Maersk Line recently noted continuing challenges faced by the supply chain and logistics industry — while also citing 'new opportunities' in the market as countries start emerging from the coronavirus pandemic.

In its Asia Pacific market update for May, the Danish international container shipping company said as "businesses continue to face challenges, Asia Pacific leads the way in projected GDP growth" around the world — with China leading economic growth (8.9%), Vietnam (7.7%), the Philippines (8%) as well as Malaysia (6.5%).

As consumer habits are changing, and online shopping is growing rapidly in Asia, Maersk also touted the Southeast Asia region as a growth area for sourcing as companies continue to look for solutions in addition to China.

"The apparel sector is expected to grow by 8.2% globally in 2021, with more than half annual spend happening outside of North America and Europe. Asia already leads the way with 38% share of the 2020 global spend and this is expected to increase to 41% by 2025," Maersk said citing its Asia Pacific customer insight analysis based on Statista Apparel Report 2020 (August

2020) and Seabury Database).

Ocean networks to be ‘highly utilized’

"We expect strong demand for exports from Asia to continue in Q3 and ocean networks are projected to be highly utilized," Maersk said, noting that the shipper's focus remains on securing coverage and providing reliable capacity solutions.

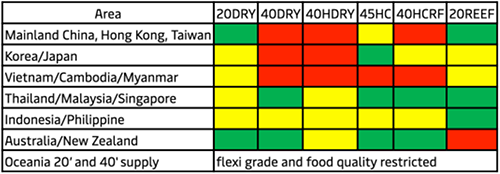

It also noted equipment shortages as an industry-wide challenge in the Asia Pacific. Maersk said 20-foot dry containers are sufficient, but 40-foot and 45-foot- dry containers are short. 40-foot non-operating reefer is also insufficient.

Latest equipment status traffic for main loading ports in Asia

Based on the chart, Maersk noted that the Green colour indicates the equipment availability is enough to cover demand forecast; Yellow colour indicates it’s tight to cover demand forecast; Red colour indicates it’s insufficient to cover demand forecast.

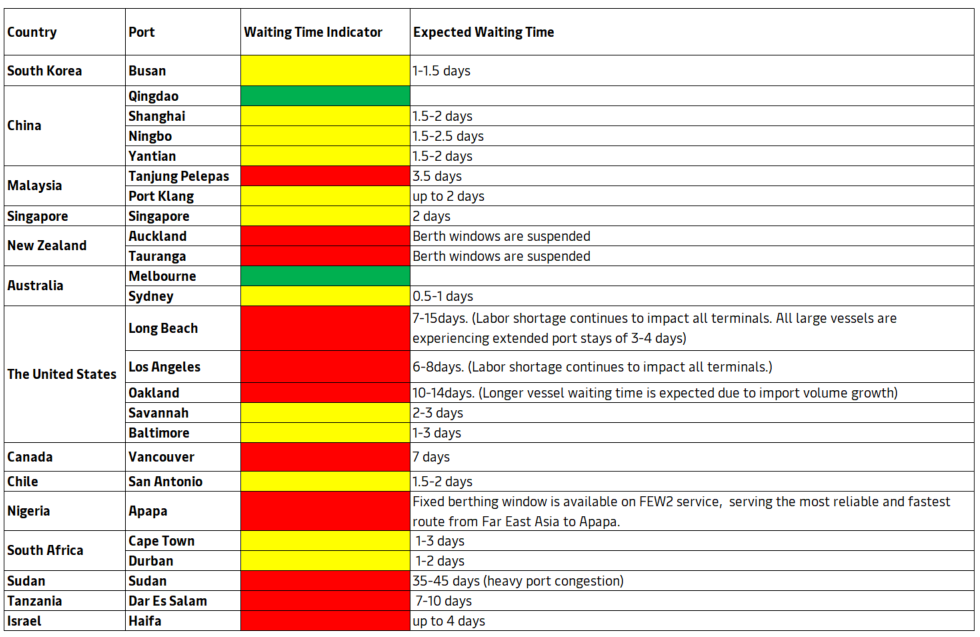

"Australia and New Zealand ports continue to experience significant congestion," Maersk said, adding that on its end, it has introduced our new service, the Sirius Star, and added capacity to our Southern Star service to improve network flexibility and supply chain stability.

"Our Oceania/Americas services continue to be impacted by delays in the US and terminal congestion in New Zealand. To protect overall network stability, and therefore available capacity, the OC1/Trident service (connecting Oceania to the US East Coast) will now be calling at Napier and Port Chalmers bi weekly. In Australia, we have deployed Soroe Maersk to reposition empty containers and ease depot congestion," it added.

Container shortages through May

"Less-than-Container-Load (LCL): Container shortages for China LCL shipments are expected throughout May. LCL space will be impacted by general ocean capacity and schedule reliability. Lead time for LCL shipments is expected to be longer than usual as carriers are omitting ports, putting pressure on LCL capacity," the shipper said.

For Europe ports, Maersk noted that the "pressure" remains as the industry earlier faced multiple challenges.

"Ports in North Europe are under high pressure due to import cargo peak and the ripple effect of Suez incident," it said.

"Ports in West Central Asia are facing operational delays due to high yard density. Across the globe, most ports are facing operational delays," it added.

Maersk said it is working on port swaps and port omissions to mitigate the impact and improve schedule reliability.