With the Asian Development Bank lowering its forecast for Taiwan’s economic growth in 2016 to 1.1%, perhaps it shouldn’t come as a surprise that operators in the freight industry have been disappointed with how the market has performed.

Eddy Liu, vice president of cargo at China Airlines, says that the company’s first-half results were below expectations.

“So far, air cargo demand has stayed flat and expansion in available freight capacity continues to outpace the growth in demand,” says Liu. “Under these circumstances, air cargo yields are slowly declining, consistent with persisting weakness in load factors, keeping downward pressure on our cargo business performance.”

China Airlines is finding ways to address these weakening conditions to remain competitive. “We’re not only making efforts to improve the product mix by expanding the proportion of high-yield freight such as pharmaceuticals, aircraft parts and special cargo, but also focusing on developing and maintaining relationships with freight forwarders,” says Liu. “Furthermore, CI adopts revenue management tools to enhance the sales and space-control functions. In the next 12 months, the aforementioned strategies will still be the main priorities for us.”

According to the International Air Transport Association, while annual growth in freight tonne kilometres rose to 5% year-on-year in July 2016, FTKs have overall only grown about 3% since the beginning of the year.

“That’s why we put a lot of focus on the soaring e-commerce market and on strengthening our partnership with post offices and integrators,” says Liu. “Except working closely with postal agencies, particularly China Post and its brokers, Vietnam Post and Malaysia Post, CI also cooperates with UPS, FedEx, DHL, and SF Express to further enhance our revenues and business diversification. In addition, CI has been dedicated to exploring the freight-to-post business since the Taiwan Customs Administration permitted the addition of postal bags to transhipment cargo from March 31, 2015.”

