The International Air Transport Association (IATA) released data for April 2023 global air cargo markets, showing a continued, but slower, decline against the previous year’s demand performance.

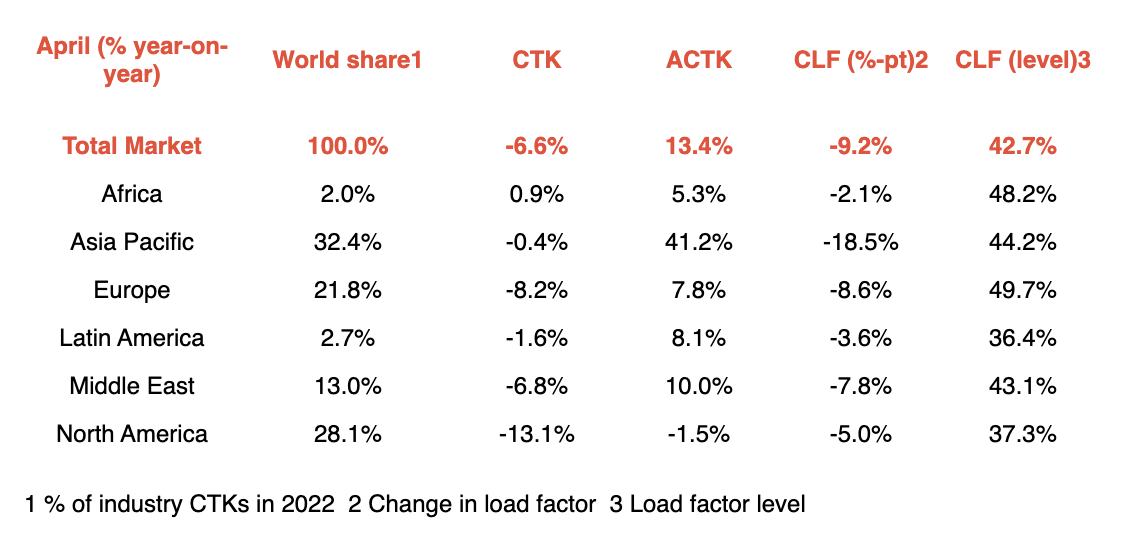

IATA said that global demand — measured in cargo tonne-kilometres (CTKs) — fell 6.6% compared to April 2022 (-7.0% for international operations).

“This decline was an improvement over the previous month's performance (-7.6%),” it added.

Capacity surpasses pre-Covid levels

Capacity — measured in available cargo tonne-kilometres, ACTK — was up 13.4% compared to April 2022.

“It was also up 3.2% compared to April 2019, marking the first time in three years that the capacity has surpassed pre-COVID levels,” IATA said, noting that the strong uptick is primarily driven by belly capacity as demand in the passenger business recovers.

Adjusting for this, freighter capacity declined by 2.3%.

IATA said, meanwhile, that “preighter” operations ceased in March after 2.5 years of continuous activity.

“The air cargo industry is adjusting itself to the implications of the recovery in passenger demand that brings with it an expansion of belly capacity. Preighter operations stopped in March, and freighter services were scaled back by 2.3% in April,” said Willie Walsh, director-general of IATA.

“The demand environment is challenging to read. Tapering inflation is definitely a positive. But the degree and speed at which that could lead to looser monetary policies that might stimulate demand is unclear. The resilience that got the air cargo industry through the COVID-19 crisis is also critical in the aftermath," Walsh added.

Photo: IATA

April regional performance

In terms of regional performance, IATA said Asia-Pacific airlines saw their air cargo volumes decrease by 0.4% in April 2023 compared to the same month in 2022 — but a “significant improvement” in performance compared to March (-6.8%).

It said available capacity in the region increased by 41.2% compared to April 2022 as more and more belly capacity came online from the passenger side of the business.

North American carriers saw the weakest performance of all regions with a 13.1% decrease in cargo volumes year-on-year in April. This was also a drop in performance compared to March (-10.2%).

IATA said that airlines in the region notably saw a significant decrease in international demand in April due to a substantial fall in volumes on two major trade lanes: North America-Europe (-13.5%) and North America-Asia (-9.3%). Capacity decreased by 1.5% compared to April 2022.

Meanwhile, European carriers experienced an 8.2% decrease in cargo volumes in April — a slight decline in performance compared to March (-7.4%).

IATA said airlines in the region saw a significant decrease in international demand due to double-digit contractions on the North America-Europe (-13.5%) trade lane, as well as within Europe (-16.1%), which was partially offset by strong demand on the Europe-Asia route (3.4%).

Middle Eastern carriers experienced a 6.8% year-on-year decrease in cargo volumes year-on-year, also posting a -5.5% decline compared to March.

For April, IATA said Latin American carriers reported a 1.6% decrease in cargo volumes in April this year compared to the same period in 2022 — although an “improvement” compared to March (-4.4%).

“African airlines had the only positive performance in April, posting a 0.9% increase in demand compared to April 2022. This was an improvement in performance compared to the previous month (-4.3%),” IATA said.

It added that notably, Africa to Asia trade route experienced a significant increase in cargo demand in April, up 20.0% year-on-year. Capacity was 5.3% above April 2022 levels.