North Africa led air cargo growth in the first half of 2023, according to an analysis by WorldACD Market Data, amid a wider overall picture of declining year-on-year (YoY) chargeable weight and average rates on most markets.

The air cargo market data provider was based on the 2 million monthly transactions covered by WorldACD's data and compared the second quarter (Q2) and the first half (H1) of 2023 with the equivalent periods last year and in 2019, the last pre-Covid year, highlighting a number of areas recording ongoing growth and interesting demand and pricing patterns, as markets continue their post-Covid readjustments.

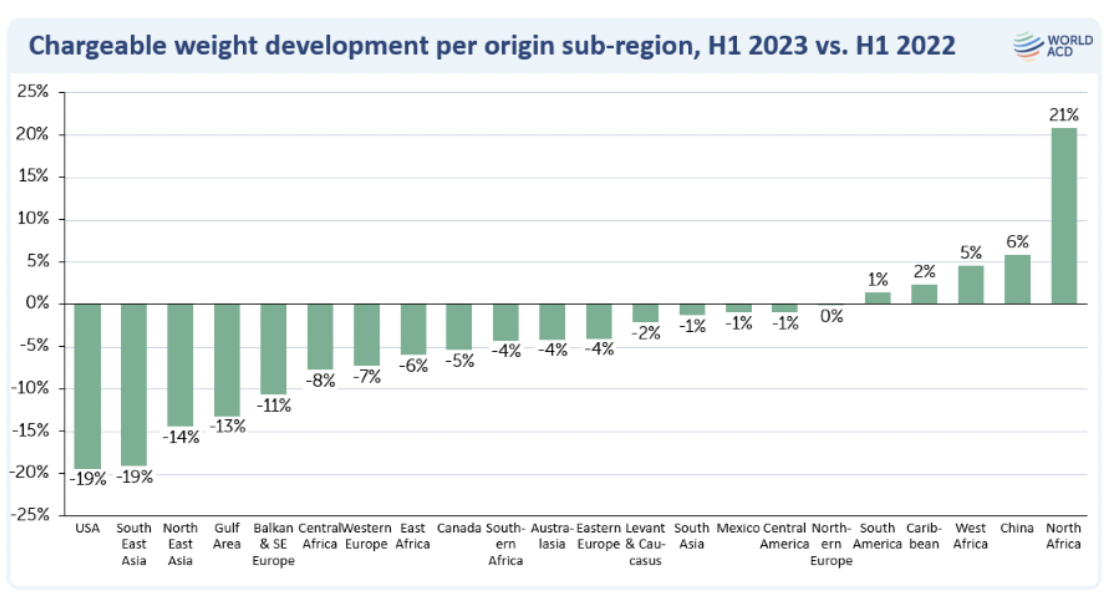

"It reveals, for example, that chargeable weight from North Africa in the first 6 months of this year rose by +21%, YoY, with China (+6%), West Africa (+5%), Caribbean (+2%) and South America (+1%) the only other origin subregions to register positive growth compared with the equivalent H1 period last year," WorldACD wrote.

It added that subregions remaining relatively stable include Northern Europe (0%), Central America, Mexico, and South Asia (-1%), with single-digit percentage declines also recorded for Eastern Europe (-4%), Australia & Pacific (-4%), Southern Africa (-4%), Canada (-5%), East Africa (-6%), Central Asia (-7%), Western Europe (-7%), and Central Africa (-8%).

Meanwhile, origin subregions recording particularly steep declines include USA and Southeast Asia (-19%), Northeast Asia (-14%), the Gulf area (-13%), and Balkan & Southeast Europe (-11%).