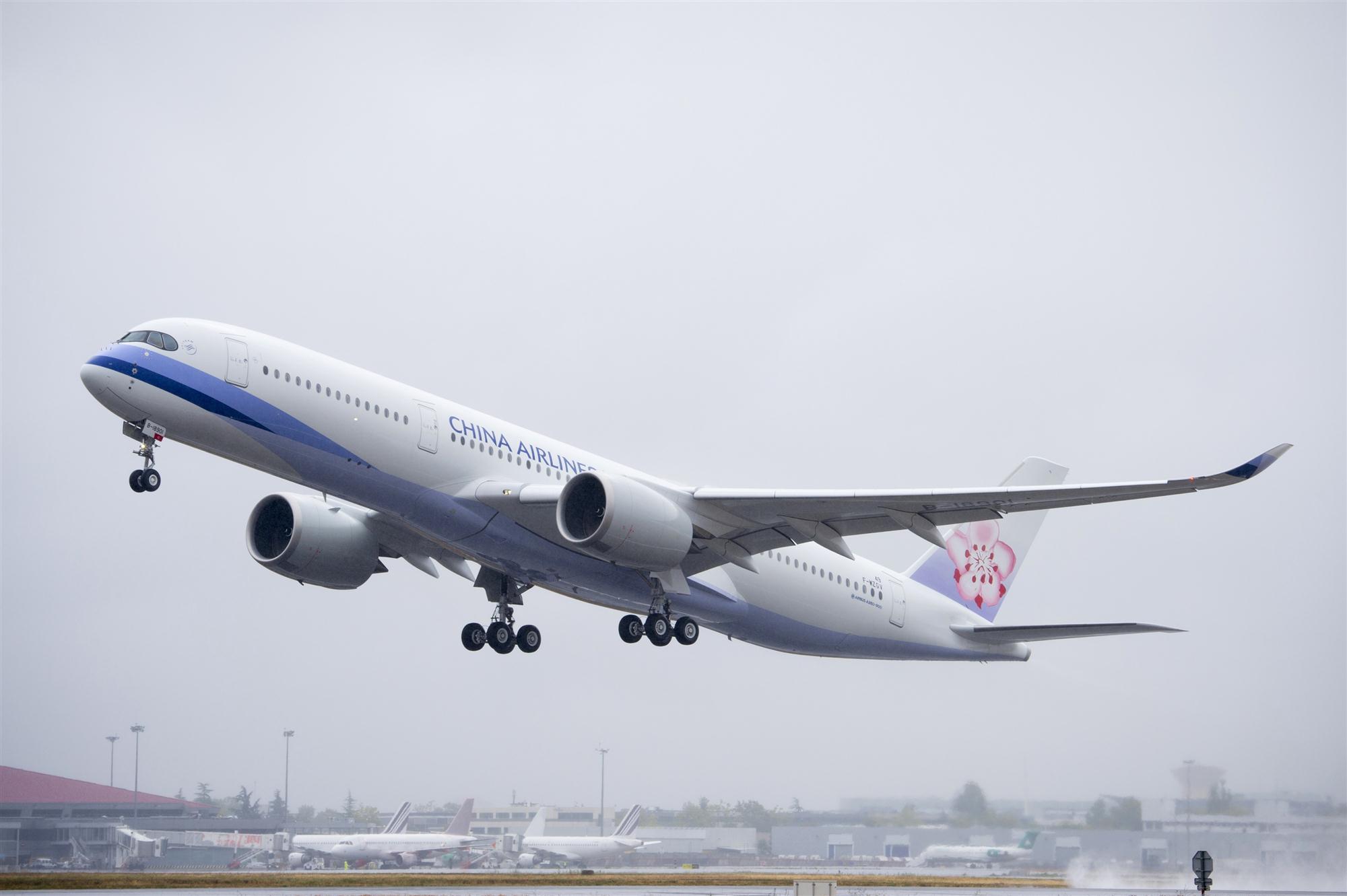

Another way in which the airline hopes to improve its competitiveness is with its order for 14 Airbus A350-900s. “The A350-900 is fuel-efficient and its payload capability is about 20% higher than other long-range aircraft,” says Liu. “Our new A350-900s will primarily be deployed on long-haul routes to Europe such as Amsterdam, Rome and Vienna, and to the United States, enabling CI to save cost and provide more useful cargo capacity if used on regular passenger operations.”

The first frame was originally scheduled to be delivered in July 2016, but has since been pushed back to the end of September by Airbus because of production delays.

“We have temporarily deployed other existing airplanes such as the Boeing 747-400, A330-300 and A340-300 in place of the new A350-900s,” says Liu. “So far there has not been any significant impact on our cargo operations.”

The carrier is also growing its operations in Southeast Asia and the Indian subcontinent, which Liu says are two main drivers of the global economy and where demands for international shipments are still increasing.

On top of passenger flights, China Airlines Cargo now serves Hanoi and Ho Chi Minh City four times a week each with 747-400Fs, and resumed dedicated main-deck capacity to Delhi with a weekly 747-400F flight from August 28, 2016.

Liu says that, given the state of the global economy and the slowdown in the Asian manufacturing sectors, one might expect export growth in Taiwan to flatten out, but that hasn’t necessarily been the case.

“Fortunately, the increasing global popularity of sports and recreation, as well as growing demand for electric vehicles, means that Taiwan’s functional textiles and electric-vehicle components will become key drivers of air cargo exports,” he says. “Moreover, air shipments of forged wheels, vaccines and semiconductor equipment are also rising.”

On the other end of the cargo spectrum, the Taiwanese shipping industry has been experiencing similarly challenging conditions.

“Affected by the slowdown of the world economy, Taiwanese exports suffered 17 straight months of decline, according to statistics released by Taiwan’s Ministry of Finance in early July,” says Lawrence Lee, president of Evergreen Marine Corporation. “In spite of the local market downturn, Evergreen Line managed to secure customer support and achieved a moderate increase in lifting performance during the first half of this year.”

The first and foremost priority for Evergreen Line in the next 12 months, according to Lee, is to closely watch market developments and optimize service deployment so that company can return to a healthy level of profitability and maintain a sustainable service to its customers.

The first and foremost priority for Evergreen Line in the next 12 months, according to Lee, is to closely watch market developments and optimize service deployment so that company can return to a healthy level of profitability and maintain a sustainable service to its customers.

Facilitating that is the completion of both the expanded Suez Canal and the expanded Panama Canal during 2016, which has enabled Evergreen to offer more capacity, shorter transit times and improved reliability.

“We’ve been deploying 8,500 TEU L-type vessels on Far East-US East Coast all-water services since June, replacing Panamax ships of around 4,200 TEUs,” says Lee. “Our internal research indicates that the eco-friendly L-class vessels can offer the equivalent capacity of two traditional Panamax ships while at the same time reducing fuel consumption by 40% and lowering carbon emissions by the same percentage. These efforts are recognized by our customers, especially those who care about the carbon footprint in their supply chains.”

Evergreen is also counting on its alliance strategy to help it tackle changes in the market. While it is currently still part of the CKYHE Alliance with COSCO Container Lines, “K” Line, Yang Ming and Hanjin, Evergreen announced in April 2016 that it would link up with CMA CGM, COSCO Container Lines and Orient Overseas Container Line to form a new alliance called the OCEAN Alliance, scheduled to begin in April 2017.

“Our approach is to choose the most suitable partners that can provide complementary services to our network,” Lee says. “Such cooperation can produce synergy, enhance our competitiveness and enable us to cope with changing market demand. Together with the partners of the OCEAN Alliance, we can optimize our service network, expand port coverage, provide more direct sailings and shorten transit times. Most importantly, our service networks can be optimized to enhance our cost competitiveness.”

In an environment with minimal growth but maximal competition, cost management has become ever more crucial and Lee is wary of how the market will play out in the short term.

“Low cargo demand and tonnage oversupply have resulted in unsustainable freight rates and imposed heavy pressure on shipping companies,” he says. “Unless the global economy can regain growth momentum and produce sufficient cargo to reduce the gap between capacity demand and supply, the global shipping market, including the local market in Taiwan, is unlikely to pick up in the year ahead.”

By Jeffrey Lee

Asia Cargo News | Hong Kong