Worldwide air cargo demand and pricing stayed strong throughout August, with tonnages up 10% year over year (YoY) and rates 12% above last year's levels, according to the latest figures and analysis from WorldACD Market Data.

The air cargo market data provider said August's YoY comparison figures are similar to those in July 2024, when chargeable weight was up 13% YoY, and rates showed a 10% YoY improvement.

Compared with July, total flown chargeable weight dipped slightly in August, by 2%, but average yields edged up by a further 1%, to US$2.49 per kilo – based on a full-market average of spot rates and contract rates.

WorldACD said prices from Asia Pacific origins also rose by a further 1% in August, compared with July, to US$3.26 per kilo, taking them 22% above their equivalent level last year.

Rates from the Middle East and South Asia (MESA) origins rose by another 3% to an average of US$2.81 per kilo, 58% higher than last August's levels.

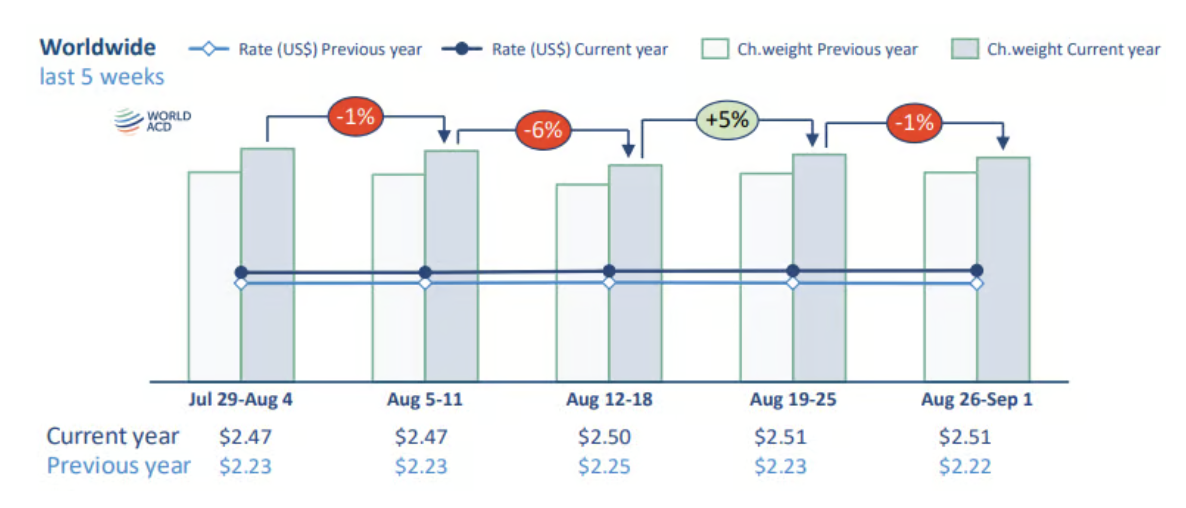

It added that average contract rates and spot rates both rose slightly in week 35 (August 26 to September 1) to US$2.41 and US$2.71 per kilo, taking overall average rates to US$2.51 — 13% above last year and an increase of 46% compared with the last pre-Covid equivalent period, August 2019.

Meanwhile, tonnages in week 35 slipped by 1%, week on week (WoW), due to week-on-week (WoW) decreases from North America (4%), Europe (2%), MESA (1%) and Central & South America (CSA, 1%) origins.

The drop in volumes ex-North America is related to the Labor Day holiday weekend in the US and Canada, impacting capacity with a 5% drop WoW in week 35, tonnages by 4%, while rates were up by 4%, WoW.

[Source: WorldACD]

Asia dynamics

WorldACD said total tonnages from Asia Pacific origins were unchanged, WoW, despite a further 6% WoW recovery of volumes from Japan from the effects of Typhoon Ampil.

It noted that after tonnages from Japan fell by around 60% in week 33, volumes from Japan saw a strong recovery (up 102%) in week 34. However, tonnages from Japan in week 35 were still down 12% below their levels in week 32.

Elsewhere, in the MESA region, the continuing disruptions triggered by political instability in Bangladesh, in addition to the effects of the Red Sea disruptions, caused spot rates from Bangladesh to Europe to rise slightly further to a new high of US$5.06 per kilo.

Spot rates ex-Sri Lanka rose again to their second-highest level this year, at US$3.66 per kilo.

Peak performance

"The relatively robust performance of the market throughout the summer in the northern hemisphere will leave air cargo stakeholders anticipating a busy fourth quarter (Q4) peak season, likely to be characterized by high and rising prices that reflect high load factors and shortages of available capacity on certain head-haul lanes, especially from Asia," WorldACD said.

In addition to the usual rise in seasonal demand in the final months of the year, it added that air cargo looks set to experience an additional seasonal spike from e-commerce shipments, especially from China and Hong Kong, as it has in the last two cycles.

Meanwhile, potential industrial action at US East Coast and Gulf container ports could lead to further conversion of sea to air cargo, in addition to that already occurring due to the disruptions to Red Sea shipping.