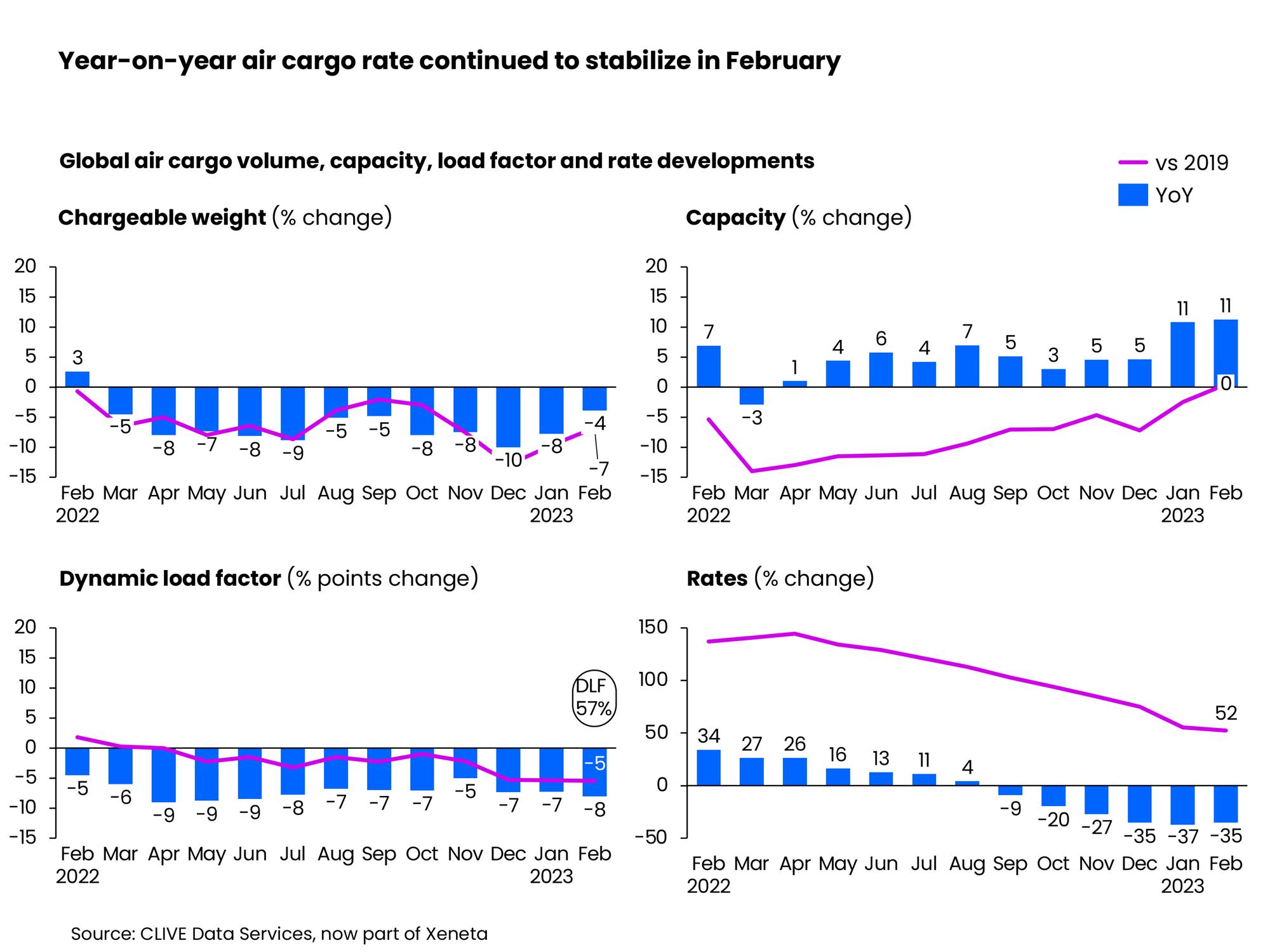

Global air cargo capacity rose above the pre-pandemic level in February for the first time in four years, according to the latest market analysis from CLIVE Data Services, part of Xeneta.

