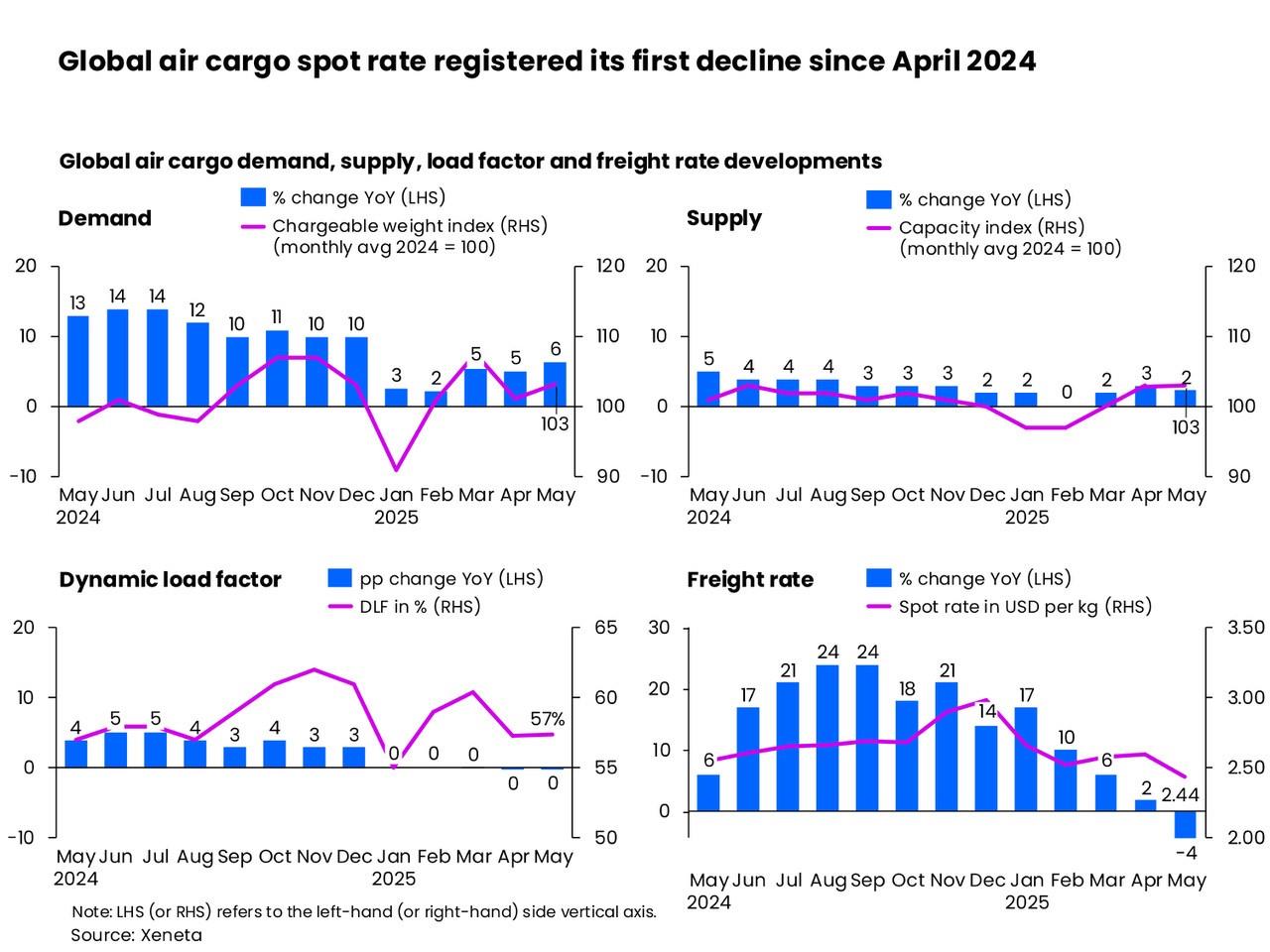

While international trade continued to flow in May and global air cargo volumes rose by 6% year-on-year, market sentiment and concerns over what comes next saw airfreight spot rates decline for the first time in a year, according to Xeneta's latest market analysis.

