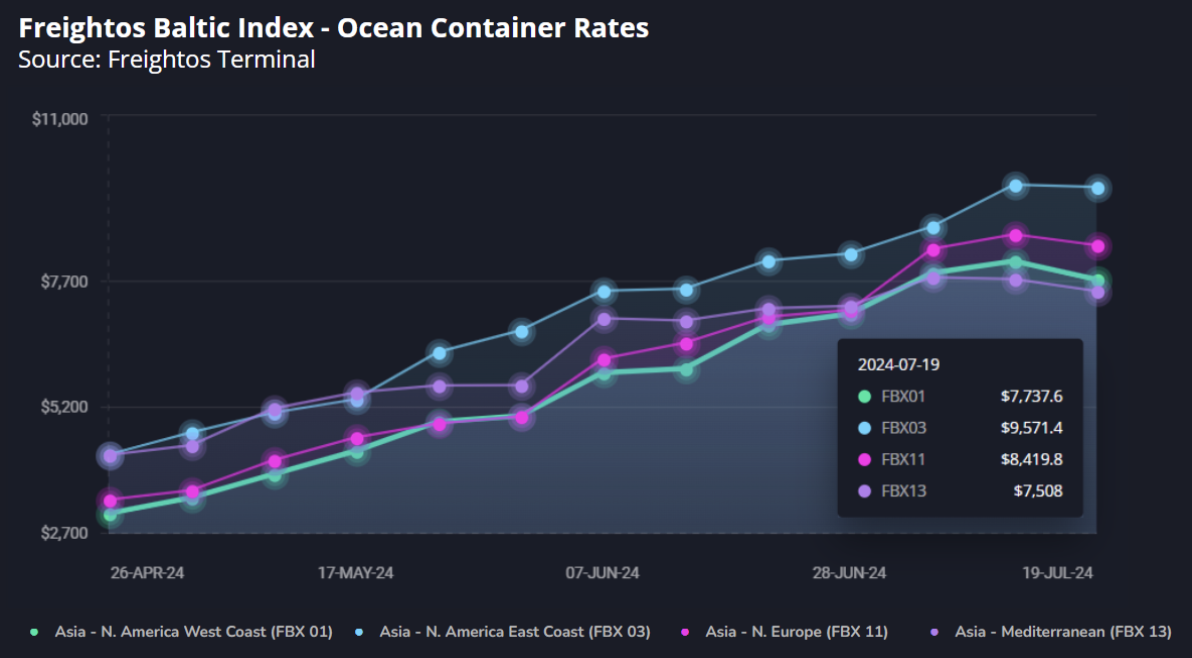

Judah Levine, head of research at Freightos, noted that even with this congestion, there are signs of easing conditions on the main East-West lanes, like reports of lower utilization levels and a dip in freight rates after two and half months of increases.

"Prices across these lanes that fell 1% to 4% last week still remain extremely elevated, but this dip may signal that pressure on rates is past its peak," he said.

Levine noted that this decrease in pressure is likely partially due to major carriers and new, smaller entrants adding capacity to transpacific and Asia-Europe services as demand and spot rates surged in the last two months.

"But if peak season pressure is starting to ease earlier than usual, it is likely also due to the pull forward of a good share of peak season volumes to earlier than usual in the year both to North America and Europe in efforts to account for longer lead times due to Red Sea diversions and avoid delays later in the year and closer to the holidays, bring in shipments before possible labour disruptions at US East Coast ports, and beat some new tariff roll-outs in July in August," the Freightos head of research added.

"The rate decrease will be welcome news for shippers."

The report noted, though, that as peak season goods will likely keep demand relatively elevated into September and congestion remains an issue, a gradual decline could be more likely than a rate collapse as demand eases.

"As long as Red Sea diversions continue, we should not expect prices to go below levels seen during the demand lull in March and April when rates were still about double 2019 levels," Levine said.

He noted that for many other regions, though – including intra-Asia, the Middle East, South Asia and parts of Africa – carriers continue to announce significant GRIs and Peak Season Surcharge increases, supported by some shift of capacity to the main ex-Asia lanes as rates soared.

But Levine said as demand eases on the main trade lanes, capacity should gradually be moved back to these lower-volume trades and prices should start to come down there as well.

E-commerce to keep ex-China volumes high

"In air cargo, B2C e-commerce demand is expected to keep ex-China volumes and rates elevated through what is normally slow season and into Q4's peak season," Levine said.

He noted that Freightos Air Index rates out of China dipped slightly to US$5.34/kg to North America and were level at US$3.38/kg to Europe last week, with both well above typical summer rate levels.

"With prices already elevated in Q3, rates are likely to climb well above peak season norms when demand increases in Q4," the Freightos executive said.