Air cargo capacity increased for the eleventh consecutive month in February, up 11% on the same period last year.

In contrast, global air cargo volumes fell 4% year-on-year last month, and rates also declined 35% during the same period to US$2.73 per kg — although still 52% above the pre-Covid level seen in 2019.

With increasing capacity and declining rates and volumes, Niall van de Wouw, chief airfreight officer at Xeneta, warned of the possibility for the industry to still see "zero overall growth" for general air cargo in 2023.

He said the latest data also means that it's time for the industry to "let go" of pre-Covid comparisons and to acknowledge a new baseline for air cargo market growth.

Risk of zero air cargo growth in 2023

"CLIVE Data Services was one of the first industry analysts to benchmark data versus the pre-pandemic level because a comparison was needed at the time to accurately measure air cargo's performance. But the fascination and rhetoric around airfreight rates going back to the 2019 level need to be replaced based on the inflationary components we now see," van de Wouw said.

"Name me a service or product that you acquired four years ago that you're still paying the same price for now? The air cargo industry should be focused on where growth is going to come from because the general air cargo volumes have seen negative growth for four years and, based on the first two months of 2023, are still -8% in terms of chargeable weight compared to four years ago. That is not a growth market," the chief airfreight officer at Xeneta added.

van de Wouw noted that 2019 was also a relatively weak year for air cargo after a buoyant 2018.

"The volumes are not here, the flights are less full, and more capacity will be coming in April as summer flight schedules commence, so I don't see fundamental changes that will help current market conditions," he added.

The chief airfreight officer at Xeneta explained, however, that there is hope and expectation of volumes increasing in the third quarter as companies restock.

"... but when I talk to shippers, I don't hear anyone saying they're going to ship more airfreight," van de Wouw said.

"If restocking comes, many shippers will look first to use cheaper modes of transport and, from where we are now, even if there is a boost, we might still be seeing zero overall growth for general air cargo by later in the year," he added.

The market, he further said, will be especially tough for cargo handlers which are dependent on the input of volume.

CLIVE noted in its report that labour shortages and industrial action continued to present challenges for the global air cargo industry.

The recent strikes in German airports on February 17, for example, had a "profound impact on air cargo capacity," it added, noting that on the same day, outbound Frankfurt cargo capacity fell a sharp 60% compared to the week prior.