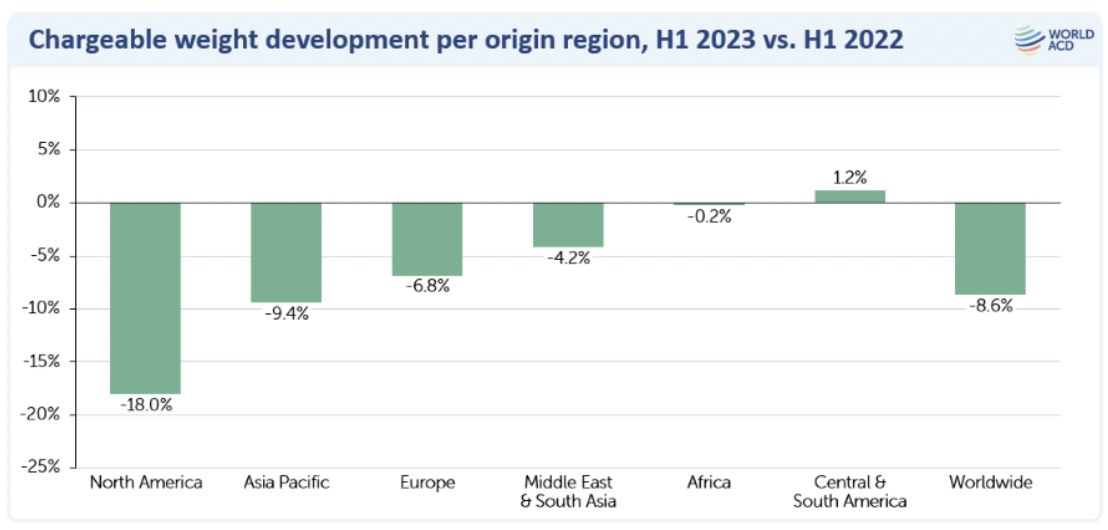

Global tonnages down 9% in H1

On a global basis, WorldACD said chargeable weight in H1 was down by almost -9%, YoY, driven regionally by a sizeable (-18%) drop in tonnages from North America and from the big Asia-Pacific origin region (-9%), with significant drops ex-Europe (-7%) and from the Middle East & South Asia region (-4%).

On a full regional basis, only Central & South America (+1%) recorded any YoY growth in the first half of 2023, with tonnages ex-Africa stable.

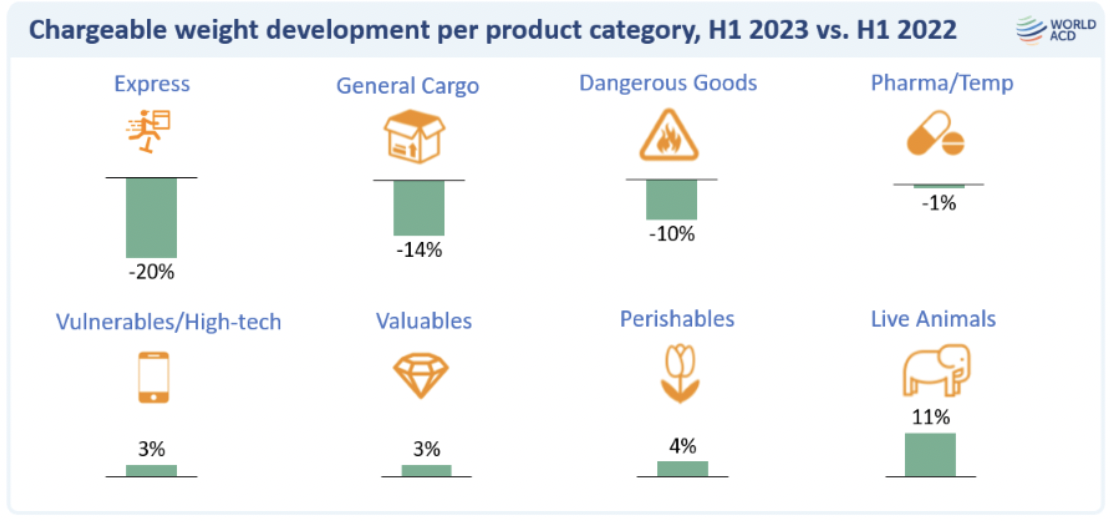

Growth in valuables, perishables, and live animals

The air cargo market data provider said a handful of product categories have continued to record YoY growth this year on a global basis in the first 6 months, notably Vulnerables/High-tech (+3%), Valuables (+3%), Perishables (+4%), and Live Animals (+11%).

