Air cargo should not be left out of China’s Belt and Road Initiative, a senior industry official told IATA’s World Cargo Symposium in Singapore.

China’s plans for the mammoth programme of road, rail and port building would link it closer with its trade partners all over the world, and aviation needs to join up quickly or risk losing out, Vladimir Zubkov, secretary general of The International Air Cargo Association (TIACA), said in a WCS session.

“We should not be passive in this adventure. We need to make it clear we will have our share,” Zubkov said.

Zubkov argued that the growth of infrastructure, especially that connecting China to Europe, and the greater inter-modality that growth will make available, will erode the time advantage air cargo usually has and will make other modes of transport more competitive at air cargo’s expense.

Zubkov was cheered by Italian Prime Minister Guiseppe Conti’s meeting with Chinese President Xi Jinping in Rome in late March. The two sides will discuss Italy joining the BRI, but with air cargo a part of the agenda, Zubkov told Asia Cargo News.

“[Italian air cargo firms] were not silent,” he said, describing the industry’s lobbying efforts for aviation to be part of the top-level talks.

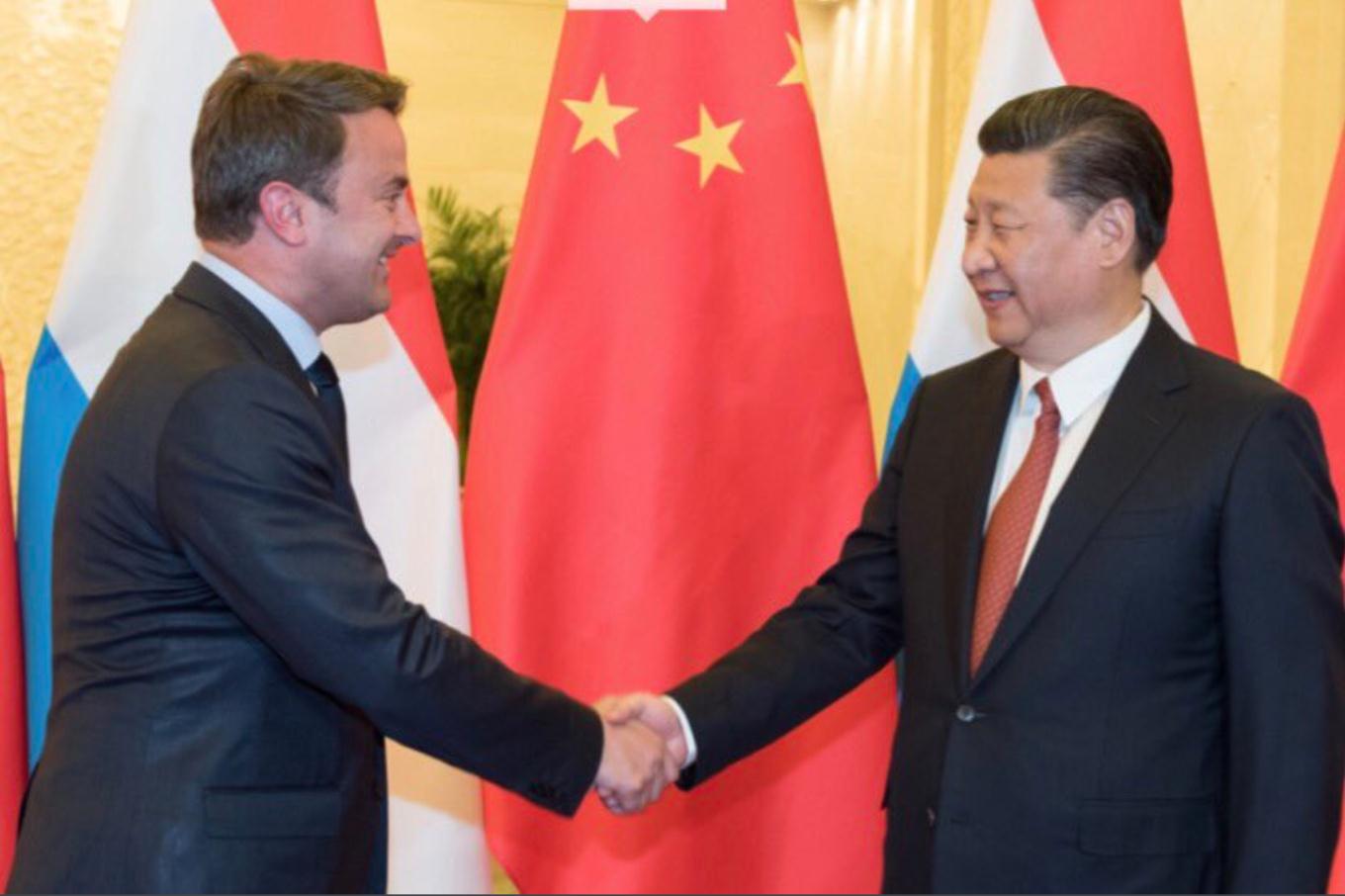

There is a successful precedent for bringing air cargo into talks with China. In June 2017, Xi met with Xavier Bettel, the prime minister of Luxemburg, to kick start the “air Silk Road” with a freighter flight from Luxemburg to the Chinese city of Zhengzhou in Henan province. “It is exactly how to do things,” Zubkov told Asia Cargo News.

This is only a start, though, Zubkov emphasized. Air cargo needs to lobby hard – and at high levels. His suggestion was to reach out to governments and trade bodies such as national chambers of commerce.

“Our partners in this and our main support are international trade organizations and international trade officials in governments,” he said. “The trade officials will be very interested in this.” Another group which would be interested are customs and aviation security departments, he added.

The issue is already percolating through Southeast Asian and, especially, Singapore, which has long looked towards China and which has, in its own way, subtly tied the two countries to each other over the past 40 years and is today very well-positioned to take advantage of that relationship.