Midway through the month, Xeneta said the global air cargo market appeared to have "dodged a perfect storm" as the U.S.-China 90-day tariff truce began on May 14, after the escalating retaliatory tariffs since April.

The U.S. administration lowered its additional tariffs on China from 145% to 30%, while China responded by decreasing its tariffs on the U.S. to 10%.

The freight rate benchmarking and market analytics platform said this welcome news came "too late to reverse a softening in freight rates."

The global air cargo spot rate fell by 4% year-on-year in May to US$2.44 per kg— the first such decline since April 2024.

Xeneta's Chief Airfreight Officer, Niall van de Wouw, said this could, in part, also be attributed to nearly 20% year-on-year declines in jet fuel costs and "more downward pressure may lie ahead."

"Market fundamentals are holding up, but the drop in rates is likely a reflection of declining sentiment and concerns, particularly among airlines, over what will happen once more stability returns to international trade and there is less of a push for the security of airfreight. Whatever worse trade conditions take away from overall trade, this uncertainty gives a bit back to airfreight," he said.

"This climate is reducing trade, and airfreight is getting a temporary piggyback on this uncertainty through an increase in 'emergency shipments', but that will not continue," van de Wouw added.

The Xeneta chief airfreight officer noted that it is difficult to relate the 6% growth in demand in May to increased e-commerce or increasing trade at a time when "companies overall are becoming more conservative."

The slower growth in airfreight volumes and rates over the last 5-6 months, he added, reflects growing sentiment "that it doesn't look good for trade."

"At the moment, the climate might be positive on certain lanes to airfreight demand, but there will be a time when there's an agreement on tariffs – and I don't expect the end result to promote trade and will, therefore, hamper airfreight," van de Wouw further said.

Rates on a downward trajectory

The Xeneta chief airfreight officer noted that more visibility and more clarity in the market will not benefit airfreight.

"We've seen very short upticks in rates, but in the overall trend in recent months shows rates on a downward trajectory, and I think there is room for more decline for a longer period of time. The sentiment over what's coming is reflected in falling rates," he said.

Airlines, he added, will be trying to hold onto their volumes in this very uncertain environment and are willing to "pay a little bit for that security".

Van de Wouw went on to note that the dynamics of fear-of-missing-out (FOMO), which played out in 2023, may well be back because the moment the balance changes even a little bit.

"It can have a much bigger impact than that small change would seem to indicate," van de Wouw said. "So, the moment flights become less full, airlines might just want to settle their rate negotiations a little bit quicker and more keenly – and I think we're seeing that starting to play out in the negotiation of rates at a global level."

Meanwhile, global demand, just 1 percentage point higher month-on-month in May, will also have been impacted by the shockwave of April's "de minimis" announcement.

Xeneta's report noted that this saw the sudden removal of the "de minimis" threshold for shipments from China and Hong Kong into the US.

"Just a few weeks on, some calm has returned to the market. The U.S. has lowered tariffs on Chinese and Hong Kong low-value e-commerce shipments to 54% or a flat fee of US$100 for parcel shipments," van de Wouw said, adding that cross-border e-commerce giants, like Temu and Shein, however, are expected to face the general 30% tariffs as they traditionally use commercial airlines for international air freight before using local postal networks for last-mile deliveries.

"This indicates that they may still retain a competitive advantage if the incremental taxes are 40-50% as per Xeneta's prior analysis," he added.

For the air cargo industry, the analysis noted that a lot is riding on the outcome. In 2024, e-commerce volumes accounted for about 50% of China- US airfreight volume.

Supply chains are a mess

The Xeneta analysis noted that the speed of changes to the trading environment presents another hurdle that the airfreight industry is being forced to overcome.

"It's very frustrating when the plans you've made become completely obsolete a few weeks down the line because things change again, but that's the current reality," van de Wouw said.

