Non-alliance and small carriers plying the Transpacific route are expected to continue reducing capacity as shipping conditions start to normalise.

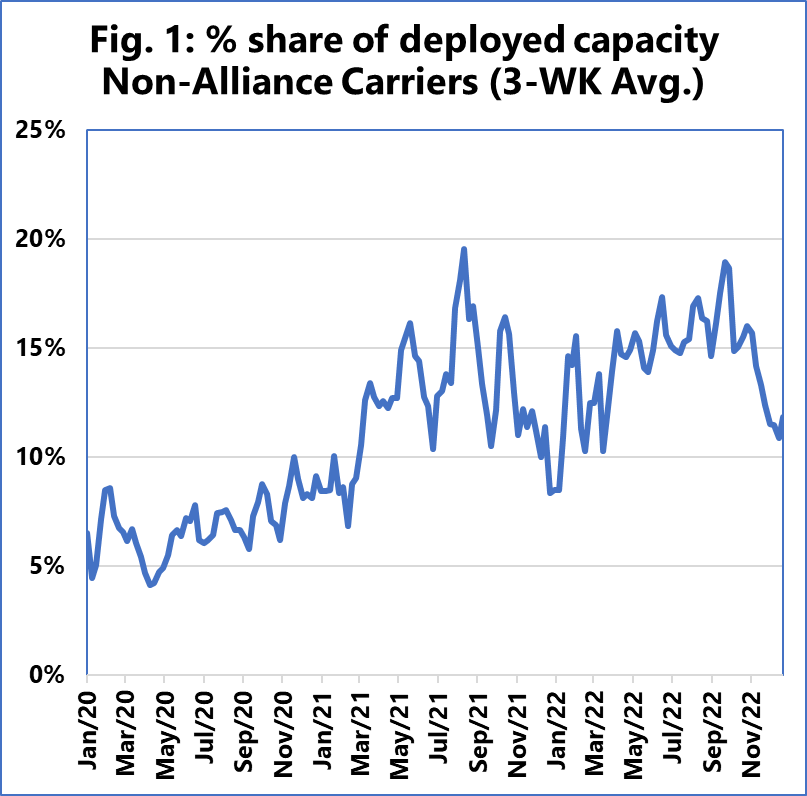

Sea Intelligence said in a report that non-alliance carriers managed to triple their market share from around 5% to around 15% during the peak of the market when rates are at a peak, there was a surge in demand and tight capacity in the market.

"This trend can be explained by the fact that the market conditions were very favourable for the carriers from the second half of 2020 and into the first half of 2022. There was excess demand and a struggle to make enough capacity available to fulfil that demand," said Alan Murphy, CEO, Sea-Intelligence.

"This significantly reduces the barriers of entry for smaller carriers who can get in while the market is hot, and then exit when it blows cold. This is exactly what happened, as a large number of newcomers entered the trade," he added.

Source: Sea-Intelligence

Sea Intelligence said that its analysis only covers the carriers on the Transpacific that are not a member of the alliances — this analysis does not cover the operating carriers within 2M, Ocean Alliance, and THE Alliance.

Meanwhile, the shipping analyst said the market share of these smaller carriers is also about to drop severely as we get to the end of 2022.

"Much of this additional niche carrier capacity has been sourced from exceptionally high-priced vessel charters for small and inefficient vessels, which in turn has been entirely fuelled by the exceptionally high spot rates, and as these have been coming down fast in recent months, many of these small-vessel services will quickly approach the point where they become loss-making, forcing a swift closure and exit from the market," the report said.

"This is not something unexpected either, as these small-vessel services were never expected to remain in the market, beyond the elevated spot rate period," it added.