Air cargo demand slipped back below pre-Covid levels in March, according to the latest market data from the International Air Transport Association (IATA), and also showed a continued downtrend against the previous years.

IATA data for March 2023 on global air cargo markets shows a continued decline against the previous year's demand performance — this trend, the airline association noted, began in March 2022.

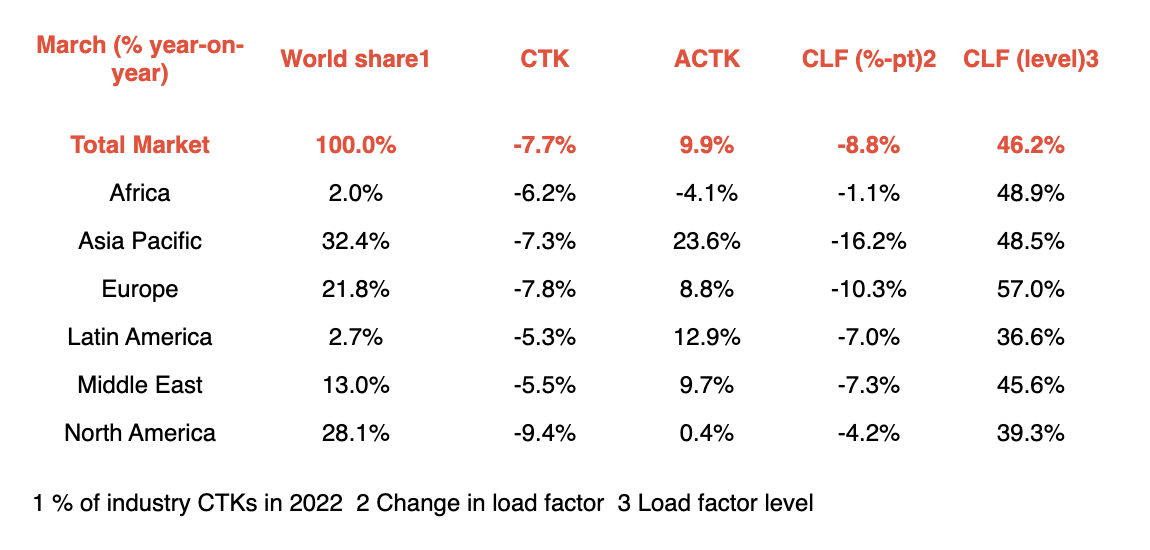

Global demand, measured in cargo tonne-kilometres (CTKs), fell 7.7% compared to March 2022 (-8.1% for international operations).

IATA, noted, however, that this was a "slight improvement" over the previous February's performance (-9.4%) and half the rate of annual decline seen in January and December (-16.8% and -15.6% respectively).

Air cargo demand back to below pre-Covid levels

"At this point, it is unclear if this is a potentially modest start of an improvement trend or the upside of market volatility. Irrespective of this, March's performance slipped back into negative territory compared to pre-COVID levels (-8.1%)," it said.

Meanwhile, capacity — measured in available cargo tonne-kilometres, ACTK — was up 9.9% compared to March 2022, reflecting the addition of belly capacity as the passenger side of the business continues to recover.

"Air cargo had a volatile first quarter," said Willie Walsh, IATA's Director General. "In March, overall demand slipped back below pre-COVID-19 levels and most of the indicators for the fundamental drivers of air cargo demand are weak or weakening."

"While the trading environment is tough, there is some good news. Airlines are getting help in managing through the volatility with yields that have remained high and fuel prices that have moderated from exceptionally high levels," he added.

"Looking ahead, with inflation reducing in G7 countries policymakers are expected to ease economic cooling measures and that would stimulate demand," Walsh further said.

March regional performance