Rates continue to stabilise

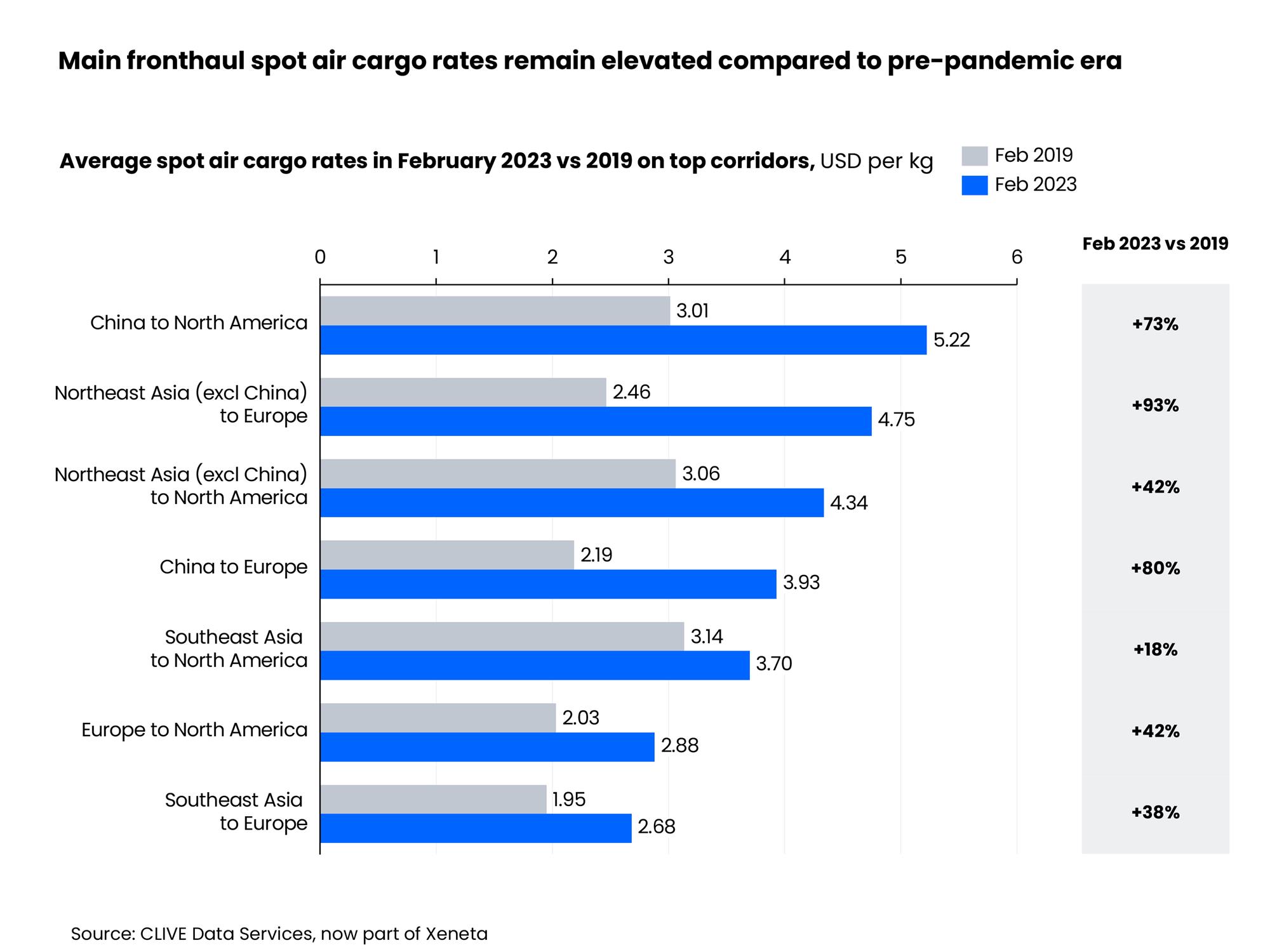

Meanwhile, the air freight market intelligence provider said on APAC to Europe, the average spot rate was down 9% month-on-month and also declined 48% year-on-year — but remained 74% above the pre-pandemic level. Southeast Asia to Europe fell a considerable 63% from last year but also still 38% above the pre-pandemic level, while spot rates from China and other Northeast Asian regions (such as Hong Kong, Japan and South Korea) remained elevated.

CLIVE said due to capacity shortage and increased operating costs on these lanes, spot air freight rates were 80% and 93% above pre-pandemic levels.

APAC to North America and Europe to North America spot rates also remained above the pre-pandemic levels, and spot rates from China and other Northeast Asian regions remained elevated compared to pre-pandemic levels.

On the Europe to North America corridor, CLIVE noted that February's average spot air freight rate fell 6% from January's level and 40% from a year ago but remained up 42% on the pre-pandemic level.

The air freight market intelligence provider said in February the air cargo market often sees a surge of flower shipments two weeks prior to Valentine's Day, as was the case this year, but to a different extent on different trade lanes.

It said elevated transportation, fertilizer and labour costs, as well as consumers hit by the cost-of-living crisis, dampened cargo volumes from Kenya and Ethiopia to Amsterdam — below the levels seen in three of the past four years — however, volumes from Colombia and Ecuador to Miami stayed strong, outperforming the past four years.

"The stabilizing market is creating a new baseline. It's time to let go of pre-Covid comparisons, and we will now reflect this in our own weekly data analysis from March 2023," van de Wouw further said.