Consensus expectations have been for a “flat-to-slightly-up” year-over-year (y/y) peak season, according to a new analysis by Stifel, noting that recent conversations with shippers and service providers across the freight ecosystem have been corroborating that view.

Writing in a Baltic Air Freight Index (BAI) newsletter, Bruce Chan, director and senior research analyst covering global logistics and future mobility at Stifel, said the latest BAI airfreight rate data also seems to prove this as well.

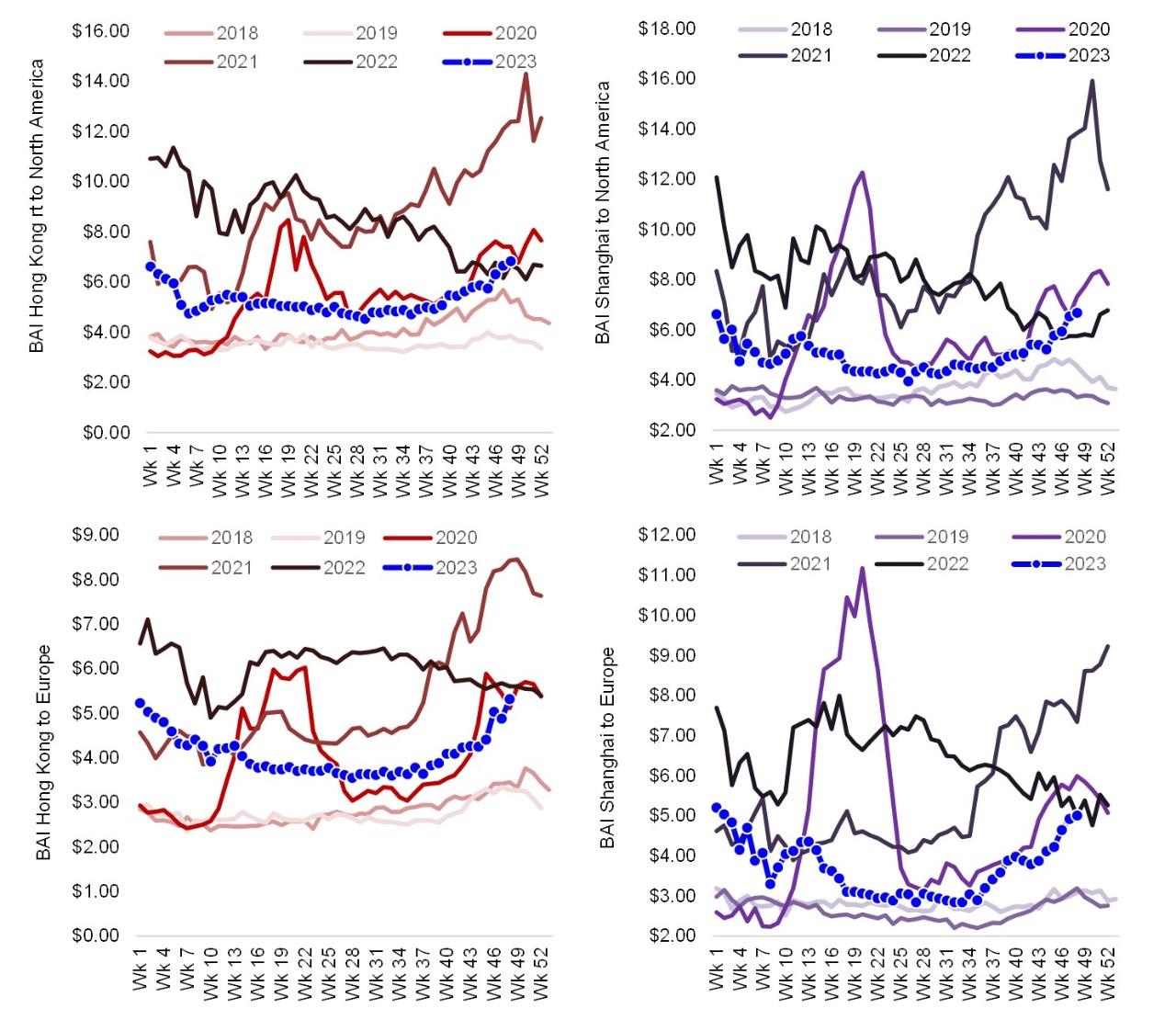

On a monthly basis, the average rate per kilo in November was down approximately 30% y/y from both Hong Kong to Europe (BAI 31) and Shanghai to Europe (BAI 81) and down 17% and 18% y/y from Hong Kong to North America (BAI 32) and Shanghai to North America (BAI 82), respectively.

However, Chan noted that the average monthly comparison doesn’t tell the full story.

“November saw a steady upward trend through the month, heralding a return to normal seasonal patterns after a very abnormal post-pandemic period. In week 48, y/y declines in Hong Kong to Europe rates were only 5%, while on the Shanghai to Europe lane, rates were flat,” the Stifel senior research analyst said.

He noted, meanwhile, that on Hong Kong to North America and Shanghai to North America routes, week 48 rates increased by 2% and 16%, respectively.

“These are encouraging signs, and as we discussed last month, strong e-commerce activity out of Asia seems to be driving a large chunk of the capacity demand,” Chan said, adding that Cyber Week sales in the United States climbed a robust 8% year-on-year.

“That’s generally good news for air cargo service providers, but we think it is too early to extrapolate this trend to a broader economic recovery.”

“For one thing, we believe some of the cyber activity, at least in the US, was a product of attractive “doorbuster” deals. Moreover, broader retail sales performance was much more muted and, net of inflation, was likely even slightly more negative y/y,” Chan further said.

The analysis cited how, according to IATA, air cargo demand has improved and was up for three consecutive months as of October.

Capacity to continue to be a headwind for rates

But Chan pointed out that for most of the year, capacity — in particular air cargo belly capacity — continues to increase at a faster rate.

Global available cargo tonne-kilometres (ACTKs) climbed over 13% y/y, while cargo tonne-kilometres (CTKs) increased about 4% y/y.

It added that the supply-demand discrepancy was even more pronounced in the Asia-Pacific theatre, where CTKs increased 7.6% y/y in October and ACTKs were up a full 30%.

“While the recovery in BAI air cargo rates this month has been encouraging, and we continue to see a return to normal seasonal patterns, capacity is still plentiful and will remain a headwind to rates for the foreseeable future,” the Stifel senior research analyst said.

“Ultimately, freight demand trends need to improve more, but for now, they remain fragile,” Chan added.

Exhibits 1-4: Rates on Asia outbound lanes increased throughout November for a relatively late seasonal push; the market appears to have resumed normal patterns, but we remain cautious given numerous demand risks and continued capacity growth.