"Trade is not benefiting right now, airfreight is. Supply chains are a mess, and with all this disruption, we're seeing goods moving by airfreight that typically wouldn't be flown. That's due to the uncertainty."

The Xeneta chief airfreight officer added: "Tariffs are of a different overall magnitude in terms of financial impact compared to the cost of using airfreight instead of ocean – this is the clearest business case you can have right now for moving goods by air if you avoid tariffs as a result. This market environment gives, and it takes."

The airfreight market must be prepared for more surprises, he said: "This U.S. tariffs are not a longer-term process that you can see coming, and therefore anticipate. This hits you in the face from one day to the next. It's not the result of legislation which has taken months, quarters, or years to be developed and approved."

And, the market may yet still feel the full force of consumer sentiment amidst rising prices, which van de Wouw says is likely being "masked by the focus on trade disruption".

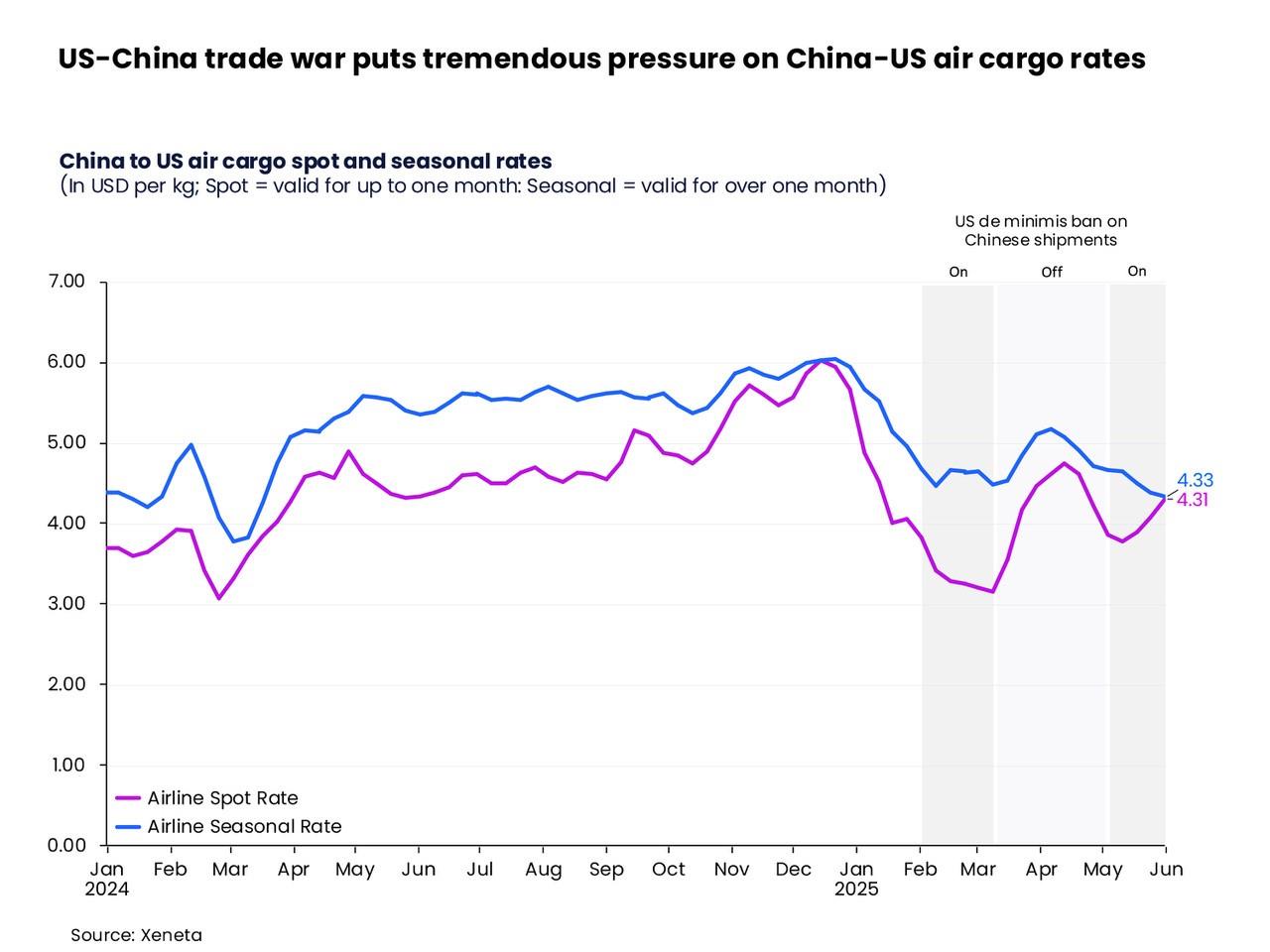

By the week ending June 1, the analysis noted that China to U.S. spot rates rose 14% to US$4.31 per kg, up from their low point in the week ending May 11 prior to the reduction in tariffs.

Spot rates on this lane have now recovered above those from China to Europe, which stood at US$4.11 per kg.

Despite the recent uptick, however, van de Wouw said China to U.S. seasonal rates continue to trend downwards from their early April peak, signaling ongoing caution in the mid-term market outlook.

Prior to the implementation of the "de minimis" tariffs into the U.S., China customs reported that low-value and e-commerce shipments from China to the US surged by 30% year-on-year in April, outperforming a modest 6% growth observed in the first quarter.

However, the 30% surge was behind China's overall cross-border e-commerce sales, which climbed 45% year-on-year in April. This indicates China's cross-border e-commerce sales managed to divert elsewhere.

For the period, global air cargo capacity rose a modest 2% year-on-year in May as airlines increased passenger belly capacity for the Northern hemisphere's summer season.

However, global air cargo dynamic load factor remained subdued, remaining flat at 57% for the fifth straight month in May. Dynamic load factor is Xeneta's measurement of capacity utilization based on volume and weight of cargo flown alongside available capacity.

