Geopolitical tensions and extreme weather events disrupted global air cargo supply chains this year and have significantly impacted Bangladesh.

According to a new analysis by Xeneta, Bangladesh has not only had to deal with the knock-on impacts of conflict in the Red Sea throughout 2024, but it has also experienced widespread civil unrest within its borders since early July, which has caused factory shut-downs and cargo stockpiles at sea and air freight terminals.

More recently, in August, major flooding halted rail and road transportation on the critical route between Chittagong and Dhaka.

Wenwen Zhang of Xeneta said that as the world's second-largest garment exporter, the implications of these disruptions are serious—particularly for importers in Europe and the US.

Air freight market shocks

The report noted that Bangladesh's air cargo market is very short-term oriented because about 70% of the capacity procured by freight forwarders comes at a price which is valid for no more than a month.

This series of adverse events led to outbound Bangladesh air cargo spot rates accelerating at one of the highest paces on record (+163% year-on-year) in the week ending August 25, reaching their highest level in over two-and-a-half years.

Bangladesh also holds the record for the highest air freight rate increase so far in 2024 across all global air corridors.

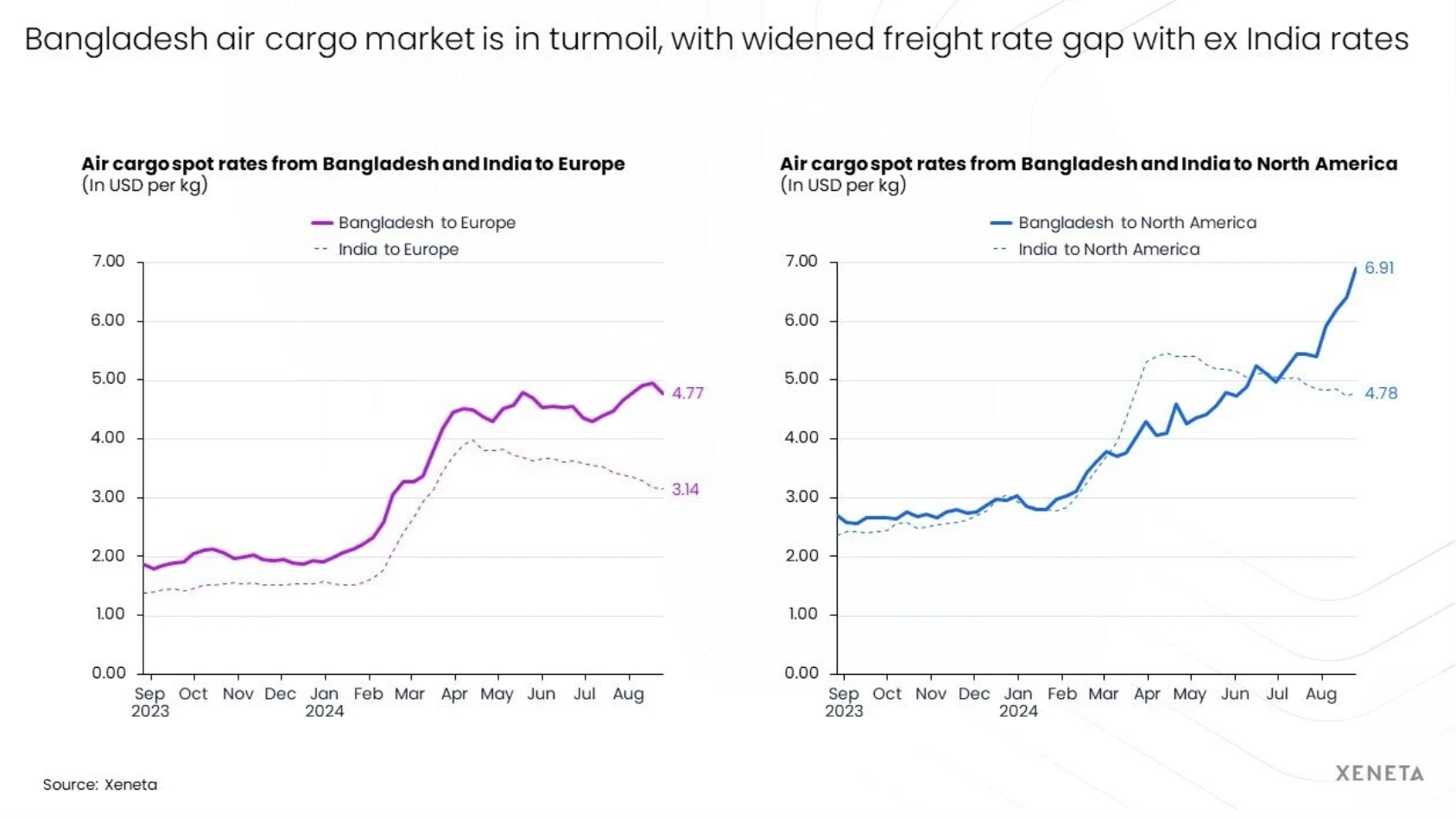

More specifically, the air cargo spot rate from Bangladesh to Europe, one of Bangladesh's major corridors, exceeded its previous Red Sea peak in May by reaching US$4.95 per kg in the week ending August 18. The all-time record freight rate on this corridor was observed during the pandemic when it reached US$5.71 per kg in mid-November 2021.

Zhang said the spot rate from Bangladesh to North America in the week ending August 25 reached its highest level in over two years, rising to US$6.91 per kg, or up 127% compared to the same week in 2023.

This market stress is echoed in the ocean container market.

The Xeneta analysis said for instance, the average spot rate to ship a 40ft dry container from Chittagong to North Europe stood at more than US$6,300 in late August, which is up 270% than 12 months ago.

"As a result, shippers are facing hefty demand surcharges and shrinking margins. These increases are driven purely by a supply/demand imbalance," Zhang said.

"This will likely prompt some shippers with urgent cargo to reroute from Dhaka and truck it to alternative air freight hubs, such as Delhi and Kolkata in India—such events were previously observed during the height of the Red Sea crisis," she added, noting that there is also a financial incentive for shippers to re-route supply chains away from Bangladesh with the air cargo spot rates from India to Europe and North America were US$3.14 per kg and US$4.78 per kg, respectively, which is about 30% lower than corridors out of Bangladesh.

Longer term repercussions

"Bangladesh will emerge from the civil unrest, and flood waters will subside, but there may be a longer-term impact if the turmoil of 2024 spooks shippers into shifting supply chains to other regions," Zhang said.

"Currently, several global fashion brands are reportedly cancelling orders from Bangladesh and shifting them to other garment export markets such as Cambodia and Indonesia in Southeast Asia," she added.