New data from the US Census Bureau, detailing both sales and inventory changes in the US up until the end of April 2024, shows absolutely no signs of a sudden surge in container demand prior to the sharp rise in container spot rates in early May 2024, according to a new analysis by Freightos.

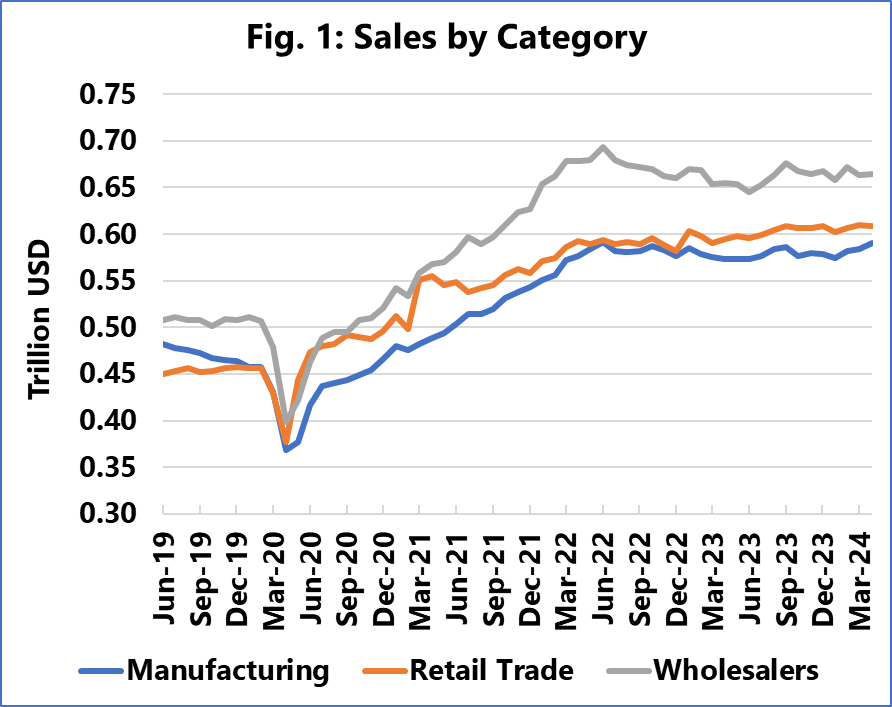

The online freight marketplace noted an example (Figure 1) that shows that the overall trend for all three categories of US sales remained flat from the end of the pandemic through April 2024.

[Source: Freightos]

Similarly, inventories by category and inventory-to-sales ratios show no deviations from long-term trends.

"This would have made it virtually impossible for carriers to proactively deploy more capacity to prevent capacity shortages and rate spikes," Freightos said in its new analysis.

It added that this severely challenges the notion that the current rate spikes are solely due to carriers deliberately manipulating the market to cause rate spikes.

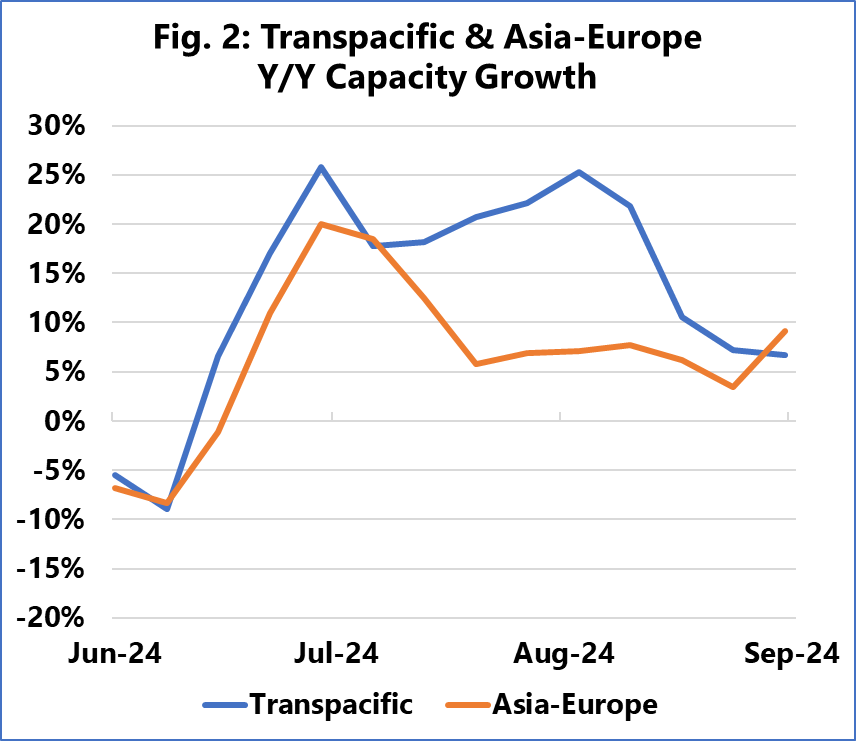

"What we are, though, is that carriers are now planning to increase capacity sharply the main East/West trades, as shown in Figure 2," said Alan Murphy, CEO of Sea-Intelligence.

[Source: Freightos]

In Asia-Europe, a sharp capacity increase is planned for the first two weeks of July, but then capacity growth will abate to around 6% year-on-year (Y/Y) for the rest of July and August.

On Transpacific, not only do we see a sharp imminent increase in capacity growth, but the carriers also intend to sustain this high supply growth through mid-August.

"The success of these capacity expansions — and their potential to alleviate market pressure — hinges on whether growing port congestion allows carriers to operate the envisioned vessels according to their planned sailing schedules," Murphy said.