Pharma/Temperature-controlled products stayed more or less stable (-1%), but there were double-digit percentage drops in volumes of Dangerous Goods (-10%), General Cargo (-14%), and Express (-20%).

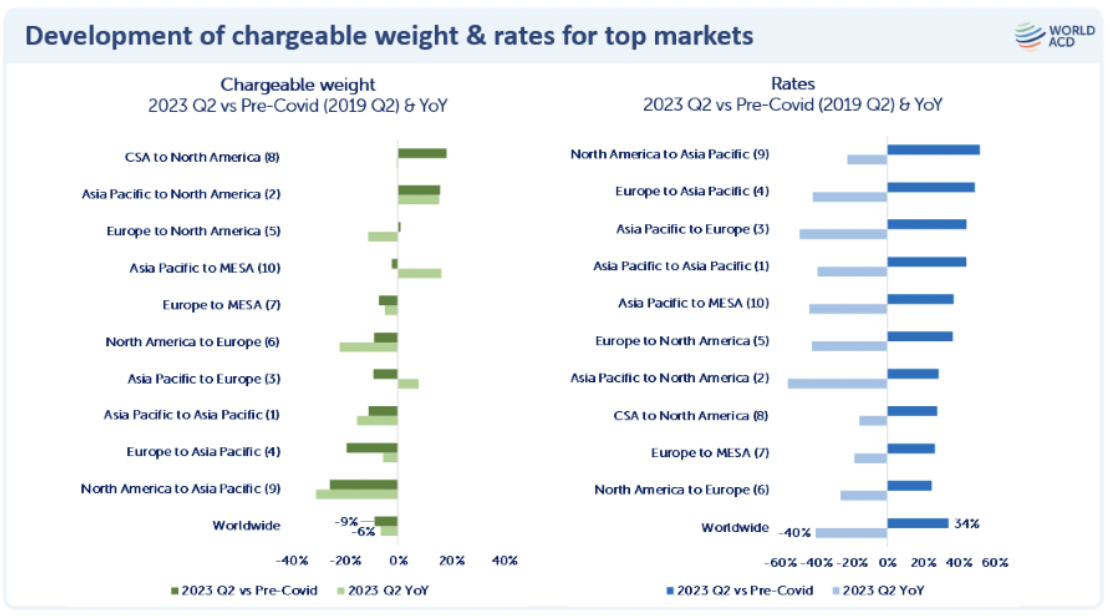

"While worldwide tonnages were down by almost -9% in H1, the comparison moderated to -6% in Q2, YoY, although tonnages have now fallen -9% below their pre-Covid levels of Q2 2019," the report said.

It added that capacity, meanwhile, has now recovered to its pre-Covid levels in Q2 2019, having risen by +11% compared with Q2 last year.

On the pricing side, WorldACD said average air cargo rates in the second quarter of 2023 were down by -40% YoY, although they remain significantly above pre-Covid levels (+34% compared with Q2 2019).

"Those rate and demand patterns are also illustrated well if we examine the world's top 10 air cargo trade lanes (based on chargeable weight)," WorldACD added.

It noted that demand in the second quarter of 2023 was below its levels in the equivalent period last year and below 2019 pre-Covid levels on most major lanes, with the exception of Asia Pacific to North America (up vs 2022 and 2019) and Central & South America (CSA) to North America (up vs Q2 2019), and Asia Pacific to Middle East & South Asia (MESA), up vs 2022.

However, it said that average yields on all of the world's top 10 international air cargo markets were significantly higher in Q2 this year than their 2019 pre-Covid levels, although they were down vs last year's levels.