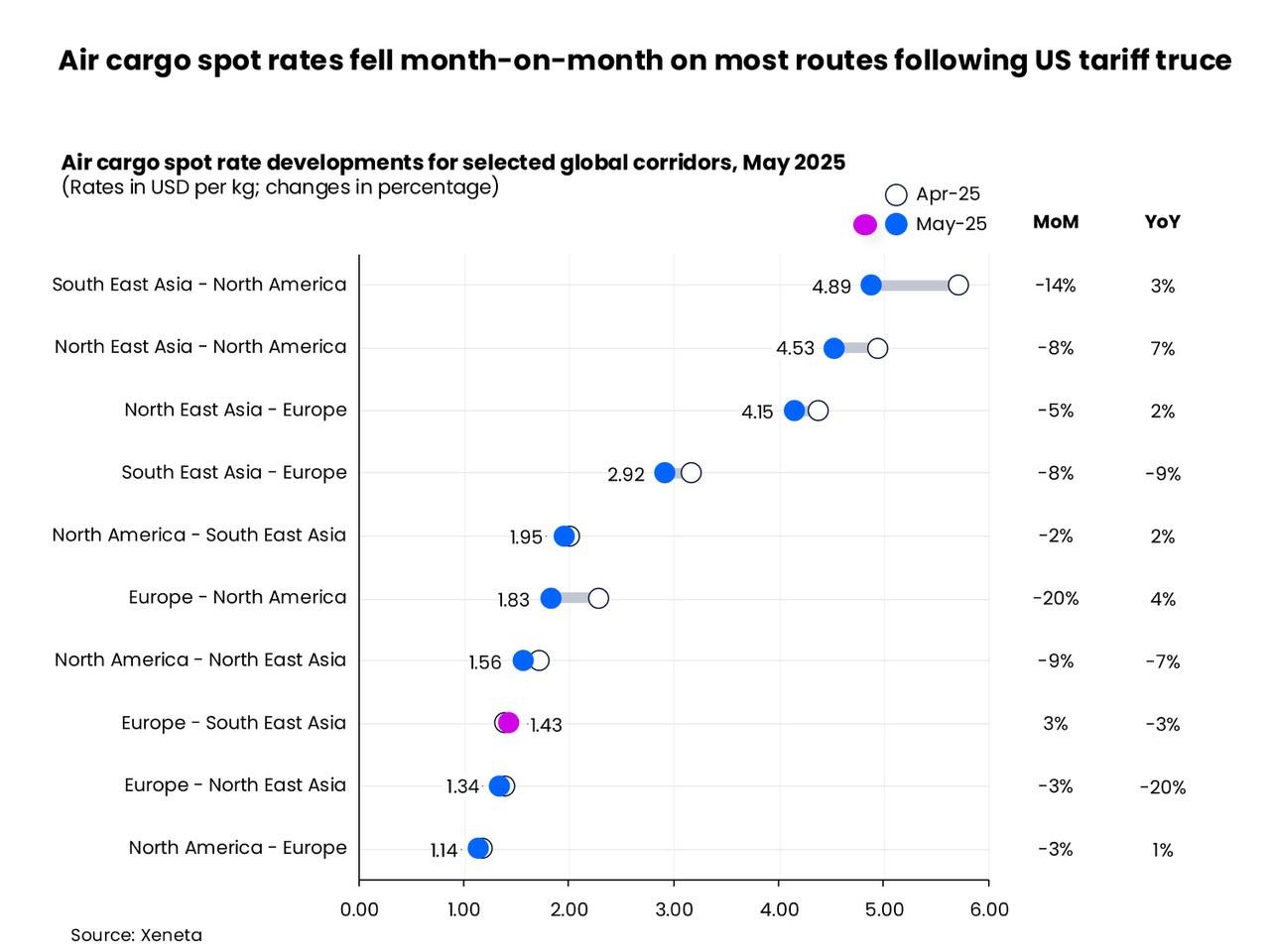

At the corridor level, most backhaul trades saw year-on-year spot rate declines in May, particularly on the Europe–Northeast Asia route, where rates dropped 20% due to ongoing trade imbalances. In contrast, spot rates on fronthaul trades remained above the levels from a year earlier.

"Although the majority of trades experienced seasonal month-on-month declines and ebbing volumes following frontloading, rates still held above last year’s figures," the Xeneta analysis said.

Short-term air cargo surge likely

As the 90-day tariff truce nears its end, on July 9 for most countries and 13 August for China, a short-term surge in cargo demand is likely, driven by mounting concerns over a potential breakdown in trade talks or new duties, such as the recent U.S. threat of a 50% tariff on goods from the EU.

van de Wouw said the ocean container shipping market may shed some light on what is to come for airfreight, due to its longer lead times from point-of-order to final delivery.

From June 1, 40ft container freight rates from China to the US West Coast jumped to more than US$6000 per FEU despite a considerable reduction in blank sailing by carriers.

More uncertainty lies ahead

On top of this is the uncertainty caused by the U.S. Court of International Trade's ruling that the tariffs imposed by President Donald Trump were unlawful.

The analysis said that while the tariffs remain in place during the ensuing legal battle, this casts further concern over what's to come for global trade.

Additionally, the EU plans a €2 fee on small parcels entering the bloc. The fee will apply to parcels valued under €150 sent directly to consumers from outside the EU. Parcels routed through EU-based warehouses will incur a reduced fee of €0.50, which could favor global companies with large logistics operations.

Given average order values at around €35 for Temu, the €2 fee is to inflate the price by 6%, which may still see it maintain its competitiveness in the EU market.

"The sentiment we saw in May may be preluding market fundamentals, leading to less demand, falling rates, and lower load factors. But one thing is clear: the airfreight market will get through this. We just don't know how long it will take," van de Wouw said.

"At the end of the pandemic, what I call the 'emotional bank account' between shippers and freight forwarders had a zero balance, because there was so much frustration left and right. In the current climate, it's important to think longer-term and to protect relationships because the challenges being faced today will pass," he added.