Asia Pacific airlines recorded another month of cargo decline in March as weakness in global trade continued to dampen demand for air shipments.

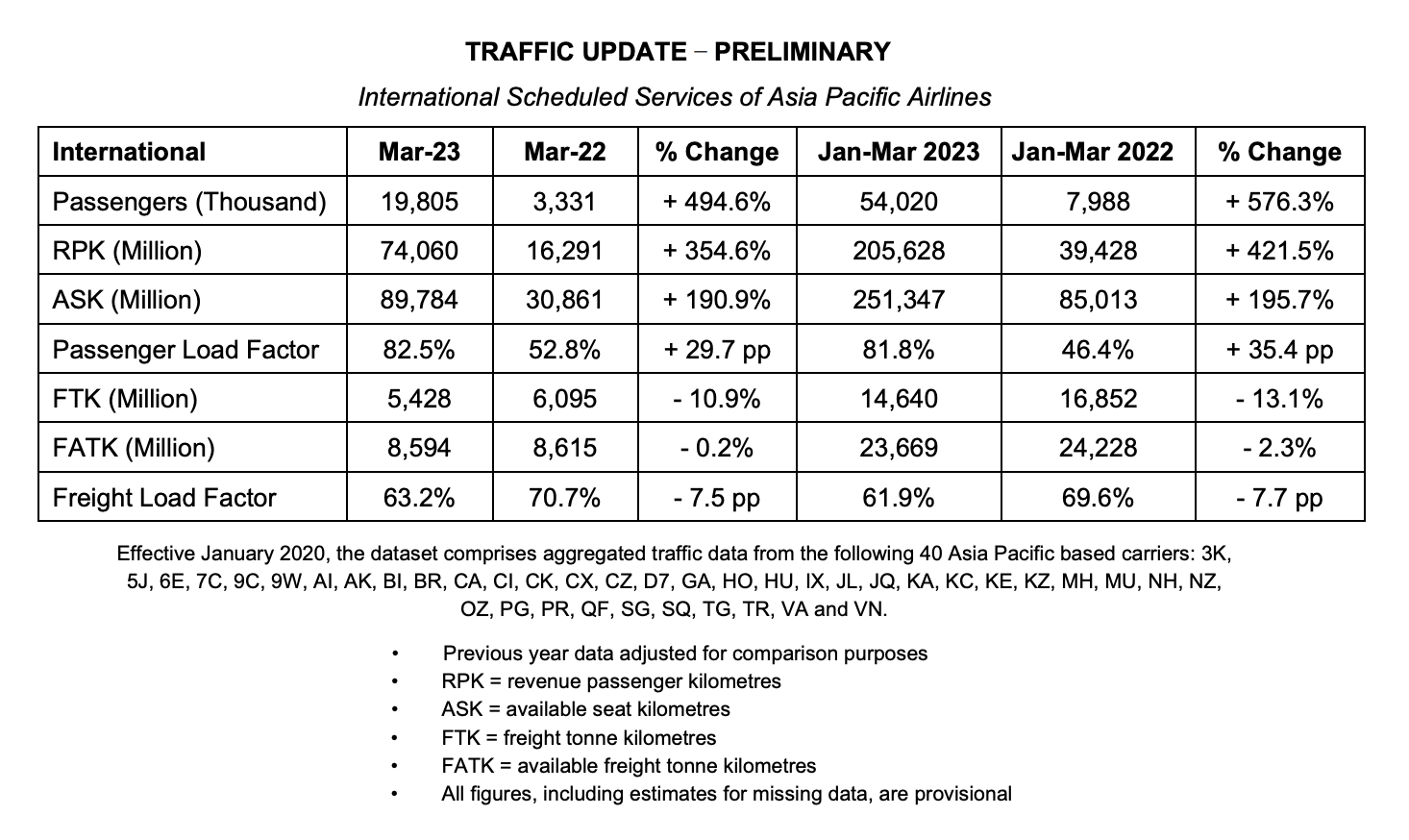

Preliminary March 2023 traffic figures released by the Kuala Lumpur-based Association of Asia Pacific Airlines (AAPA) showed international air cargo demand — measured in freight tonne-kilometres (FTK) — recorded a 10.9% year-on-year decline in international air cargo demand.

This follows a 9.8% drop in February 2023 and a steeper 20.5% decline in January this year which also followed a drop of 8.2% for the full year 2022.

Asia Pacific airlines have been seeing freight volumes decline since March 2022.

"The prevailing weakness in global trade continued to dampen demand for air shipments," AAPA said in a statement.

For the period, offered freight capacity remained relatively stable, with a 0.2% year-on-year decline, supported by the ongoing restoration of belly hold capacity on passenger flights.

As a result, the average international freight load factor declined by 7.5 percentage points to an average of 63.2% for the month.

"Air cargo markets declined by 13.1% during the same period, reflecting weakness in consumer demand amidst general inflationary pressures and rising economic uncertainty," said Subhas Menon, AAPA director-general.

APAC airlines to record strong revenue growth

Despite the continued downtrend in air cargo volumes, the chief of the AAPA signalled optimism that overall, Asia Pacific airlines are set for a good year — mainly due to the bounce back of passenger demand, which in March, marked a 494.6% year-on-year growth.

This is equivalent to 19.8 million international passengers carried by Asia Pacific airlines in March — and already reaching 61.0% of the pre-pandemic 2019 levels.

"Despite a more subdued global economic outlook, international passenger markets remain buoyant, as the rebuilding of travel confidence and return to face-to-face business meetings, continue apace," Menon said.

"Asia Pacific carriers expect to see strong revenue growth this year even though increasing cost pressures, led by persistently high fuel prices, would erode the earnings margins," he added, noting that Asia Pacific carriers continue to focus on cost efficiencies whilst restoring flights to destinations in a bid to improve profitability.