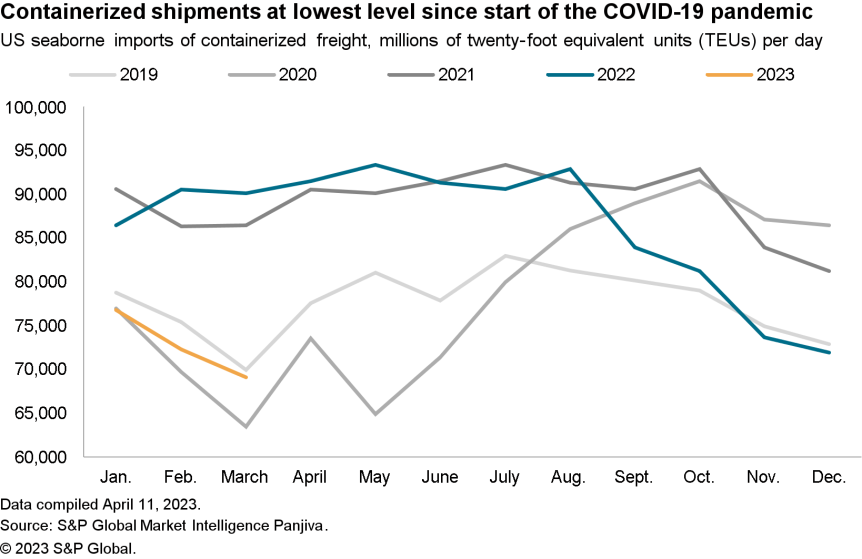

US containerized shipments in March were at its lowest level since the start of the Covid-19 pandemic helping further reduce pressure on supply chains.

A recent analysis by S&P Global Market Intelligence noted that supply chains are "steadily recovering" from three years of disruptions — with one critical piece of evidence being the state of supply chain activity shown by containerized freight shipments.

"US seaborne imports of containerized freight fell by 23% year over year in March," according to S&P Global Market Intelligence Panjiva data.

"That marked an acceleration from a drop of 20% in February and was the eighth straight month of declining activity."

S&P noted that "on a days-adjusted basis, activity in March 2023 was also the slowest since May 2020 and was 1% below the same month of 2019."

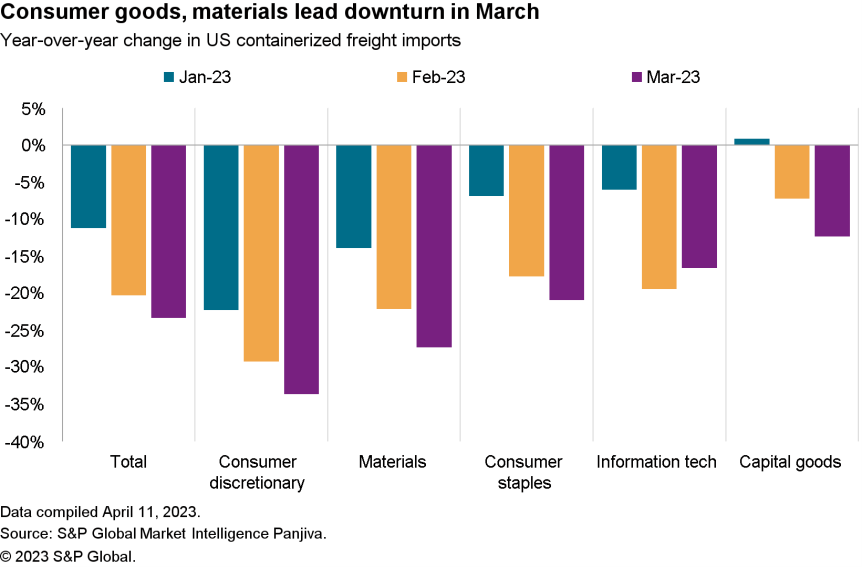

On a year-over-year basis, as in prior months, the downturn was led by consumer discretionary goods which fell by 34% in total in March, S&P Global Market Intelligence said.

"That was largely due to a 45% slide in shipments of home furnishings and a 46% drop in leisure products (ranging from toys to sports equipment). The latter are still coming off from their pandemic-era highs," it added.

The report said shipments of industrial materials were also weaker across the board, with a decline of 27% including lower shipments of chemicals, metals and forestry products.

A downturn of 12% in capital goods also "masks a 32% slump" in building products shipments, which may be driven by the housing slowdown, which also weighed on furniture shipments.

S&P said electrical equipment, however, including power generation equipment, improved by 12% on higher infrastructure spending.

"The smooth recovery of supply chains is far from proven though as we are still in the off-peak shipping season. It remains to be seen whether the latter part of the year will bring a return to normal seasonal shipping patterns," S&P Global Market Intelligence said.

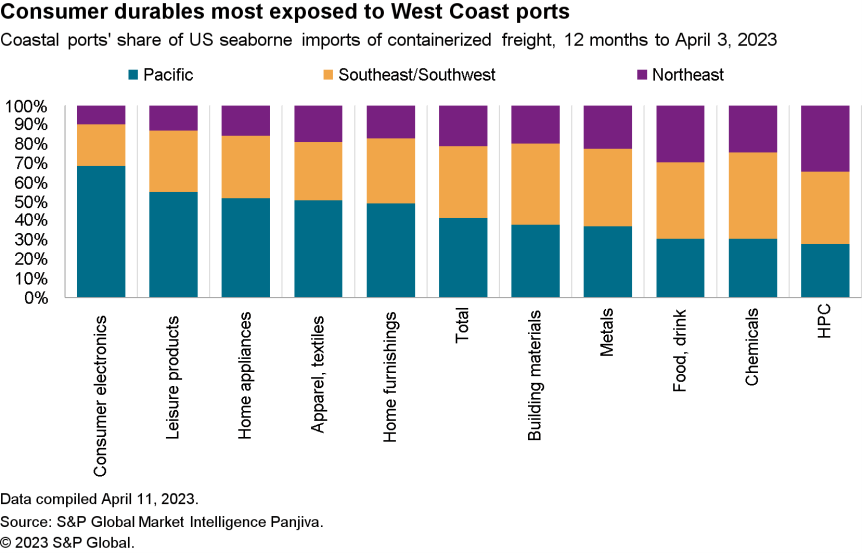

The report noted that one risk to smooth operation could come from labour disputes at US West Coast ports, which have included port closures at Los Angeles and Long Beach recently owing to labour-related actions.

Sectors, where manufacturing is dominated by Asian suppliers, are most vulnerable to West Coast port disruptions, S&P added.

The report said on average, West Coast ports accounted for 41% of total US imports of containerized freight in the 12 months to April 3, 2023 — with the most exposed sectors being consumer electronics and leisure products, with West Coast ports representing 69% and 55% of imports, respectively.

"Among the least exposed are products led by producers in Europe, which are more generally shipped into US East Coast ports," S&P Global Market Intelligence added.

"Those include home and personal care and chemicals products where West Coast imports only represent 28% and 31% of total seaborne imports, respectively."