Ocean carriers are bullish for the remainder of the traditional peak cargo season, according to a new Sea-Intelligence analysis, evident in the relatively low blank sailings level announced so far for the third quarter of 2024.

The Danish maritime analysis firm noted that with almost one-third into the traditional peak cargo season for container shipping, assessing the extent of cancelled sailings and planned capacity deployment by the carriers for the rest of the third quarter could give valuable insights into the carriers' confidence in the 2024 peak season.

[Source: Sea-Intelligence]

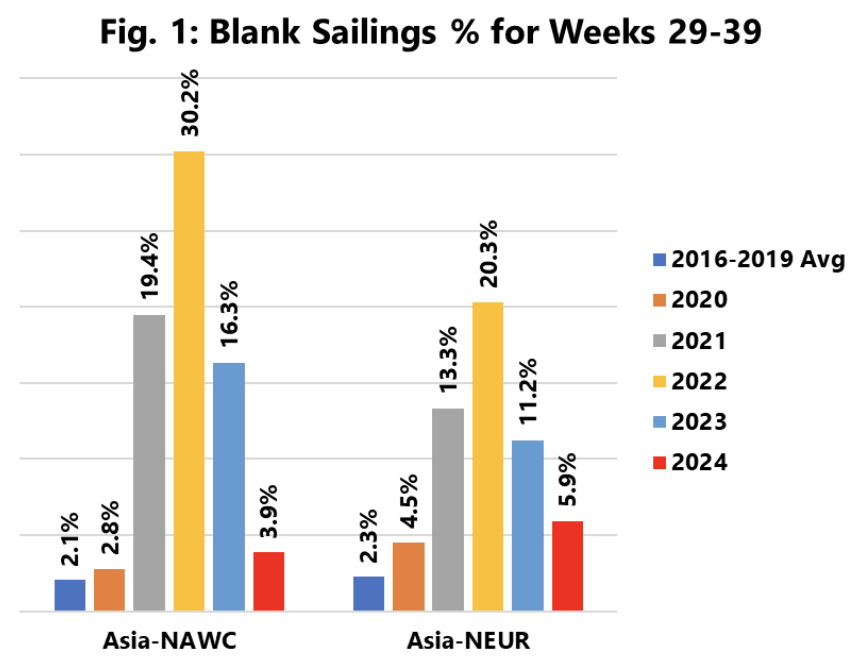

Figure 1 shows the percentage of blanked capacity slated for the rest of the peak season (weeks 29-39) for the two most important East/West trades: Asia-North America West Coast and Asia-North Europe.

Sea-Intelligence said on Asia-North America West Coast, carriers have so far planned to blank 3.9% of the total capacity, which is not too dissimilar from the pre-pandemic average or from 2020.

It is, however, significantly lower than in the pandemic years (where blank sailings were forced due to port congestion).

Capacity growth across the same weeks in 2024 is slated to be 24.6% when compared to 2023 and 10.2% over 2020 (where we saw peak capacity deployed in terms of TEU).

"Given this strong capacity growth and the relatively low blank sailings level, it suggests that the carriers are bullish for the peak season on this trade lane," said Alan Murphy, CEO, Sea-Intelligence.

On Asia-North Europe, the report said blanked capacity is slated to be 5.9% for the coming 11 weeks, which is only higher than 2020 and the pre-pandemic average, although the difference from 2020 is not that high.

Murphy noted that in 2024, there is no Y/Y growth in deployed capacity. However, in 2023, Y/Y capacity growth on the trade was 13.1%, which was not only high relative to historical reference points but also too high for the demand levels on the trade lane (evidenced by the falling freight rates).

"The fact that carriers are willing to maintain that level of elevated capacity on Asia-North Europe in 2024, coupled with the relatively low level of blank sailings, indicates the carriers have a confident strong outlook for the peak season on Asia-North Europe," the Sea-Intelligence chief added.