The most obvious tangible parts of the relationship are the Chongqing Connectivity Initiative, a joint Sino-Singapore project, and China’s own Southern Transport Corridor. This is a multi- modal transport corridor with Qinzhou Port in Guangxi on China’s southern coast linked by rail to Chongqing in central China and by ports and ships (and investments by Singapore’s PSA) to Singapore to the South.

According to a statement on PSA’s website, the Beibu Gulf-PSA International Container Terminal (BPCT) is only 456 sea miles from Hong Kong, 1,485 sea miles from Singapore, 940 kilometres from Kunming and 1,320 kilometres from Chongqing. The terminal was jointly established by PSA and the Guangxi Beibu Gulf International Port Group at a cost of Rmb1.86 billion (US$276.9 million).

Without much fuss – and seemingly without much attention being paid – Singapore has built itself a hub between hubs, one it works hard at and to which it gives high-level political support with ministerial level commitment and exchanges.

“It will create new possibilities,” Law Chung Ming, transport and logistics director at government agency Enterprise Singapore, told the WCS. “It can bring Southeast Asia closer to West China.”

More importantly still, the North-South Transport Corridor overlays the east-to-west land road as well as the east-west marine belt of the BRI. “We are linking up two of the most dynamic regions in the region,” said Law.

Aviation is not being left out of this project, with both government and private sector stepping up. “I think we focus very much on the Chongqing corridor,” Steven Lee, chairman of the Singapore Aircargo Agents Association, told the WCS.

Government support in Singapore is strong and expressed through the Changi East Industrial Zone. This will be centred on a brand new cargo hub which will increase Changi’s cargo capacity from the current 3 million tonnes to a future 5.4 million tonnes. It also aims to attract and facilitate new logistic businesses, Jaisey Yip, assistant GM for cargo and logistics development at Changi Airport, told the WCS.

By Michael Mackey

Southeast Asia Correspondent | Singapore