Air cargo demand continued its upward trajectory in July driven by improving global trade, surge in e-commerce and persisting capacity issues on maritime shipping.

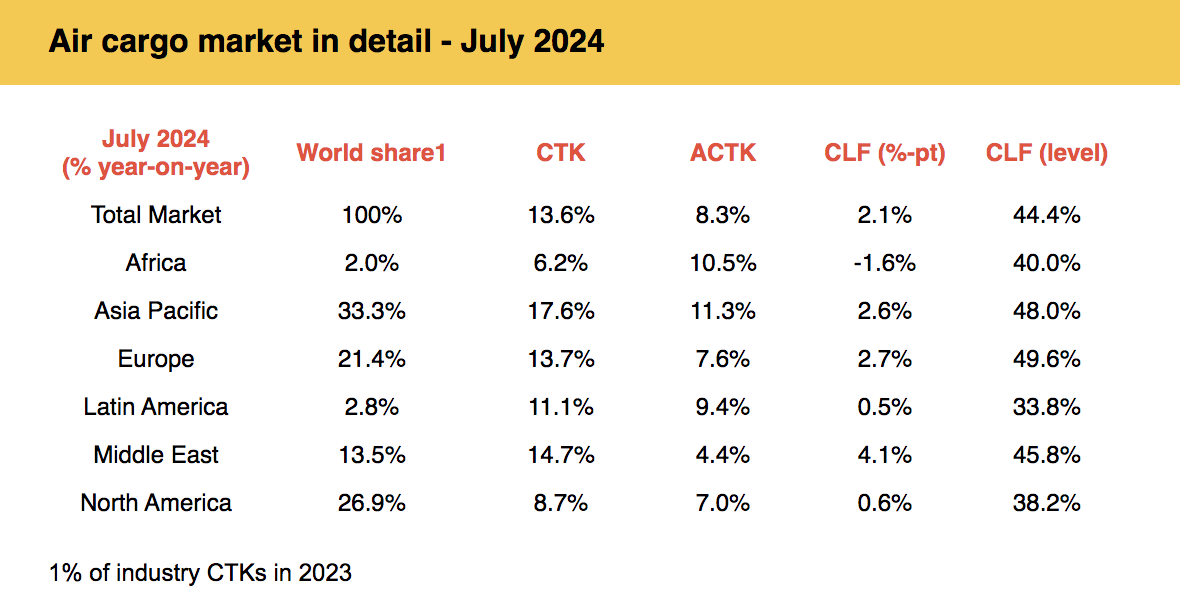

The International Air Transport Association (IATA) released data for July 2024 global air cargo markets showing continuing strong annual growth with total demand — measured in cargo tonne-kilometers (CTKs) — up by 13.6% compared to July 2023 levels (14.3% for international operations).

This is the eighth consecutive month of double-digit year-on-year growth, with overall levels reaching heights not seen since the record peaks of 2021.

Very strong year for air cargo seen

"Air cargo demand hit record highs year-to-date in July with strong growth across all regions. The air cargo business continues to benefit from growth in global trade, booming e-commerce and capacity constraints on maritime shipping," said Willie Walsh, director general at IATA.

"With the peak season still to come, it is shaping to be a very strong year for air cargo," he added, noting that airlines have proven adept at navigating political and economic uncertainties to flexibly meet emerging demand trends.

Meanwhile, IATA said capacity, measured in available cargo tonne-kilometers (ACTKs), increased by 8.3% compared to July 2023 (10.1% for international operations).

This was largely related to the growth in international belly capacity, which rose 12.8% on the strength of passenger markets and balanced the 6.9% growth of international freighter capacity.

It should be noted that the increase in belly capacity is the lowest in 40 months, whereas the growth in freighter capacity is the highest since an exceptional jump was recorded in January 2024.

[Source: IATA]

July regional performance

For the period, IATA said Asia Pacific airlines saw a 17.6% year-on-year demand growth for air cargo, the strongest of all regions. Intra-Asia demand grew by 19.8% over the same period in 2023, while the Europe-Asia, Middle East-Asia and Asia-Africa trade lanes rose by 17.9%, 15.9% and 15.4%, respectively.

North American carriers saw 8.7% year-on-year demand growth for air cargo in July, hampered in part by flight cancellations and airport closures in the US and the Caribbean in relation to Hurricane Beryl.

IATA said demand on the Asia-North America trade lane, the largest trade lane by volume, grew by 10.8% year-on-year, while the North America-Europe route saw a modest increase of 5.3%. July capacity increased by 7.0% year-on-year.

European carriers saw 13.7% year-on-year demand growth for air cargo in July. The Middle East-Europe trade lane led growth, up 32.2%, maintaining a streak of double-digit annual growth that originated in September 2023.

It added that the Europe-Asia route, the second largest market, was up 17.9%, while within Europe, it also saw double-digit growth, up 15.5%. July capacity increased 7.6% year-on-year.

For July, Middle Eastern carriers saw a 14.7% demand growth for air cargo with the Middle East-Europe trade lane performed particularly well, surging 32.2%, ahead of Middle East-Asia, which grew by 15.9% year-on-year. July capacity increased 4.4% year-on-year.

Latin American carriers reported an 11.1% demand growth in July compared to the same period in 2023.

Meanwhile, African airlines saw 6.2% air cargo demand — the lowest of all regions and their lowest recorded figure in 2024.

IATA noted, however, that demand on the Africa-Asia market increased by 15.4% compared to July 2023.