Global airlines managed the traditional ‘summer slack season’ for air cargo space in July by constantly tweaking capacity levels to address flat demand during the month versus pre-Covid levels, according to analysts CLIVE Data Services and TAC Index.

CLIVE said new industry volume, loadfactor and rates data also highlight airfreight rates lagging two weeks behind changes in the demand/supply ratio.

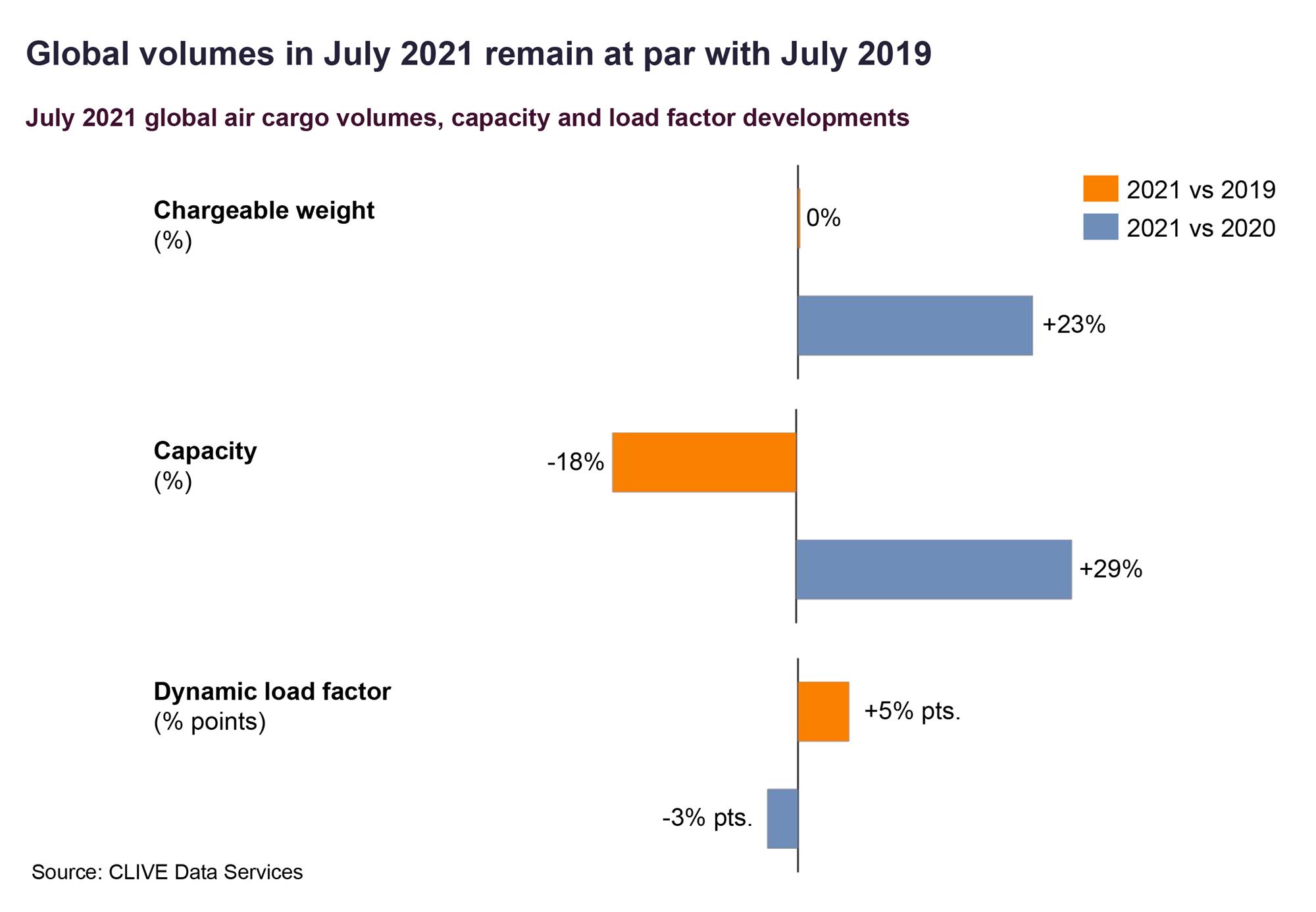

It noted that chargeable weight was flat in July versus 2019 and +23% over 2020.

Air cargo dynamic load factors also hit the lowest level since the start of the Covid-pandemic in July as the industry entered the summer slack season.

CLIVE said dynamic load factors stood at 66% last month which is down by three percentage points against the same month last year, but up five percentage points on 2019.

Capacity in July was up 29% on 2020 but it down 18% compared to the pre-Covid levels seen two years earlier before the pandemic took hold in 2019.

“The dynamic load factor for July of 66% is the lowest we have seen since the start of the Covid crisis. The difference compared to 2019 is also 2-4% pts lower than in recent months,” said CLIVE managing director Niall van de Wouw noting that carriers responded to the slow down in demand by removing capacity as the month progressed.

“The start of the holiday season and its traditional impact on air cargo volumes is obviously a factor, but it’s also clear that airlines are constantly tweaking capacity. Demand has not picked up yet, so they are tightly managing supply,” he added.

“Compared to where the market was a year ago, performance on a par with July 2019 is certainly not bad news, but the demand vs. supply ratio is going to remain tight, especially with no signals that the inter-continental passenger market is going to recover anytime soon.”

van de Wouw added that a closer look into the data showed that this figure of 66% was mainly caused by low loadfactors at the start of the month, while, in the last week of July, it rose to 68% and this continued in the first week of August.

“So, if those early weeks were the ‘slack season,’ the loadfactor was still at a relatively high level and any summer slump was short-lived – but this has to be seen against the backdrop of current capacity trends in the market,” he added.

“The rise in loadfactor during the last two weeks of July was mainly caused by capacity being taken out of the market based on less strong airfreight demand, as we have reported previously.”

Rates up in July but lower than “highs” in May

TAC Index said the BAI (Baltic Air Freight Indices) monthly average increased by 2% in July over June but was 6% below the year-to-date high seen in May.

It said it saw week-on-week reductions in the final two weeks of July, which followed the drop in loadfactor at the start of the month — adding that 13 of its 17 trade lane indexes saw an increase over June 2021. The overall index was positive versus July last year at +38% and versus 2019 by 98%, reflecting both demand and constraints in capacity, it added.

TAC Index noted that the China and Hong Kong markets saw an improvement in July over June, 2% and 5% respectively, after large declines in June. All the trade lanes from these markets were positive over June.

“Demand continues to be strong in the airfreight industry versus 2020 as economies recover, e-commerce continues to thrive, and the sea freight industry continues to suffer from capacity and operational challenges. In summary, air freight market prices were up in July but did not recover back to the highs seen in May,” said Gareth Sinclair of TAC Index.

“Prices continue to be strong versus last year and pre-pandemic levels and this is expected to be the case for the foreseeable future as demand continues to outstrip supply,” he added.